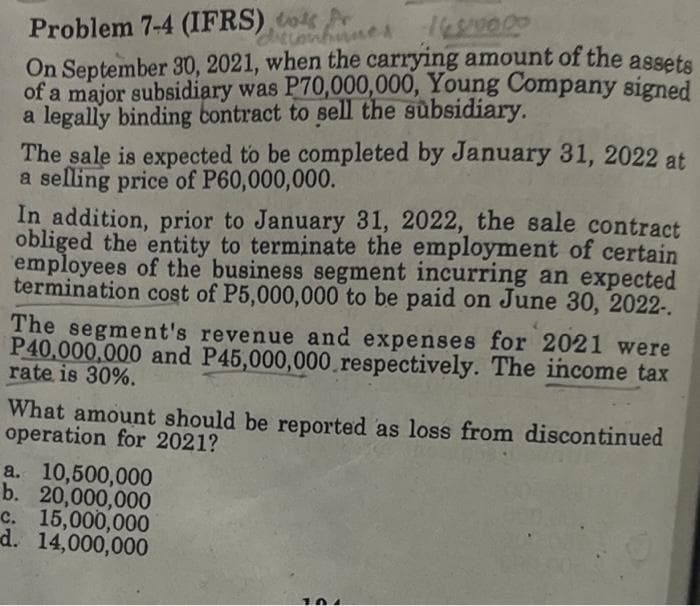

Problem 7-4 (IFRS) r On September 30, 2021, when the carrying amount of the assets of a major subsidiary was P70,000,000, Young Company signed a legally binding contract to sell the subsidiary. The sale is expected to be completed by January 31, 2022 at a selling price of P60,000,000. In addition, prior to January 31, 2022, the sale contract obliged the entity to terminate the employment of certain employees of the business segment incurring an expected termination cost of P5,000,000 to be paid on June 30, 2022. The segment's revenue and expenses for 2021 were P40,000,000 and P45,000,000 respectively. The income tax rate is 30%. What amount should be reported as loss from discontinued operation for 2021? a. 10,500,000 b. 20,000,000 c. 15,000,000 d. 14,000,000

Problem 7-4 (IFRS) r On September 30, 2021, when the carrying amount of the assets of a major subsidiary was P70,000,000, Young Company signed a legally binding contract to sell the subsidiary. The sale is expected to be completed by January 31, 2022 at a selling price of P60,000,000. In addition, prior to January 31, 2022, the sale contract obliged the entity to terminate the employment of certain employees of the business segment incurring an expected termination cost of P5,000,000 to be paid on June 30, 2022. The segment's revenue and expenses for 2021 were P40,000,000 and P45,000,000 respectively. The income tax rate is 30%. What amount should be reported as loss from discontinued operation for 2021? a. 10,500,000 b. 20,000,000 c. 15,000,000 d. 14,000,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 12MC: (Appendix 14.1)Pamlico Company has a 500,000, 15%, 3-year note dated January 1, 2019, payable to...

Related questions

Question

Problem 7-4 (IFRS) r

On September 30, 2021, when the carrying amount of the assets of a major subsidiary was P70,000,000, Young Company signed a legally binding contract to sell the subsidiary.

The sale is expected to be completed by January 31, 2022 at a selling price of P60,000,000.

In addition, prior to January 31, 2022, the sale contract obliged the entity to terminate the employment of certain employees of the business segment incurring an expected termination cost of P5,000,000 to be paid on June 30, 2022.

The segment's revenue and expenses for 2021 were P40,000,000 and P45,000,000 respectively. The income tax rate is 30%.

What amount should be reported as loss from discontinued operation for 2021?

a. 10,500,000

b. 20,000,000

c. 15,000,000

d. 14,000,000

Transcribed Image Text:Problem 7-4 (IFRS) to r

169/00.00

On September 30, 2021, when the carrying amount of the assets

of a major subsidiary was P70,000,000, Young Company signed

a legally binding contract to sell the subsidiary.

discontinues

The sale is expected to be completed by January 31, 2022 at

a selling price of P60,000,000.

In addition, prior to January 31, 2022, the sale contract

obliged the entity to terminate the employment of certain

employees of the business segment incurring an expected

termination cost of P5,000,000 to be paid on June 30, 2022-.

The segment's revenue and expenses for 2021 were

P40,000,000 and P45,000,000 respectively. The income tax

rate is 30%.

What amount should be reported as loss from discontinued

operation for 2021?

a. 10,500,000

b. 20,000,000

c. 15,000,000

d. 14,000,000

104

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning