Problem 6: Income Inclusions Ted Crisp reports the following transactions for 2022: • In exchange for providing consulting services Ted entered into an agreement to receive a bag of diamonds with a fair market value of $25,000. The diamonds are delivered to a warehouse in Ted's town on 12/20/2022 but he doesn't pick them up until 01/15/2023. On January 1st, Ted made a loan in the amount of $110,000 to his co- worker Lem so that Lem could purchase Bitcoin. He didn't charge Lem any interest on the loan. The applicable federal funds rate for 2022 was 10% and Lem had net investment income of $500. His employer, Veridian Dynamics, provided Ted with product discounts in the amount of $5,000. The discounts are offered to all employees. Ted purchases stock in Alibaba, Ltd for $20,000. The stock is worth $5,000 on 12/31/2022. ● ● ● Ted invests in an S-corp for a 10% ownership interest. The S-corp earned total profits of $500,000 and distributed cash of $40,000 to Ted. Required: How much must Ted include in his 2022 gross income as a result of the above transactions?

Problem 6: Income Inclusions Ted Crisp reports the following transactions for 2022: • In exchange for providing consulting services Ted entered into an agreement to receive a bag of diamonds with a fair market value of $25,000. The diamonds are delivered to a warehouse in Ted's town on 12/20/2022 but he doesn't pick them up until 01/15/2023. On January 1st, Ted made a loan in the amount of $110,000 to his co- worker Lem so that Lem could purchase Bitcoin. He didn't charge Lem any interest on the loan. The applicable federal funds rate for 2022 was 10% and Lem had net investment income of $500. His employer, Veridian Dynamics, provided Ted with product discounts in the amount of $5,000. The discounts are offered to all employees. Ted purchases stock in Alibaba, Ltd for $20,000. The stock is worth $5,000 on 12/31/2022. ● ● ● Ted invests in an S-corp for a 10% ownership interest. The S-corp earned total profits of $500,000 and distributed cash of $40,000 to Ted. Required: How much must Ted include in his 2022 gross income as a result of the above transactions?

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 2RP

Related questions

Question

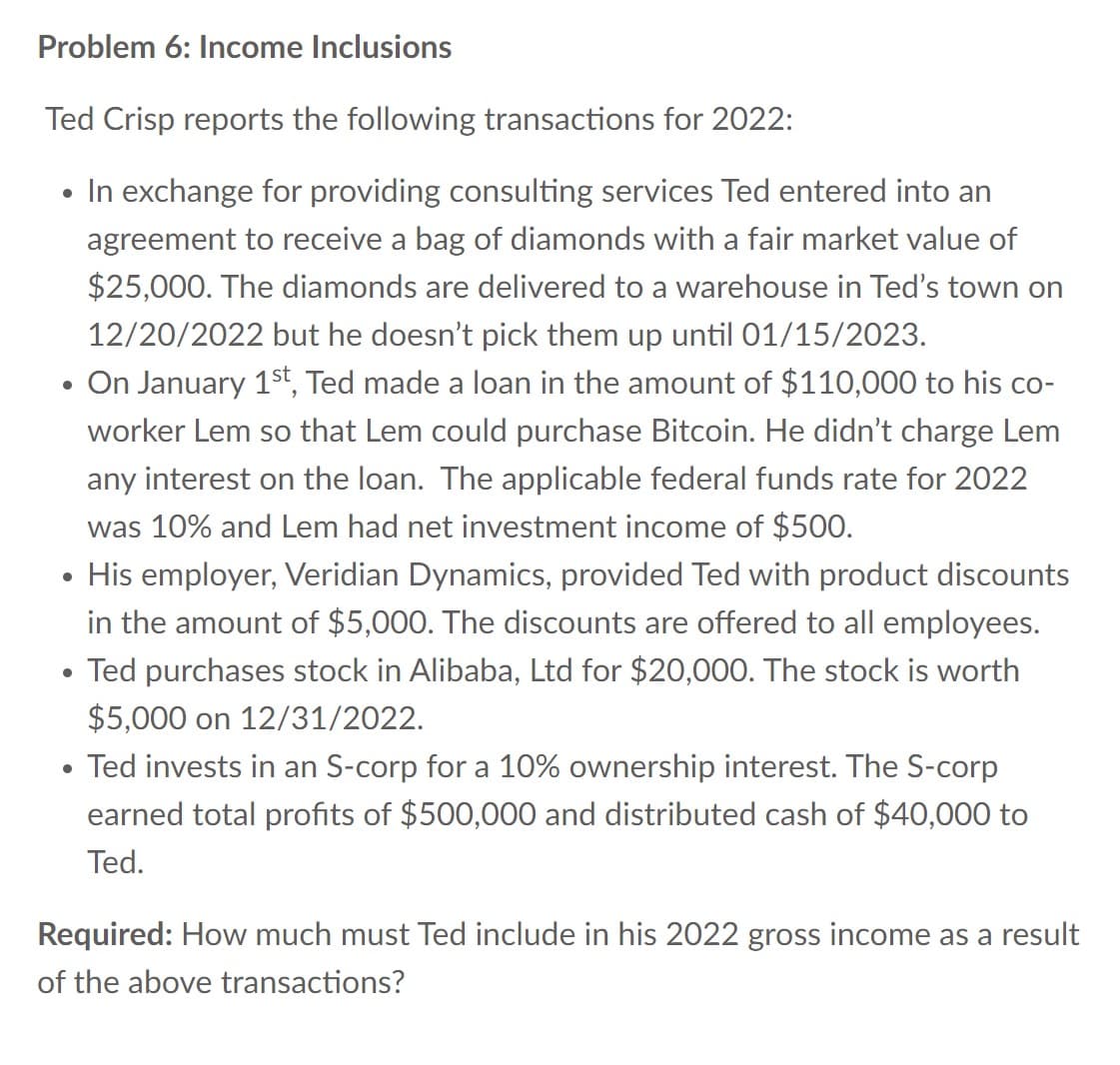

Transcribed Image Text:Problem 6: Income Inclusions

Ted Crisp reports the following transactions for 2022:

• In exchange for providing consulting services Ted entered into an

agreement to receive a bag of diamonds with a fair market value of

$25,000. The diamonds are delivered to a warehouse in Ted's town on

12/20/2022 but he doesn't pick them up until 01/15/2023.

• On January 1st, Ted made a loan in the amount of $110,000 to his co-

worker Lem so that Lem could purchase Bitcoin. He didn't charge Lem

any interest on the loan. The applicable federal funds rate for 2022

was 10% and Lem had net investment income of $500.

• His employer, Veridian Dynamics, provided Ted with product discounts

in the amount of $5,000. The discounts are offered to all employees.

• Ted purchases stock in Alibaba, Ltd for $20,000. The stock is worth

$5,000 on 12/31/2022.

• Ted invests in an S-corp for a 10% ownership interest. The S-corp

earned total profits of $500,000 and distributed cash of $40,000 to

Ted.

Required: How much must Ted include in his 2022 gross income as a result

of the above transactions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT