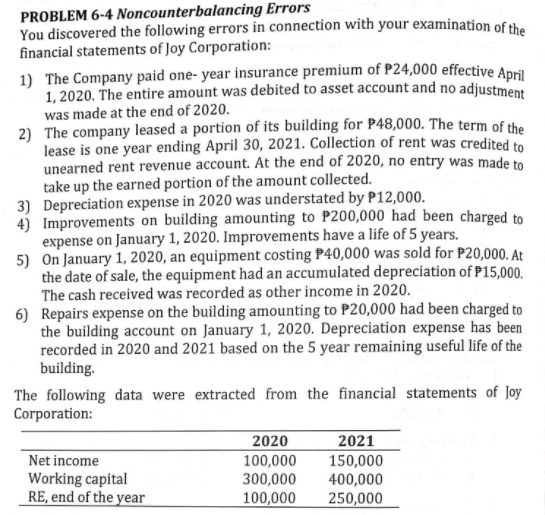

PROBLEM 6-4 Noncounterbalancing Errors You discovered the following errors in connection with your examination of the financial statements of Joy Corporation: 1) The Company paid one- year insurance premium of P24,000 effective April 1, 2020. The entire amount was debited to asset account and no adjustment was made at the end of 2020. 2) The company leased a portion of its building for P48,000. The term of the lease is one year ending April 30, 2021. Collection of rent was credited to unearned rent revenue account. At the end of 2020, no entry was made to take up the earned portion of the amount collected. 3) Depreciation expense in 2020 was understated by P12,000. 4) Improvements on building amounting to P200,000 had been charged to expense on January 1, 2020. Improvements have a life of 5 years. 5) On January 1, 2020, an equipment costing P40,000 was sold for P20,000. At the date of sale, the equipment had an accumulated depreciation of P15,000. The cash received was recorded as other income in 2020. 6) Repairs expense on the building amounting to P20,000 had been charged to the building account on January 1, 2020. Depreciation expense has been recorded in 2020 and 2021 based on the 5 year remaining useful life of the building. The following data were extracted from the financial statements of Joy Corporation: 2020 2021 Net income Working capital RE, end of the year 100,000 300,000 100,000 150,000 400,000 250,000

PROBLEM 6-4 Noncounterbalancing Errors You discovered the following errors in connection with your examination of the financial statements of Joy Corporation: 1) The Company paid one- year insurance premium of P24,000 effective April 1, 2020. The entire amount was debited to asset account and no adjustment was made at the end of 2020. 2) The company leased a portion of its building for P48,000. The term of the lease is one year ending April 30, 2021. Collection of rent was credited to unearned rent revenue account. At the end of 2020, no entry was made to take up the earned portion of the amount collected. 3) Depreciation expense in 2020 was understated by P12,000. 4) Improvements on building amounting to P200,000 had been charged to expense on January 1, 2020. Improvements have a life of 5 years. 5) On January 1, 2020, an equipment costing P40,000 was sold for P20,000. At the date of sale, the equipment had an accumulated depreciation of P15,000. The cash received was recorded as other income in 2020. 6) Repairs expense on the building amounting to P20,000 had been charged to the building account on January 1, 2020. Depreciation expense has been recorded in 2020 and 2021 based on the 5 year remaining useful life of the building. The following data were extracted from the financial statements of Joy Corporation: 2020 2021 Net income Working capital RE, end of the year 100,000 300,000 100,000 150,000 400,000 250,000

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Can you explain how are the amounts in the errors calculated given the attached problem? Thank you

Transcribed Image Text:PROBLEM 6-4 Noncounterbalancing Errors

You discovered the following errors in connection with your examination of the

financial statements of Joy Corporation:

1) The Company paid one- year insurance premium of P24,000 effective April

1, 2020. The entire amount was debited to asset account and no adjustment

was made at the end of 2020.

2) The company leased a portion of its building for P48,000. The term of the

lease is one year ending April 30, 2021. Collection of rent was credited to

unearned rent revenue account. At the end of 2020, no entry was made to

take up the earned portion of the amount collected.

3) Depreciation expense in 2020 was understated by P12,000.

4) Improvements on building amounting to P200,000 had been charged to

expense on January 1, 2020. Improvements have a life of 5 years.

5) On January 1, 2020, an equipment costing P40,000 was sold for P20,000. At

the date of sale, the equipment had an accumulated depreciation of P15,000.

The cash received was recorded as other income in 2020.

6) Repairs expense on the building amounting to P20,000 had been charged to

the building account on January 1, 2020. Depreciation expense has been

recorded in 2020 and 2021 based on the 5 year remaining useful life of the

building.

The following data were extracted from the financial statements of Joy

Corporation:

2020

2021

Net income

Working capital

RE, end of the year

150,000

400,000

100,000

300,000

100,000

250,000

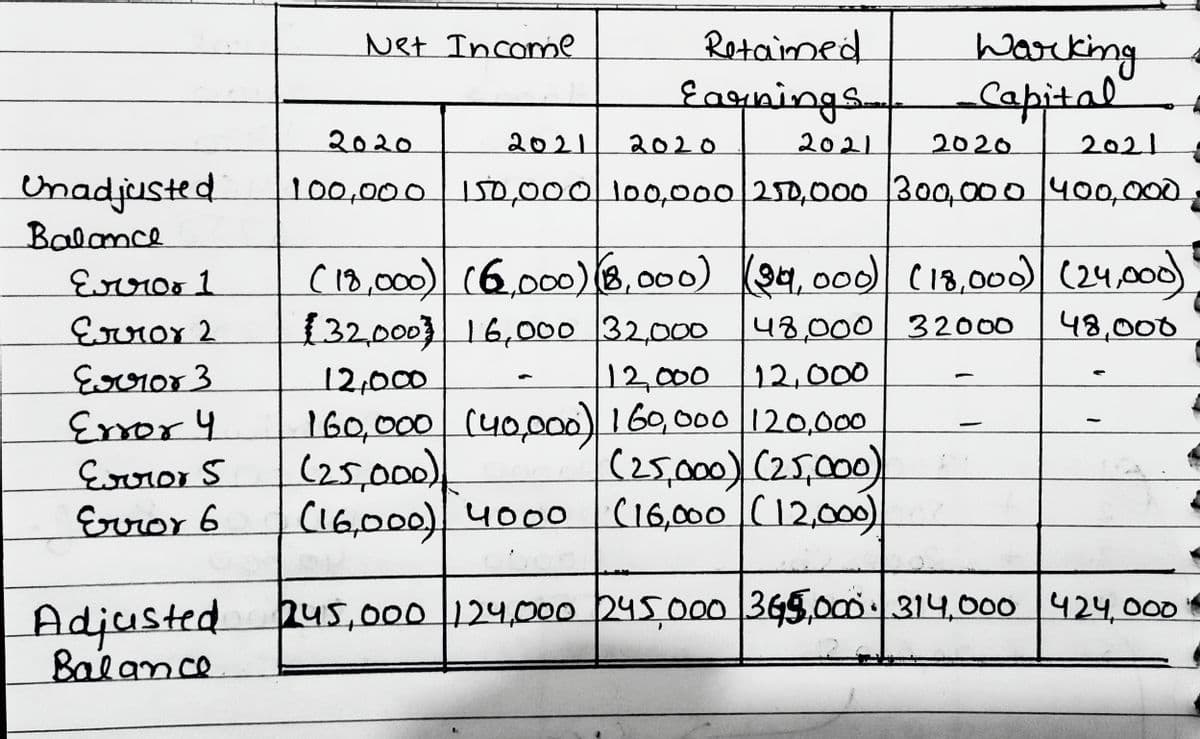

Transcribed Image Text:Net Income

Retaimed

Eaunings.

Warking

Capital

2020

2021

2020

2021

2020

2021

Unadjusted

Balomce

100,000 ISD,000 100,000 250,000 300,000/400,000,

(18,000) (6.0B,00) (94, 00 00(24,0

132,0003 16,000 32,000 48,000 32000

12,000

160,000 (40,000) 160, 000 120.000

(25,000) (25,000)

CI6,000) 400o (16,000 C12,o0)

Evroo1

48,000

Eooror3

Enor4

Eoror5

Error 6

12,000

12,000

(25,000)

pus,000 |124,000 245,000 345,00 314,000 424,000

Adjusted

Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education