Problem 8-5 Bridgeport Limited stocks a variety of sports equipment for sale to institutions. The following stock record card for basketballs was taken from the records at the December 31, 2020 year end: Invoice Number Unit Invoice Gross Invoice Units Received Date Terms Cost Amount Jan. 1 balance Net 30 122 $20 $2,440 15 10624 Net 30 70 20 1,400 Mar. 15 11437 1/5, net 30 80 16 1,280 1/10, net 30 June 20 21332 110 15 1,650 Sept. 12 1/10, net 30 27644 102 12 1,224 1/10, net 30 Nov. 24 31269 92 11 1,012 Totals 576 $9,006 A physical inventory on December 31, 2020, reveals that 100 basketballs are in stock. The bookkeeper informs you that all the discounts were taken. Assume that Bridgeport Limited uses a periodic inventory system and records purchases at their invoice price less discount During 2020, the average sales price per basketball was $22.25. Calculate the December 31, 2020 inventory using the FIFO formula. (Round answer to 2 decimal places, e.g. 52.75.) Ending inventory sl LINK TO TEXT LINK TO TEXT Calculate the December 31, 2020 inventory using the weighted average cost formula. (Round weighted average cost per unit and the final answer to 2 decimal places, e.g. 52.75.) Ending inventory s

Problem 8-5 Bridgeport Limited stocks a variety of sports equipment for sale to institutions. The following stock record card for basketballs was taken from the records at the December 31, 2020 year end: Invoice Number Unit Invoice Gross Invoice Units Received Date Terms Cost Amount Jan. 1 balance Net 30 122 $20 $2,440 15 10624 Net 30 70 20 1,400 Mar. 15 11437 1/5, net 30 80 16 1,280 1/10, net 30 June 20 21332 110 15 1,650 Sept. 12 1/10, net 30 27644 102 12 1,224 1/10, net 30 Nov. 24 31269 92 11 1,012 Totals 576 $9,006 A physical inventory on December 31, 2020, reveals that 100 basketballs are in stock. The bookkeeper informs you that all the discounts were taken. Assume that Bridgeport Limited uses a periodic inventory system and records purchases at their invoice price less discount During 2020, the average sales price per basketball was $22.25. Calculate the December 31, 2020 inventory using the FIFO formula. (Round answer to 2 decimal places, e.g. 52.75.) Ending inventory sl LINK TO TEXT LINK TO TEXT Calculate the December 31, 2020 inventory using the weighted average cost formula. (Round weighted average cost per unit and the final answer to 2 decimal places, e.g. 52.75.) Ending inventory s

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 86PSA: Problem 10-86A Stock Dividends and Stock Splits Lance Products balance sheet includes total assets...

