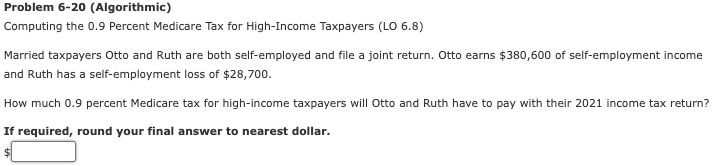

Problem 6-20 (Algorithmic) Computing the 0.9 Percent Medicare Tax for High-Income Taxpayers (LO 6.8) Married taxpayers Otto and Ruth are both self-employed and file a joint return. Otto earns $380,600 of self-employment income and Ruth has a self-employment loss of $28,700. How much 0.9 percent Medicare tax for high-income taxpayers will Otto and Ruth have to pay with their 2021 income tax return? If required, round your final answer to nearest dollar.

Problem 6-20 (Algorithmic) Computing the 0.9 Percent Medicare Tax for High-Income Taxpayers (LO 6.8) Married taxpayers Otto and Ruth are both self-employed and file a joint return. Otto earns $380,600 of self-employment income and Ruth has a self-employment loss of $28,700. How much 0.9 percent Medicare tax for high-income taxpayers will Otto and Ruth have to pay with their 2021 income tax return? If required, round your final answer to nearest dollar.

Chapter3: Computing The Tax

Section: Chapter Questions

Problem 25P

Related questions

Question

100%

Transcribed Image Text:Problem 6-20 (Algorithmic)

Computing the 0.9 Percent Medicare Tax for High-Income Taxpayers (LO 6.8)

Married taxpayers Otto and Ruth are both self-employed and file a joint return. Otto earns $380,600 of self-employment income

and Ruth has a self-employment loss of $28,700.

How much 0.9 percent Medicare tax for high-income taxpayers will Otto and Ruth have to pay with their 2021 income tax return?

If required, round your final answer to nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning