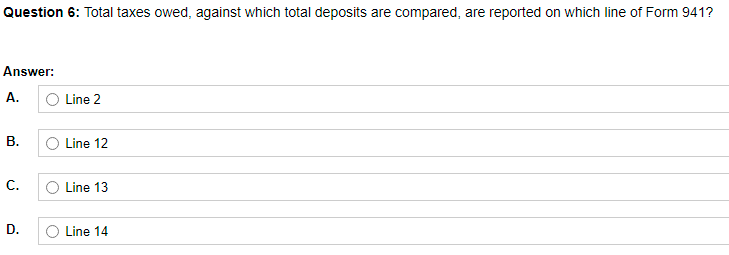

Question 6: Total taxes owed, against which total deposits are compared, are reported on which line of Form 941? Answer: А. O Line 2 В. Line 12 C. O Line 13

Q: Zekany Corporation would have had identical income before taxes on both its income tax returns and…

A: Given : The asset cost $160,000 and is depreciated for income tax purposes in the following amounts:…

Q: Earnings per share is computed on a. ordinary shares only b. preference shares only c. both…

A: Earnings Per Shares refers to Total Dividable profit divided by its number of common shares…

Q: Alicia has been working for JMM Corporated for 32 years. Alicia participates in JMM’s defined…

A: As per IRS Maximum benefit that can be paid under defined benefit plan for employees retiring in…

Q: If company A has current ratio of 1.3 while company B has a current ratio of 2.3, which is a better…

A: Current ratio is a ratio which measures the proportion of current assets over current liabilities.…

Q: For its three investment centres, Stahl Company accumulates the following data: Centre I…

A: Lets understand the basics. For calculating expected return on investment, we need to use below…

Q: Required: Prepare a budget for sales expenses for a typical month in the coming year. (Do not round…

A: Solution:- Given, SPU, Ltd., has just received its sales expense report for January You have been…

Q: sume a company had the following inventory information: eginning Inventory: 90 units @ $4.00 cost…

A: Under average cost method, average cost per unit is arrived at by dividing Total cost of units…

Q: Plant A Plant B Plant C Average Station Heat Rate (BTU/kwh) 16500 14500 13000 Total investment…

A: International Manufacturer requirement of Electrical Energy = 50,000,000 kWh Maximum Demand = 10,000…

Q: A company reports the following amounts at the end of the year: Total sales revenue = $560.000;…

A: Formula: Net revenues = Sales revenue - Sales discount - Sales returns - Sales allowances

Q: The sales in units required by Photo Finish to make an after-tax profit (TA) of $20,000, given an…

A: Introduction:- The following formula used to calculate as follows under:- Unit sales =(Target…

Q: Agency A receives a Notice of Cash Allocation from the DBM of 10,000,000.00 for the second quarter…

A: Journal entry recording is the initial step of accounting cycle process. Under this, atleast one…

Q: Jason and Kidd are partners who share profits and losses in the ratio of 3:1, respectively. On…

A: It is a form of business in which two or more people agree to share profit and loss in agreed ratio…

Q: QUESTION 1 Uber lec purchased a car for $43100. The car has a salvage value of $2000 and is…

A: Assets consists of all type of resources being held by the business. These may be current assets or…

Q: Pheonix earns $19.45 per hour and this week works 42 hours. She is paid weekly. Her company follows…

A: Total earnings of Pheonix in this week=42 hours*$19.45 per hour=$816.90 Employer's employment…

Q: On January 1, Year 1, Pearson Moving Company paid $41187 cash to purchase a truck. The truck was…

A: Formula: Straight line method depreciation: = ( Asset value - Salvage value ) / Useful life

Q: Condensed Balance Sheets December 31 (In millions) Assets 2014 20 Assets 1,902.0 sets 2,952.8 ssets…

A:

Q: Erica Tomlinson's credit card company determines her minimum monthly payment by adding all new…

A: Minimum monthly payment for November = 2% of the outstanding principal + all new interest Interest…

Q: The net income of Monarch Skate Inc. amounted to $3,750,000 for the year ended December 31, 2020.…

A: Earning per share = Net income/ Weighted avearge no of outstanding share

Q: s. The Sanchezes would itemize deductions even if they did not have any deductible interest. The…

A: Rental payment are not deductible expenses in tax.Therefore,there will be no tax saving due to…

Q: MC19 The Diane Company has a single investment property acquired on July 1, 2019 for P11,400,000.…

A:

Q: stion 1: Under the wage-bracket metnod for an employee who completed the 2021 Form W-4, what would…

A: As per IRS , the employers are suppose to withhold the specific part of the…

Q: Select account balances from the December 31, 2015, trial balances of the Gracy Company are listed…

A: Gracy Company Adjusting entries at December 31, 2015: Account Titles Debit ($) Credit ($) Cost…

Q: A company receives an advance payment for special-order goods to be manufactured and delivered with…

A: Advance payment seems to be a type of payment made ahead of its usual timetable, such as prepayment…

Q: ting income statement for the company for the last quarter is given below: Superior Markets,…

A: Income statement shows net income which is calculated as excess of sales over expenses.

Q: You are the audit manager of Matfine & Co and are reviewing the key issues identified in the files…

A: "Since you have asked multiple questions, we will solve the first question for you. In order to get…

Q: When a corporation pays dividends, the three relevant dates for dividends occur in this order: a.…

A: Record date is the date basis which the shareholders are identified for dividend payment. date of…

Q: Fred is an investor in vacant land. When he thinks he has identified property that would be a good…

A: a. If Fred treats the right to refusal as an option to purchase the land, the asset on which he had…

Q: Drill 2 Write your answer in a bond paper or intermediate paper. Label it Drill NO. 2. Answer in

A: Assets = Liabilities + Owner's Equity All the parts have been solved using this Accounting…

Q: Total $ 260,400 159,600 Per Unit $ 31.00 19.00 Sales (8,400 units) Variable expenses Contribution…

A: Formula: Net income = Revenues - Expenses.

Q: 12. Using Percentage of Sales. Eagle Sports Supply has the following financial statements. Assume…

A: The finance can be raised through issue of stock by borrowing money or through issuing Debentures.…

Q: April Industries employs a standard costing system in the manufacturing of its sole product, a park…

A:

Q: Multiple-Step and Single-Step Income Statements The following items were derived from Gold Company’s…

A: Under single step income statement, net income is calculated as the excess of revenue and gains over…

Q: 10. Loudoun Trucking purchases 4,750 truck tires. The federal excise tax is $0.13 per tire. Find the…

A: Introduction:- Federal excise tax is charged or imposed on the sale of things. Which is charged on…

Q: The CFM Partnership shows the following profit and loss ratios and capital balances: Carter - 60% P…

A: In the context of the given question, we compute the capital balances of the partners. Here, the…

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur…

A:

Q: Critically discuss the importance of preparing a cash budget for any organisation, especially when…

A: Cash Budget: It is an estimate of how much money a company will have in its bank account at any…

Q: Smmons Inc. uses the lower of cost on meket method to valesinventory that is accounted or using he…

A: Inventory valuation method includes: First-in, First-Out (FIFO) Last-in, Last-Out (LIFO) Average…

Q: Inventory records for Dunbar Incorporated revealed the following: Number of Units 430 420 Unit Cost…

A: LIFO is also known as Last in first out method. It is the method in which goods received recently…

Q: Choose one specialized industry and identify one specific financial reporting standards or distinct…

A: Financial reporting standards are those standards which are to be followed by each business in order…

Q: RMU

A: We need to compute the future price of machine after 8 years and then shall compute the amount to be…

Q: he following information concerns production in the Forging Department for November. All direct…

A: The equivalent units are calculated on the basis of percentage of the work completed during the…

Q: Philip and Morris are partners with capital 16,000 and P 8,000, respectively. They share profits in…

A: In the context of the given question, we need to compute the new profit sharing ratio after the…

Q: Ambassador Suites Inc. operates a downtown hotel property that has 300 rooms. On average, 80% of…

A: To determine how much labor cost are incurred in order to produce the items stated in the production…

Q: Requirements: Comprehensive income and financial position.

A: Financial statements are those statements and reports which are prepared at the end of accounting…

Q: Alicia has been working for JMM Corporated for 32 years. Alicia participates in JMM's defined…

A: A defined-benefit plan is often a plan which is organized by an employer and is often a retirement…

Q: Jay-Zee Company makes an in-car navigation system. Next year, Jay-Zee plans to sell 16,000units at a…

A: Answer 1) Calculation of Sales Commission per unit sold Sales Commission per unit sold = Selling…

Q: Utah, Atlanta and Detroit have capital balances of P 150,000, P 200,000, and P 300,000, respectively…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: Assume a company reported the following results: Sales $ 400,000 Variable expenses Contribution…

A: Formula: Return on investment = ( Net operating income / Average operating Assets ) x 100

Q: mall business ate colleges tune 500 companies lic education institutions and certain tax-exempt…

A: The companies provide the pensions plans to the employee on retirement to make their life happy and…

Q: Chelm Music Corporation manufactures violins, violas, cellos, and fiddles and uses a job-order…

A: As per Accrual system of accounting, all revenue and expenses should be recorded in the books of…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 42) Identify the term, which is used for the full payment is due on the 15th of the month following the invoice date from the following? a. 15MFI b. 1/10 c. 2/10 d. 3/EOMProblem # 7 What payment should be made on an invoice in the amount of $9,400 dated January 11 if the terms of sale are 2/15, 1/30, n/45 and the bill is paid on a. January 23? b. February 20?If a business has paid rent of $1,000 for the year to 31 March 20X9, what is the prepayment in the accounts for the year to 31 December 20X8? A $250 B $750

- Find the EAR in each of the following cases: (Use 365 days a year. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)On 1 May 20X0, A pays a rent bill of $1,800 for the period to 30 April 20X1. What is the charge to the income statement and the entry in the statement of financial position for the year ended 30 November 20X0?A $ 1,050 charge to income statement and prepayment of $750 in the statement of financial positionB $ 1,050 charge to income statement and accrual of $750 in the statement of financial positionC $1,800 charge to income statement and no entry in the statement of financial positionD $750 charge to income statement and prepayment of $ 1,050 in the statement of financial position Answer the question and explain why did you choose this answerThis year's final paycheck will be issued on the last Friday of December. If you report the wages for the remaining four days of December as an expense in the next year, which principle are you violating? A. The disclosure principle B. The matching principle C. The revenue recognition prin

- 9. What amount should be adjusted in relation to the doubtful accounts for the fourth quarter? A. 0 B. 4,000 C. 41,000 D. 37,000 E. None of themWhat is the Allowance for Uncollectible Accounts at December 31 of the current year after adjustments? attached in ss below thansk rgwiohwj ohwt hwAssume an individual is wanting to determine the ending balance after 1 year based on monthly deposits of $1,000 in an account that has 6% continuous compounding. Determine the ending balance. $12,363.42 $14,336.42 $12,336.42 $12,633.42

- 67. Jansen Company prepares an account receivable aging schedule with a series of computations as follows: 10% of the total peso balance of accounts from 1-60 days past due, plus 15% of the total peso balance of accounts from 61-120 days past due and so on. How would you describe the total of the amounts determined in this series of computations? Group of answer choices It is the amount of uncollected accounts expense for the year. It is the amount of the desired credit balance of the allowance for uncollectible accounts to be reported in the year-end financial statements. When added to the total of accounts written off during the year, this new sum is the desired credit balance of the allowance account. It is the amount that should be added to the allowance for uncollectible accounts at year-end.You received invoices from Wengo Industries dated Jan 20 for $2800, Jan 25 for $4200, and Feb 1 (non-leap-year) for $1500. You have also made a payment of $4800 on Jan 27th. The invoices all have terms of 3/10, n/30. What is the outstanding balance on the January 25th invoice after the January 27th payment?P8 Prepare the adjusting entry for each of the following situations. The last day of the accounting period is December 31. a. The payment of the P19,000 insurance premium for two years in advance was originally recorded as Prepaid Insurance. One year of the policy has now expired. b. All employees earn a total of P10,000 per day for a five-day week beginning on Monday and ending Friday. They were paid for the workweek ending December 26. They worked on Monday, Dec. 29, Tuesday, Dec. 30 and Wednesday, Dec. 31. c. The Supplies account had a balance of P4,480 on January 1. During the year, P11,000 of supplies were bought. A year-end inventory showed that P6,400 worth of supplies are still on hand. d. Equipment costing P588,000 has a useful life of 5 years with an P80,000 salvage value at the end of its life. Record the depreciation for the year.