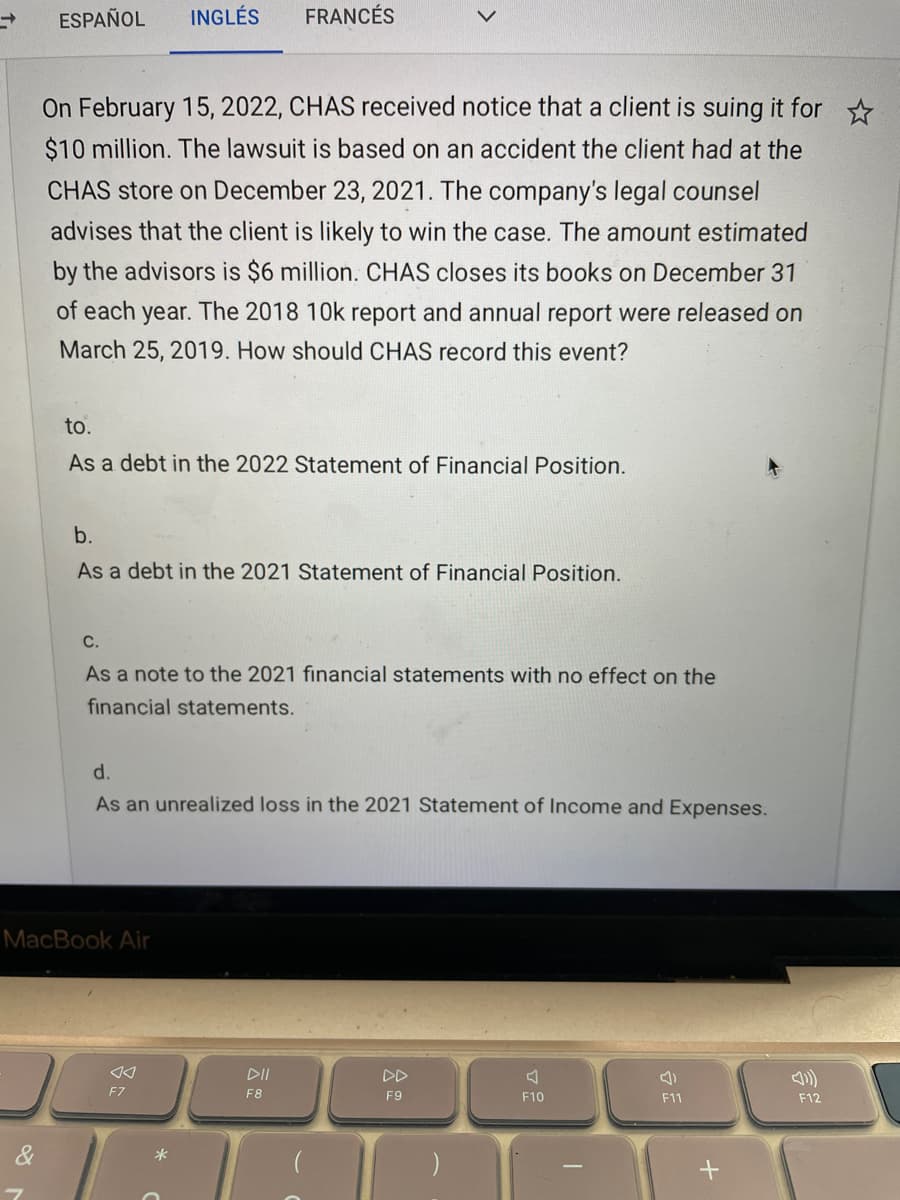

On February 15, 2022, CHAS received notice that a client is suing it for $10 million. The lawsuit is based on an accident the client had at the CHAS store on December 23, 2021. The company's legal counsel advises that the client is likely to win the case. The amount estimated by the advisors is $6 million. CHAS closes its books on December 31 of each year. The 2018 10k report and annual report were released on March 25, 2019. How should CHAS record this event? to. As a debt in the 2022 Statement of Financial Position. b. As a debt in the 2021 Statement of Financial Position. с. As a note to the 2021 financial statements with no effect on the financial statements. d. As an unrealized loss in the 2021 Statement of Income and Expenses.

On February 15, 2022, CHAS received notice that a client is suing it for $10 million. The lawsuit is based on an accident the client had at the CHAS store on December 23, 2021. The company's legal counsel advises that the client is likely to win the case. The amount estimated by the advisors is $6 million. CHAS closes its books on December 31 of each year. The 2018 10k report and annual report were released on March 25, 2019. How should CHAS record this event? to. As a debt in the 2022 Statement of Financial Position. b. As a debt in the 2021 Statement of Financial Position. с. As a note to the 2021 financial statements with no effect on the financial statements. d. As an unrealized loss in the 2021 Statement of Income and Expenses.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 13MCQ

Related questions

Question

Transcribed Image Text:ESPAÑOL

INGLÉS

FRANCÉS

On February 15, 2022, CHAS received notice that a client is suing it for

$10 million. The lawsuit is based on an accident the client had at the

CHAS store on December 23, 2021. The company's legal counsel

advises that the client is likely to win the case. The amount estimated

by the advisors is $6 million. CHAS closes its books on December 31

of each year. The 2018 10k report and annual report were released on

March 25, 2019. How should CHAS record this event?

to.

As a debt in

2022 Statement of Financial Position.

b.

As a debt in the 2021 Statement of Financial Position.

С.

As a note to the 2021 financial statements with no effect on the

financial statements.

d.

As an unrealized loss in the 2021 Statement of Income and Expenses.

MacBook Air

DII

DD

F7

F8

F9

F10

F11

F12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT