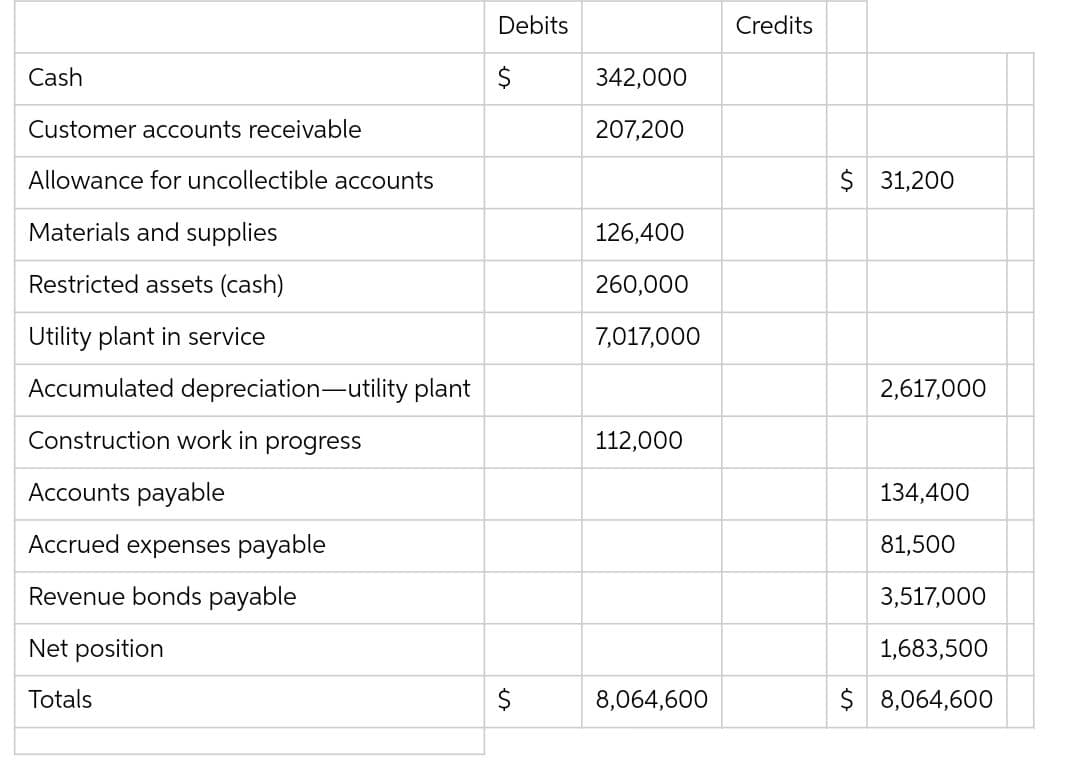

The Town of Weston has a Water Utility Fund with the following trial balance as of July 1, 2019, the first day of the fiscal year: During the year ended June 30, 2020, the following transactions and events occurred in the Town of Weston Water Utility Fund: Accrued expenses at July 1 were paid in cash. Billings to nongovernmental customers for water usage for the year amounted to $1,423,000; billings to the General Fund amounted to $118,000. Liabilities for the following were recorded during the year: Materials and supplies $ 202,000 Costs of sales and services 376,000 Administrative expenses 211,000 Construction work in progress 230,000 Materials and supplies were used in the amount of $294,000, all for costs of sales and services. After collection efforts were unsuccessful, $14,900 of old accounts receivable were written off. Accounts receivable collections totaled $1,518,000 from nongovernmental customers and $51,100 from the General Fund. $1,092,600 of accounts payable were paid in cash. One year’s interest in the amount of $184,900 was paid. Construction was completed on plant assets costing $260,000; that amount was transferred to Utility Plant in Service. Depreciation was recorded in the amount of $270,100. The Allowance for Uncollectible Accounts was increased by $10,000. As required by the loan agreement, cash in the amount of $112,000 was transferred to Restricted Assets for eventual redemption of the bonds. Accrued expenses, all related to costs of sales and services, amounted to $105,000. Nominal accounts for the year were closed. Required: a. Record the transactions for the year in general journal form.

The Town of Weston has a Water Utility Fund with the following

During the year ended June 30, 2020, the following transactions and events occurred in the Town of Weston Water Utility Fund:

Accrued expenses at July 1 were paid in cash.

Billings to nongovernmental customers for water usage for the year amounted to $1,423,000; billings to the General Fund amounted to $118,000.

Liabilities for the following were recorded during the year:

Materials and supplies $ 202,000

Costs of sales and services 376,000

Administrative expenses 211,000

Construction work in progress 230,000

Materials and supplies were used in the amount of $294,000, all for costs of sales and services.

After collection efforts were unsuccessful, $14,900 of old accounts receivable were written off.

Accounts receivable collections totaled $1,518,000 from nongovernmental customers and $51,100 from the General Fund.

$1,092,600 of accounts payable were paid in cash.

One year’s interest in the amount of $184,900 was paid.

Construction was completed on plant assets costing $260,000; that amount was transferred to Utility Plant in Service.

The Allowance for Uncollectible Accounts was increased by $10,000.

As required by the loan agreement, cash in the amount of $112,000 was transferred to Restricted Assets for eventual redemption of the bonds.

Accrued expenses, all related to costs of sales and services, amounted to $105,000.

Nominal accounts for the year were closed.

Required:

a. Record the transactions for the year in general journal form.

b. Prepare a Statement of Revenues, Expenses, and Changes in Fund Net Position.

c. Prepare a Statement of Net Position as of June 30, 2020.

d. Prepare a Statement of

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images