Related questions

Question

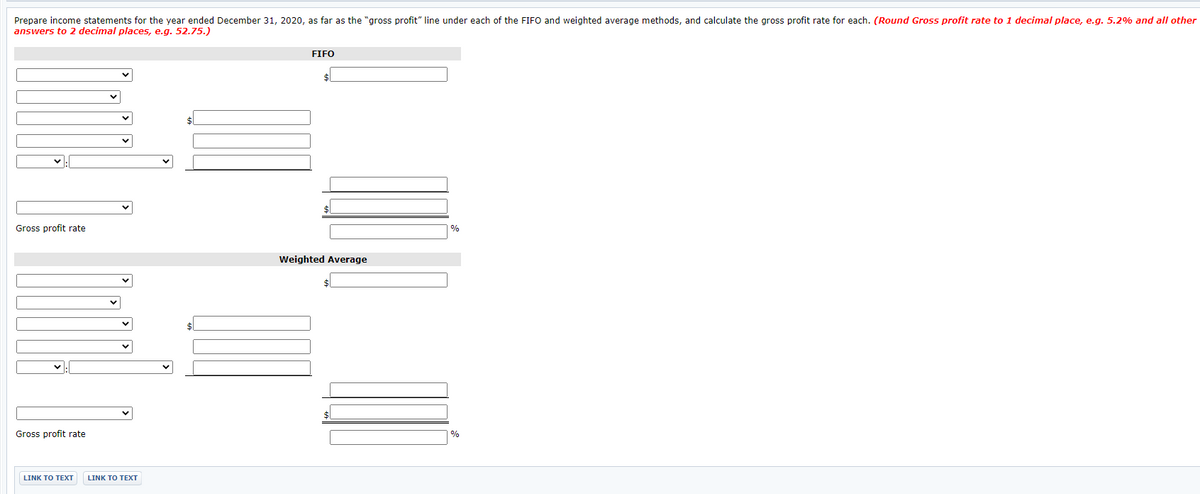

Transcribed Image Text:Prepare income statements for the year ended December 31, 2020, as far as the "gross profit" line under each of the FIFO and weighted average methods, and calculate the gross profit rate for each. (Round Gross profit rate to 1 decimal place, e.g. 5.2% and all other

answers to 2 decimal places, e.g. 52.75.)

FIFO

$

Gross profit rate

Weighted Average

Gross profit rate

%

LINK TO ΤΕXT

LINK TO TEXT

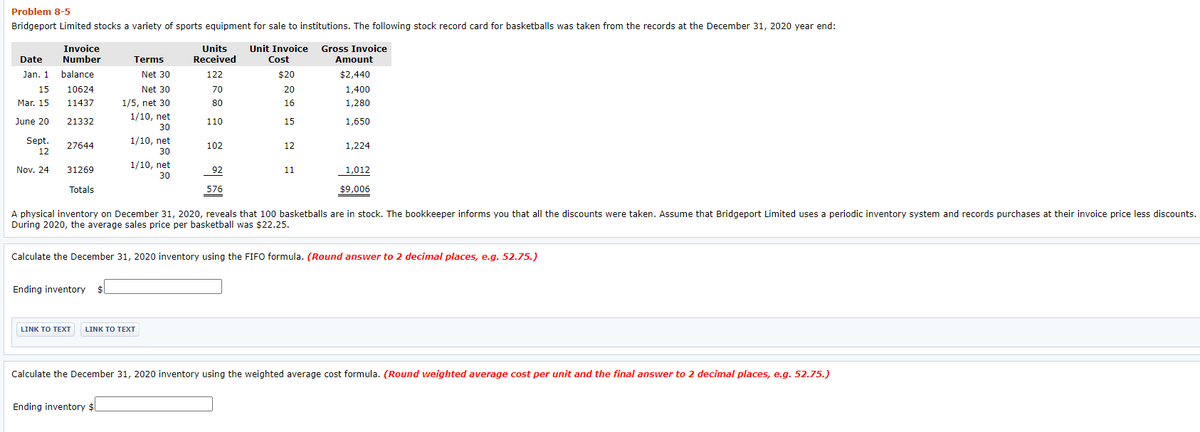

Transcribed Image Text:Problem 8-5

Bridgeport Limited stocks a variety of sports equipment for sale to institutions. The following stock record card for basketballs was taken from the records at the December 31, 2020 year end:

Invoice

Units

Unit Invoice Gross Invoice

Date

Number

Terms

Received

Cost

Amount

Jan. 1 balance

Net 30

122

$20

$2,440

15

10624

Net 30

70

20

1,400

Mar. 15

11437

1/5, net 30

80

16

1,280

1/10, net

June 20

21332

110

15

1,650

30

Sept.

1/10, net

27644

102

12

1,224

12

30

1/10, net

Nov. 24

31269

92

11

1,012

30

Totals

576

$9,006

A physical inventory on December 31, 2020, reveals that 100 basketballs are in stock. The bookkeeper informs you that all the discounts were taken. Assume that Bridgeport Limited uses a periodic inventory system and records purchases at their invoice price less discounts.

During 2020, the average sales price per basketball was $22.25.

Calculate the December 31, 2020 inventory using the FIFO formula. (Round answer to 2 decimal places, e.g. 52.75.)

Ending inventory $l

LINK TO TEXT

LINK TO ΤΕXΤ

Calculate the December 31, 2020 inventory using the weighted average cost formula. (Round weighted average cost per unit and the final answer to 2 decimal places, e.g. 52.75.)

Ending inventory $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning