5. True or False: If Richard is in the 25% tax bracket, that means he pays 25% tax on his total income. Explain.

5. True or False: If Richard is in the 25% tax bracket, that means he pays 25% tax on his total income. Explain.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter4: Profitability Analysis

Section: Chapter Questions

Problem 23PC

Related questions

Question

Transcribed Image Text:gross income

MINUS

adjustments to

income

EQUALS

adjusted gross

income

TABLE 4.9

Tax Rate"

10%

15%

25%

28%

33%

35%

39.6%

Standard

deduction

Exemption

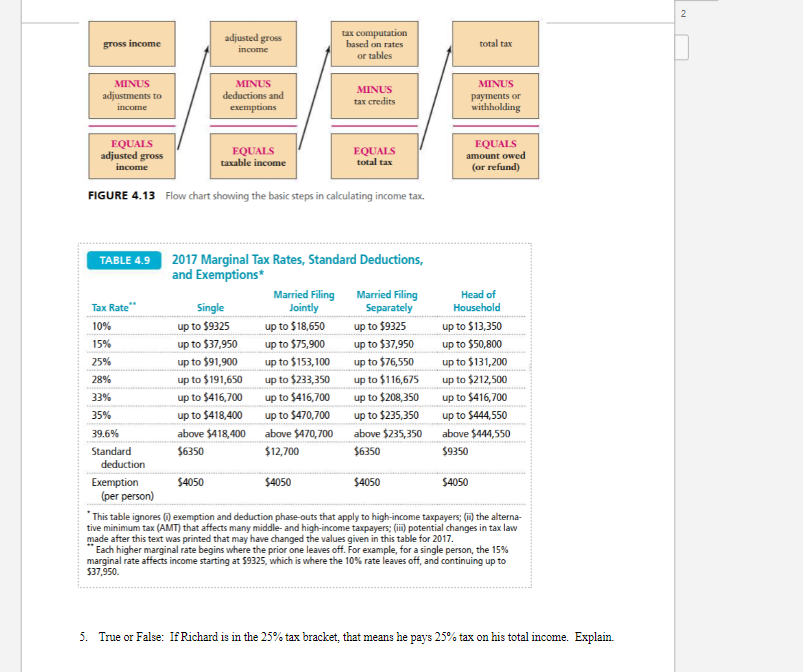

FIGURE 4.13 Flow chart showing the basic steps in calculating income tax.

(per person)

adjusted gross

income

MINUS

deductions and

exemptions

EQUALS

taxable income

$4050

Single

up to $9325

up to $37,950

up to $91,900

up to $191,650

up to $416,700

up to $418,400

above $418,400

$6350

2017 Marginal Tax Rates, Standard Deductions,

and Exemptions*

Married Filing

Jointly

tax computation

based on rates

or tables

up to $18,650

up to $75,900

up to $153,100

up to $233,350

up to $416,700

up to $470,700

above $470,700

$12,700

MINUS

tax credits

$4050

EQUALS

total tax

Married Filing

Separately

up to $9325

up to $37,950

up to $76,550

up to $116,675

up to $208,350

up to $235,350

above $235,350

$6350

$4050

total tax

MINUS

payments or

withholding

EQUALS

amount owed

(or refund)

Head of

Household

$4050

up to $13,350

up to $50,800

up to $131,200

up to $212,500

up to $416,700

up to $444,550

above $444,550

$9350

*This table ignores (1) exemption and deduction phase-outs that apply to high-income taxpayers; (ii) the alterna-

tive minimum tax (AMT) that affects many middle- and high-income taxpayers; (iii) potential changes in tax law

made after this text was printed that may have changed the values given in this table for 2017.

"Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the 15%

marginal rate affects income starting at $9325, which is where the 10% rate leaves off, and continuing up to

$37,950.

5. True or False: If Richard is in the 25% tax bracket, that means he pays 25% tax on his total income. Explain.

2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning