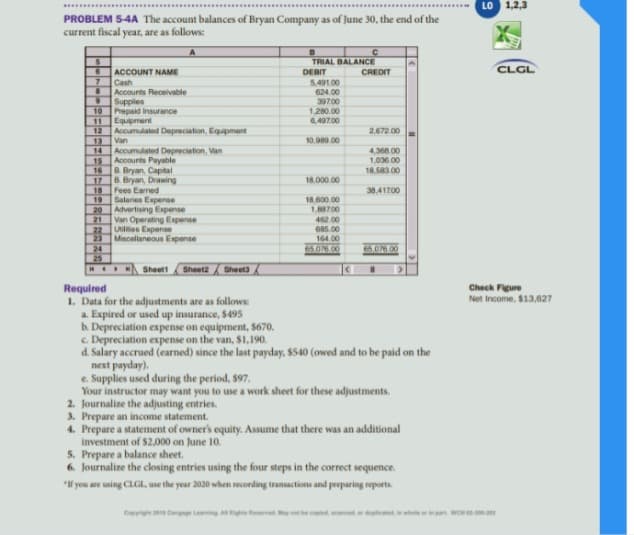

PROBLEM 54A The account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: TRIAL BALANCE DEBIT CREDIT CLGL ACCOUNT NAME Cash Accourts Receivable 5.491.00 624.00 307.00 1,280.00 6,497.00 Supples 10 Prepaid insurance 11 Equipment 12 Accumlated Depreciation, Equpment Van 2,472.00 10,980.00 13 14 Accumulated Depreciation, Van Accourts Payable 15 16 B. Bryan, Capital 17 4,368.00 1,000.00 18.583.00 B. Bryan, Drawing 10 18.000.00 Fees Earned 19 Salaries Expense Advertising Expense 38,41700 18.00.00 1.Z00 20 Van Operating Expense 462.00 G86.00 164.00 21 UNes Expense 23 22 Mincellaneous Espanse 24 25 65.0M.00 .00 00 Sheett Sheet2 Sheet3 Required 1. Data for the adjustments are as follows Check Figure Net Income, $13,027

PROBLEM 54A The account balances of Bryan Company as of June 30, the end of the current fiscal year, are as follows: TRIAL BALANCE DEBIT CREDIT CLGL ACCOUNT NAME Cash Accourts Receivable 5.491.00 624.00 307.00 1,280.00 6,497.00 Supples 10 Prepaid insurance 11 Equipment 12 Accumlated Depreciation, Equpment Van 2,472.00 10,980.00 13 14 Accumulated Depreciation, Van Accourts Payable 15 16 B. Bryan, Capital 17 4,368.00 1,000.00 18.583.00 B. Bryan, Drawing 10 18.000.00 Fees Earned 19 Salaries Expense Advertising Expense 38,41700 18.00.00 1.Z00 20 Van Operating Expense 462.00 G86.00 164.00 21 UNes Expense 23 22 Mincellaneous Espanse 24 25 65.0M.00 .00 00 Sheett Sheet2 Sheet3 Required 1. Data for the adjustments are as follows Check Figure Net Income, $13,027

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 45P

Related questions

Question

Transcribed Image Text:LO 1,2,3

PROBLEM 54A The account balances of Bryan Company as of June 30, the end of the

current fiscal year, are as follows:

TRIAL BALANCE

DEBIT

CLGL

ACCOUNT NAME

Cash

Accourts Receivable

CREDIT

5.491.00

Supplies

10

624.00

30z00

1,280.00

Prepaid insurance

Equipment

12

11

6.49700

Accumulated Depreciation, Equipment

Van

2,672.00

10,989.00

13

Accumulated Depreciation, Van

Accourts Payable

16

14

4,368 00

1,036.00

18.583.00

15

B. Bryan, Capital

17

B. Bryan, Drawing

18.000.00

18

Fees Earned

19

38,41700

18.600.00

1,88700

462.00

G85.00

164.00

65.076.00

Salaries Expense

Advertising Expense

Van Operating Expense

20

21

22

UNlities Expense

Miscellaneous Expanse

23

24

25

HEH

65,076 00

Sheett

Sheet2 Sheet3

Required

1. Data for the adjustments are as follows

a. Expired or used up insurance, $495

b. Depreciation expense on equipment, $670.

c. Depreciation expense on the van, $1,190.

d. Salary accrued (earned) since the last payday, $s40 (owed and to be paid on the

next payday).

e. Supplies used during the period, $97.

Your instructor may want you to use a work sheet for these adjustments.

2. Journalize the adjusting entries.

3. Prepare an income statement.

4. Prepare a statement of owner's equity. Assume that there was an additional

investment of S2,000 on June 10.

5. Prepare a balance sheet.

6. Journalize the closing entries using the four steps in the correct sequence.

Check Figure

Net Income, $13,027

*f you are uning CLGI, use the year 2020 when recording transactions and preparing repaorts.

Cg Cgr ng g edye et iwhte wON a

Expert Solution

Step 1 Introduction

The income statement is prepared to record revenues and expenses of the current period.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT