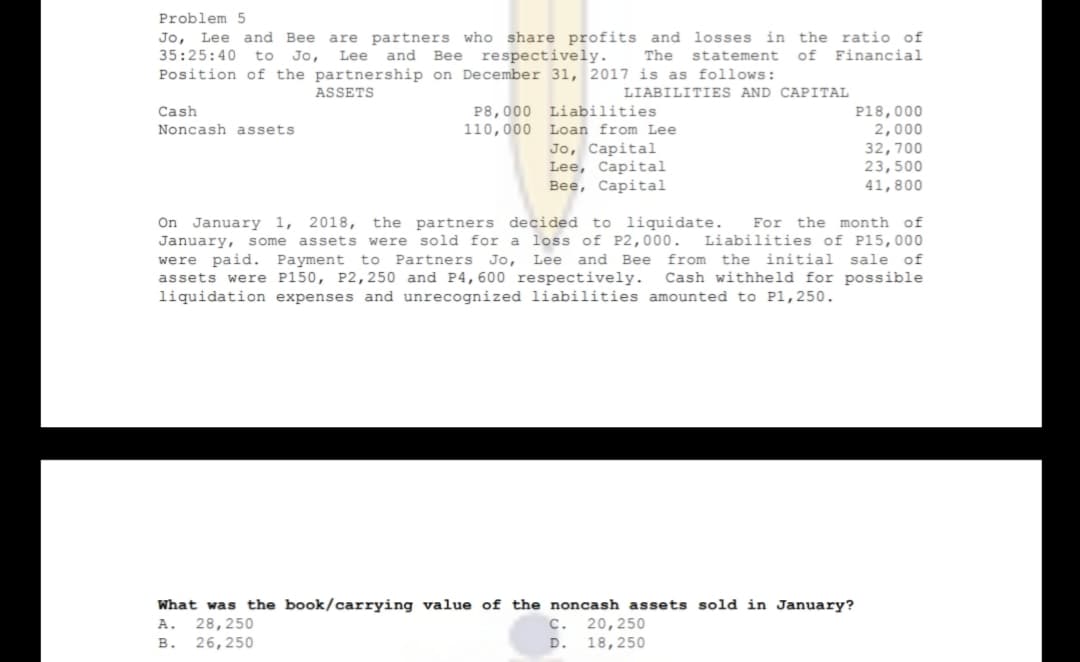

Problem 5 Jo, Lee and Bee are partners who share profits and losses in the ratio of 35:25:40 to Jo, Lee and Bee respectively. Position of the partnership on December 31, 2017 is as follows: The statement of Financial ASSETS LIABILITIES AND CAPITAL Cash P8,000 Liabilities P18,000 2,000 32,700 23,500 41,800 Noncash assets 110,000 Loan from Lee Jo, Capital Lee, Capital Bee, Capital For the month of On January 1, 2018, the partners decided to liquidate. January, some assets were sold for a loss of P2,000. Liabilities of P15,000 were paid. Payment to Partners Jo, Lee and Bee from the initial sale of assets were P150, P2,250 and P4,600 respectively. Cash withheld for possible liquidation expenses and unrecognized liabilities amounted to P1,250.

Problem 5 Jo, Lee and Bee are partners who share profits and losses in the ratio of 35:25:40 to Jo, Lee and Bee respectively. Position of the partnership on December 31, 2017 is as follows: The statement of Financial ASSETS LIABILITIES AND CAPITAL Cash P8,000 Liabilities P18,000 2,000 32,700 23,500 41,800 Noncash assets 110,000 Loan from Lee Jo, Capital Lee, Capital Bee, Capital For the month of On January 1, 2018, the partners decided to liquidate. January, some assets were sold for a loss of P2,000. Liabilities of P15,000 were paid. Payment to Partners Jo, Lee and Bee from the initial sale of assets were P150, P2,250 and P4,600 respectively. Cash withheld for possible liquidation expenses and unrecognized liabilities amounted to P1,250.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Topic Video

Question

Show the solution in good accounting form

Transcribed Image Text:Problem 5

Jo, Lee and Bee are partners who share profits and losses in the ratio of

Financial

Lee and Bee respectively.

Position of the partnership on December 31, 2017 is as follows:

35:25:40

to Jo,

The

statement

of

ASSETS

LIABILITIES AND CAPITAL

Cash

P8,000 Liabilities

110,000

P18,000

2,000

Noncash assets

Loan from Lee

Jo, Capital

Lee, Capital

Вее, Сapital

32,700

23,500

41,800

On January 1, 2018,

the partners decided to liquidate.

For the month of

assets were sold for a loss of P2,000.

Liabilities of P15,000

January, some

were paid. Payment to

assets were P150, P2,250 and P4,600 respectively.

liquidation expenses and unrecognized liabilities amounted to P1,250.

Partners

Jo, Lee

and Bee from the

initial sale of

Cash withheld for possible

What was the book/carrying value of the noncash assets sold in January?

A. 28,250

26,250

C.

20,250

в.

D. 18,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,