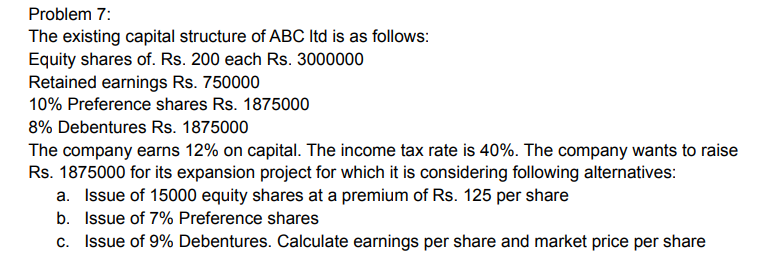

Problem 7: The existing capital structure of ABC ltd is as follows: Equity shares of. Rs. 200 each Rs. 3000000 Retained earnings Rs. 750000 10% Preference shares Rs. 1875000 8% Debentures Rs. 1875000 The company earns 12% on capital. The income tax rate is 40%. The company wants to raise Rs. 1875000 for its expansion project for which it is considering following alternatives: a. Issue of 15000 equity shares at a premium of Rs. 125 per share b. Issue of 7% Preference shares c. Issue of 9% Debentures. Calculate earnings per share and market price per share

Problem 7: The existing capital structure of ABC ltd is as follows: Equity shares of. Rs. 200 each Rs. 3000000 Retained earnings Rs. 750000 10% Preference shares Rs. 1875000 8% Debentures Rs. 1875000 The company earns 12% on capital. The income tax rate is 40%. The company wants to raise Rs. 1875000 for its expansion project for which it is considering following alternatives: a. Issue of 15000 equity shares at a premium of Rs. 125 per share b. Issue of 7% Preference shares c. Issue of 9% Debentures. Calculate earnings per share and market price per share

Chapter11: The Cost Of Capital

Section: Chapter Questions

Problem 15PROB

Related questions

Question

Transcribed Image Text:Problem 7:

The existing capital structure of ABC ltd is as follows:

Equity shares of. Rs. 200 each Rs. 3000000

Retained earnings Rs. 750000

10% Preference shares Rs. 1875000

8% Debentures Rs. 1875000

The company earns 12% on capital. The income tax rate is 40%. The company wants to raise

Rs. 1875000 for its expansion project for which it is considering following alternatives:

a. Issue of 15000 equity shares at a premium of Rs. 125 per share

b. Issue of 7% Preference shares

c. Issue of 9% Debentures. Calculate earnings per share and market price per share

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning