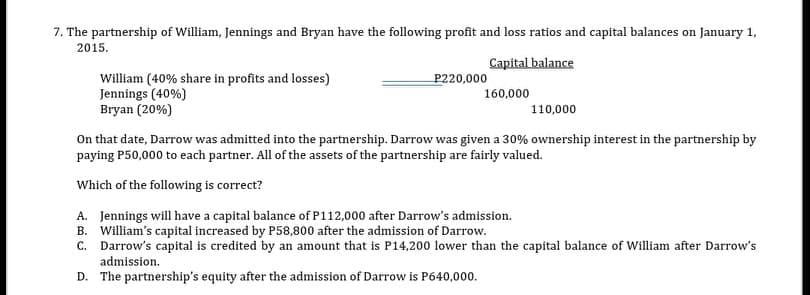

7. The partnership of William, jennings and Bryan have the following profit and loss ratios and capital balances on January 1, 2015. Capital balance William (40% share in profits and losses) Jennings (40%) Bryan (20%) P220,000 160,000 110,000 On that date, Darrow was admitted into the partnership. Darrow was given a 30% ownership interest in the partnership by paying P50,000 to each partner. All of the assets of the partnership are fairly valued. Which of the following is correct? A. Jennings will have a capital balance of P112,000 after Darrow's admission. B. William's capital increased by P58,800 after the admission of Darrow. C. Darrow's capital is credited by an amount that is P14,200 lower than the capital balance of William after Darrow's admission. D. The partnership's equity after the admission of Darrow is P640,000.

7. The partnership of William, jennings and Bryan have the following profit and loss ratios and capital balances on January 1, 2015. Capital balance William (40% share in profits and losses) Jennings (40%) Bryan (20%) P220,000 160,000 110,000 On that date, Darrow was admitted into the partnership. Darrow was given a 30% ownership interest in the partnership by paying P50,000 to each partner. All of the assets of the partnership are fairly valued. Which of the following is correct? A. Jennings will have a capital balance of P112,000 after Darrow's admission. B. William's capital increased by P58,800 after the admission of Darrow. C. Darrow's capital is credited by an amount that is P14,200 lower than the capital balance of William after Darrow's admission. D. The partnership's equity after the admission of Darrow is P640,000.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 1PA: The partnership of Tatum and Brook shares profits and losses in a 60:40 ratio respectively after...

Related questions

Question

Transcribed Image Text:7. The partnership of William, Jennings and Bryan have the following profit and loss ratios and capital balances on January 1,

2015.

Capital balance

William (40% share in profits and losses)

Jennings (40%)

Bryan (20%)

P220,000

160,000

110,000

On that date, Darrow was admitted into the partnership. Darrow was given a 30% ownership interest in the partnership by

paying P50,000 to each partner. All of the assets of the partnership are fairly valued.

Which of the following is correct?

A. Jennings will have a capital balance of P112,000 after Darrow's admission.

B. William's capital increased by P58,800 after the admission of Darrow.

C. Darrow's capital is credited by an amount that is P14,200 lower than the capital balance of William after Darrow's

admission.

D. The partnership's equity after the admission of Darrow is P640,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT