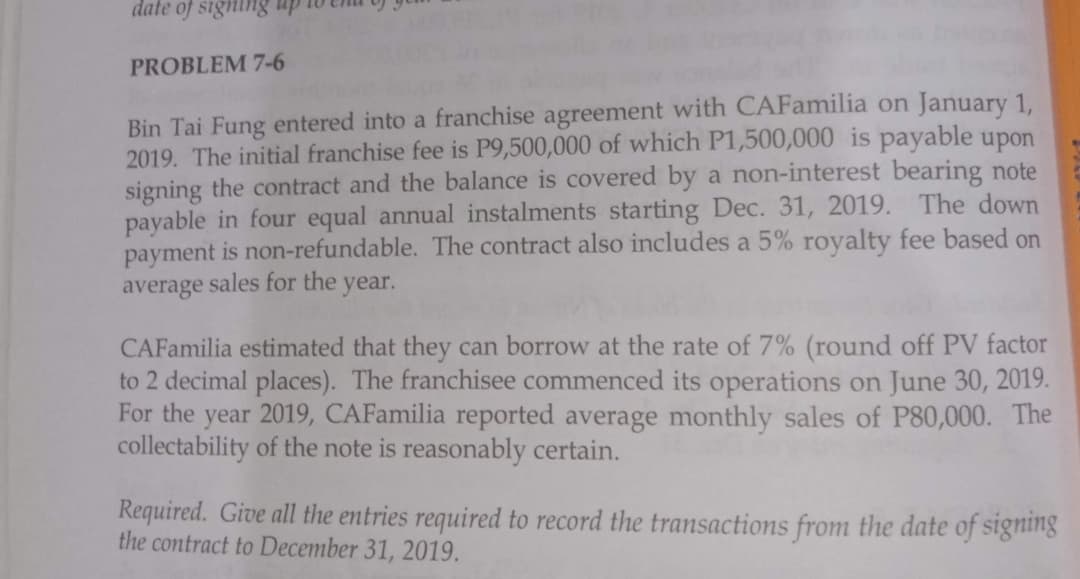

PROBLEM 7-6 Bin Tai Fung entered into a franchise agreement with CAFamilia on January 1, 2019. The initial franchise fee is P9,500,000 of which P1,500,000 is payable upon signing the contract and the balance is covered by a non-interest bearing note payable in four equal annual instalments starting Dec. 31, 2019. The down payment is non-refundable. The contract also includes a 5% royalty fee based on average sales for the year. CAFamilia estimated that they can borrow at the rate of 7% (round off PV factor to 2 decimal places). The franchisee commenced its operations on June 30, 2019. For the year 2019, CAFamilia reported average monthly sales of P80,000. The collectability of the note is reasonably certain. Required. Give all the entries required to record the transactions from the date of signing the contract to December 31, 2019.

PROBLEM 7-6 Bin Tai Fung entered into a franchise agreement with CAFamilia on January 1, 2019. The initial franchise fee is P9,500,000 of which P1,500,000 is payable upon signing the contract and the balance is covered by a non-interest bearing note payable in four equal annual instalments starting Dec. 31, 2019. The down payment is non-refundable. The contract also includes a 5% royalty fee based on average sales for the year. CAFamilia estimated that they can borrow at the rate of 7% (round off PV factor to 2 decimal places). The franchisee commenced its operations on June 30, 2019. For the year 2019, CAFamilia reported average monthly sales of P80,000. The collectability of the note is reasonably certain. Required. Give all the entries required to record the transactions from the date of signing the contract to December 31, 2019.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 23P: Notes Receivable On January 1, 2019, Lisa Company sold machinery with a book value of 118,000 to...

Related questions

Question

Transcribed Image Text:date of signing

PROBLEM 7-6

Bin Tai Fung entered into a franchise agreement with CAFamilia on January 1,

2019. The initial franchise fee is P9,500,000 of which P1,500,000 is payable upon

signing the contract and the balance is covered by a non-interest bearing note

payable in four equal annual instalments starting Dec. 31, 2019. The down

payment is non-refundable. The contract also includes a 5% royalty fee based on

average sales for the year.

CAFamilia estimated that they can borrow at the rate of 7% (round off PV factor

to 2 decimal places). The franchisee commenced its operations on June 30, 2019.

For the year 2019, CAFamilia reported average monthly sales of P80,000. The

collectability of the note is reasonably certain.

Required. Give all the entries required to record the transactions from the date of signing

the contract to December 31, 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT