Requirement No.2: Record the adjustments assuming that: 1. The Php24,000 rent is for 6 months starting December 1, 2021 2. The Php60,000 insurance is for 12 months starting October 31, 2021 3. The unused supplies as of December 31, 2021 amount to Php1,000 4. The delivery truck was acquired October 1, 2021 and has an estimated life of 5 year without scrap value. 5. Out of Php180,000 cash advance, Php120,000 has been delivered to the customer.

Requirement No.2: Record the adjustments assuming that: 1. The Php24,000 rent is for 6 months starting December 1, 2021 2. The Php60,000 insurance is for 12 months starting October 31, 2021 3. The unused supplies as of December 31, 2021 amount to Php1,000 4. The delivery truck was acquired October 1, 2021 and has an estimated life of 5 year without scrap value. 5. Out of Php180,000 cash advance, Php120,000 has been delivered to the customer.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 2EB: Johnson, Incorporated had the following transactions during the year: Purchased a building for...

Related questions

Question

Do requirement no. 2 only.

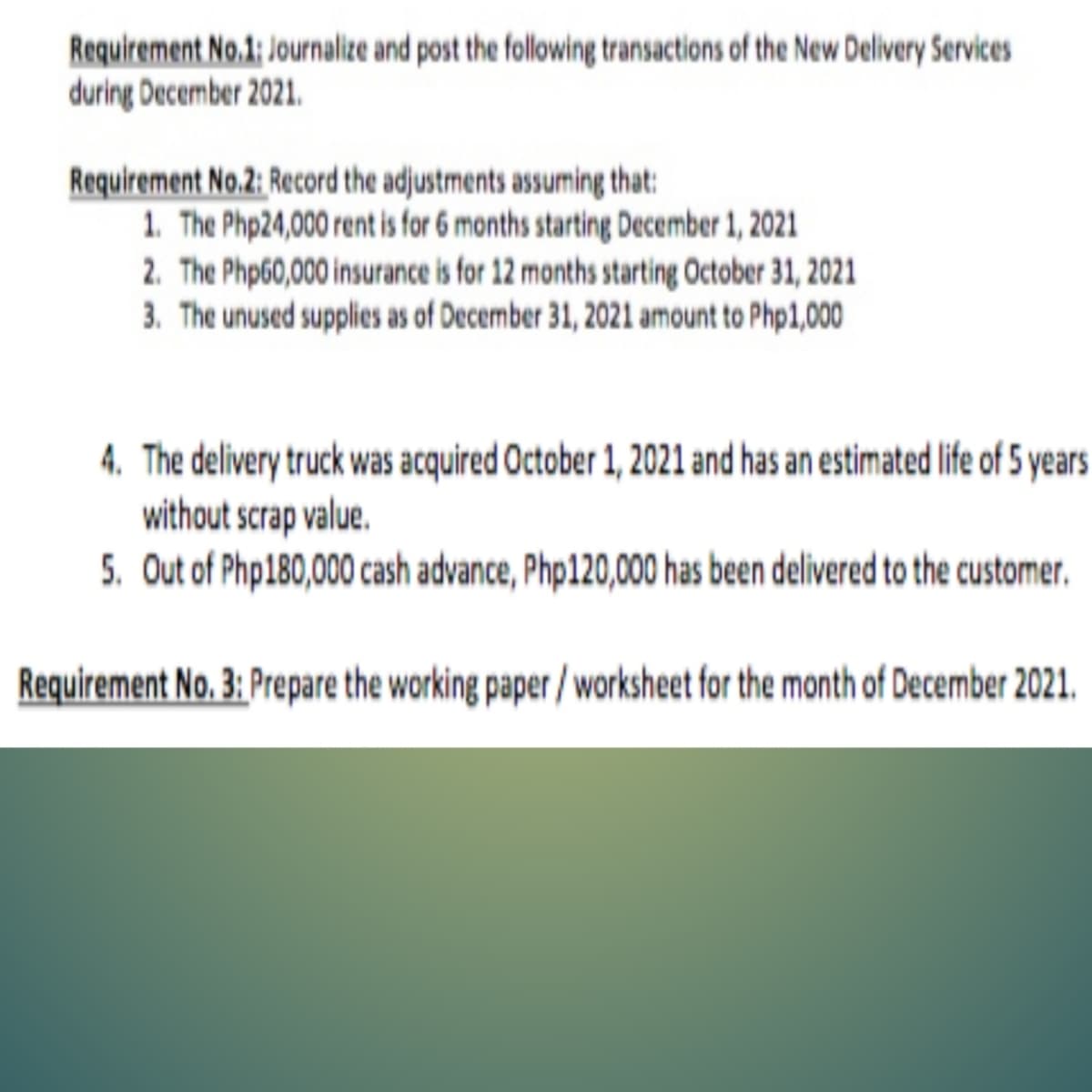

Transcribed Image Text:Requirement No.1; Journalize and post the following transactions of the New Delivery Services

during December 2021.

Requirement No.2: Record the adjustments assuming that:

1. The Php24,000 rent is for 6 months starting December 1, 2021

2. The Php60,000 insurance is for 12 months starting October 31, 2021

3. The unused supplies as of December 31, 2021 amount to Php1,000

4. The delivery truck was acquired October 1, 2021 and has an estimated life of 5 years

without scrap value.

5. Out of Php180,000 cash advance, Php120,00 has been delivered to the customer.

Requirement No. 3: Prepare the working paper/worksheet for the month of December 2021.

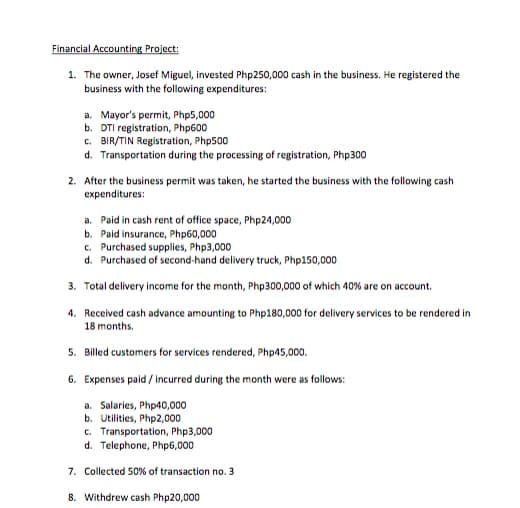

Transcribed Image Text:Financial Accounting Project:

1. The owner, Josef Miguel, invested Php250,000 cash in the business. He registered the

business with the following expenditures:

a. Mayor's permit, Php5,000

b. DTI registration, Php600

c. BIR/TIN Registration, Php500

d. Transportation during the processing of registration, Php300

2. After the business permit was taken, he started the business with the following cash

expenditures:

a. Paid in cash rent of office space, Php24,000

b. Paid insurance, Php60,000

c. Purchased supplies, Php3,000

d. Purchased of second-hand delivery truck, Php150,000

3. Total delivery income for the month, Php300,000 of which 40% are on account.

4. Received cash advance amounting to Php180,000 for delivery services to be rendered in

18 months.

5. Billed customers for services rendered, Php45,000.

6. Expenses paid / incurred during the month were as follows:

a. Salaries, Php40,000

b. Utilities, Php2,000

c. Transportation, Php3,000

d. Telephone, Php6,000

7. Collected 50% of transaction no. 3

8. Withdrew cash Php20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning