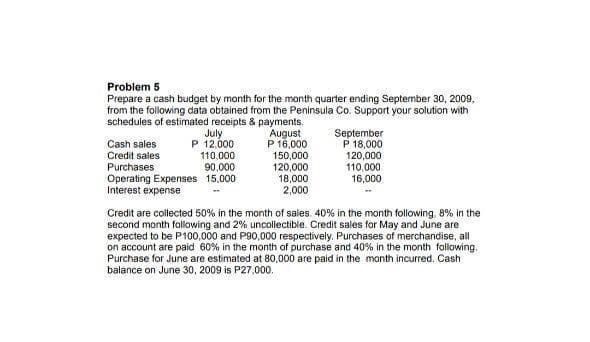

Problem 5 Prepare a cash budget by month for the month quarter ending September 30, 2009, from the following data obtained from the Peninsula Co. Support your solution with schedules of estimated receipts & payments. July P 12,000 September P 18,000 120,000 August P 16,000 Cash sales Credit sales Purchases Operating Expenses 15,000 Interest expense 110,000 150,000 120,000 18,000 2,000 90,000 110,000 16,000 Credit are collected 50% in the month of sales. 40% in the month following, 8% in the second month following and 2% uncollectible. Credit sales for May and June are expected to be P100,000 and P90,000 respectively. Purchases of merchandise, all on account are paid 60% in the month of purchase and 40% in the month following. Purchase for June are estimated at 80,000 are paid in the month incurred. Cash balance on June 30, 2009 is P27,000.

Problem 5 Prepare a cash budget by month for the month quarter ending September 30, 2009, from the following data obtained from the Peninsula Co. Support your solution with schedules of estimated receipts & payments. July P 12,000 September P 18,000 120,000 August P 16,000 Cash sales Credit sales Purchases Operating Expenses 15,000 Interest expense 110,000 150,000 120,000 18,000 2,000 90,000 110,000 16,000 Credit are collected 50% in the month of sales. 40% in the month following, 8% in the second month following and 2% uncollectible. Credit sales for May and June are expected to be P100,000 and P90,000 respectively. Purchases of merchandise, all on account are paid 60% in the month of purchase and 40% in the month following. Purchase for June are estimated at 80,000 are paid in the month incurred. Cash balance on June 30, 2009 is P27,000.

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter21: Budgeting

Section: Chapter Questions

Problem 21.1APR: Forecast sates volume and sales budget For 20Y8, Raphael Frame Company prepared the sales budget...

Related questions

Concept explainers

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

Topic Video

Question

Transcribed Image Text:Problem 5

Prepare a cash budget by month for the month quarter ending September 30, 2009,

from the following data obtained from the Peninsula Co. Support your solution with

schedules of estimated receipts & payments.

August

P 16,000

150,000

120,000

18,000

2,000

July

P 12,000

110.000

90,000

Operating Expenses 15,000

September

P 18,000

120,000

110,000

16,000

Cash sales

Credit sales

Purchases

Interest expense

Credit are collected 50% in the month of sales. 40% in the month following, 8% in the

second month following and 2% uncollectible. Credit sales for May and June are

expected to be P100,000 and P90,000 respectively. Purchases of merchandise, all

on account are paid 60% in the month of purchase and 40% in the month fallowing.

Purchase for June are estimated at 80,000 are paid in the month incurred. Cash

balance on June 30, 2009 is P27,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning