Problem 32: Pam and Drix formed a partnership in 20x1 to operate a bookkeeping services. Pam contributed the initial capital while Drix managed the business. With the assistance of their consultants, they have arrived at the following agreement: 1. Each partner is allowed to withdraw P1,000 in cash from business every month. Any withdrawal in excess of that figure will be accounted for as a direct reduction to the partners' capital balance. 2. Partnership profits and losses will be allocated each year according to the following plan: Interest of 15% will be accrued by each partner based on the monthly average capital balance for the year. As the managing partner, Drix is to receive credit for a bonus equal to 20% of the year's net income. Any remaining profit or loss will be divided equally between the two partners. Pam and Drix begin the year of 20x1 with capital balances of P150,000 and P30,000, respectively. On April 1 of the year, Pam invested additional P8,000 cash in the business, while on July 1, Drix withdraws P6,000 in excess of the specified drawing allowance. The partners withdraw the amount of cash allowed every month. The partnership reports net income of P30,000 for 20x1. The amount of capital balances of Pam and Drix on December 31, 20x1 will be: a. P167,675; P20,325 b. P155,675; P26,325 c. P158,000; P14,000 d. P159,675; P22,325

Problem 32: Pam and Drix formed a partnership in 20x1 to operate a bookkeeping services. Pam contributed the initial capital while Drix managed the business. With the assistance of their consultants, they have arrived at the following agreement: 1. Each partner is allowed to withdraw P1,000 in cash from business every month. Any withdrawal in excess of that figure will be accounted for as a direct reduction to the partners' capital balance. 2. Partnership profits and losses will be allocated each year according to the following plan: Interest of 15% will be accrued by each partner based on the monthly average capital balance for the year. As the managing partner, Drix is to receive credit for a bonus equal to 20% of the year's net income. Any remaining profit or loss will be divided equally between the two partners. Pam and Drix begin the year of 20x1 with capital balances of P150,000 and P30,000, respectively. On April 1 of the year, Pam invested additional P8,000 cash in the business, while on July 1, Drix withdraws P6,000 in excess of the specified drawing allowance. The partners withdraw the amount of cash allowed every month. The partnership reports net income of P30,000 for 20x1. The amount of capital balances of Pam and Drix on December 31, 20x1 will be: a. P167,675; P20,325 b. P155,675; P26,325 c. P158,000; P14,000 d. P159,675; P22,325

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter11: Stockholders' Equity

Section: Chapter Questions

Problem 11.9AP

Related questions

Question

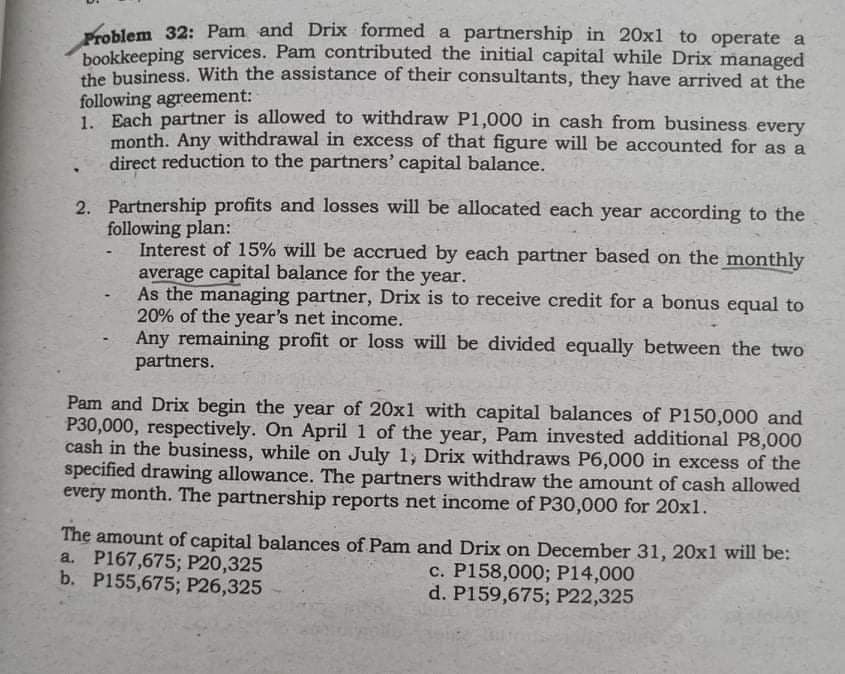

Transcribed Image Text:Problem 32: Pam and Drix formed a partnership in 20x1 to operate a

bookkeeping services. Pam contributed the initial capital while Drix managed

the business. With the assistance of their consultants, they have arrived at the

following agreement:

1. Each partner is allowed to withdraw P1,000 in cash from business every

month. Any withdrawal in excess of that figure will be accounted for as a

direct reduction to the partners' capital balance.

2. Partnership profits and losses will be allocated each year according to the

following plan:

Interest of 15% will be accrued by each partner based on the monthly

average capital balance for the year.

As the managing partner, Drix is to receive credit for a bonus equal to

20% of the year's net income.

Any remaining profit or loss will be divided equally between the two

partners.

Pam and Drix begin the year of 20x1 with capital balances of P150,000 and

P30,000, respectively. On April 1 of the year, Pam invested additional P8,000

cash in the business, while on July 1, Drix withdraws P6,000 in excess of the

specified drawing allowance. The partners withdraw the amount of cash allowed

every month. The partnership reports net income of P30,000 for 20x1.

The amount of capital balances of Pam and Drix on December 31, 20x1 will be:

a. P167,675; P20,325

b. P155,675; P26,325

c. P158,000; P14,000

d. P159,675; P22,325

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning