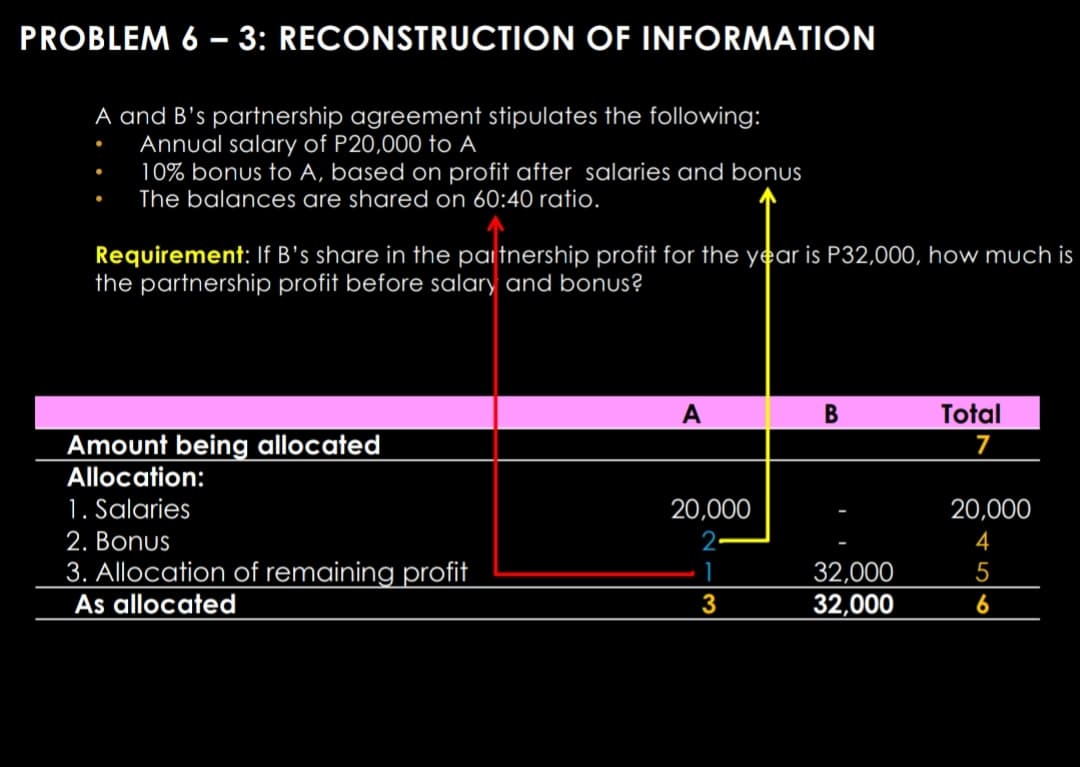

PROBLEM 6 – 3: RECONSTRUCTION OF INFORMATION A and B's partnership agreement stipulates the following: Annual salary of P20,000 to A 10% bonus to A, based on profit after salaries and bonus The balances are shared on 60:40 ratio. Requirement: If B's share in the partnership profit for the year is P32,000, how much is the partnership profit before salary and bonus? A Total Amount being allocated 7 Allocation: 1. Salaries 20,000 20,000 2. Bonus 2 4 3. Allocation of remaining profit As allocated 32,000 32,000 5 3 6

PROBLEM 6 – 3: RECONSTRUCTION OF INFORMATION A and B's partnership agreement stipulates the following: Annual salary of P20,000 to A 10% bonus to A, based on profit after salaries and bonus The balances are shared on 60:40 ratio. Requirement: If B's share in the partnership profit for the year is P32,000, how much is the partnership profit before salary and bonus? A Total Amount being allocated 7 Allocation: 1. Salaries 20,000 20,000 2. Bonus 2 4 3. Allocation of remaining profit As allocated 32,000 32,000 5 3 6

Chapter11: Investor Losses

Section: Chapter Questions

Problem 35P

Related questions

Question

100%

Transcribed Image Text:PROBLEM 6 – 3: RECONSTRUCTION OF INFORMATION

A and B's partnership agreement stipulates the following:

Annual salary of P20,000 to A

10% bonus to A, based on profit after salaries and bonus

The balances are shared on 60:40 ratio.

Requirement: If B's share in the pai tnership profit for the year is P32,000, how much is

the partnership profit before salary and bonus?

A

В

Total

Amount being allocated

7

Allocation:

1. Salaries

20,000

20,000

2. Bonus

4

3. Allocation of remaining profit

As allocated

32,000

32,000

5

3

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College