Please help solve the rest of 2B

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 29P: Jellison Company had the following operating data for its first two years of operations: Jellison...

Related questions

Question

Please help solve the rest of 2B

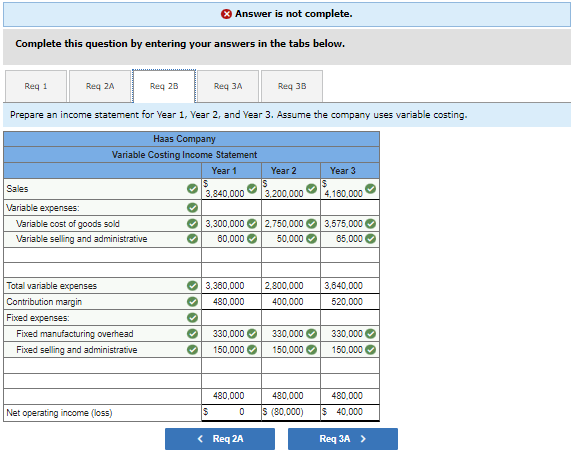

Transcribed Image Text:Answer is not complete.

Complete this question by entering your answers in the tabs below.

Req 1

Req ZA

Req 2B

Req 3A

Req 3B

Prepare an income statement for Year 1, Year 2, and Year 3. Assume the company uses variable costing.

Haas Company

Variable Costing Income Statement

Year 1

Year 2

Year 3

$

S

$

Sales

3,840,000

3,200,000

4,160,000

Variable expenses:

Variable cost of goods sold

2,750,000 3,575,000

3,300,000

60,000

Variable selling and administrative

50,000 ✓

65,000✔

Total variable expenses

✔3,360,000 2,800,000 3,640,000

Contribution margin

480,000

400,000

520,000

Fixed expenses:

330,000✔✔ 330,000✔

330,000✔

Fixed manufacturing overhead

Fixed selling and administrative

150,000✔

150,000 ✓

150,000✔

480,000

480,000

480,000

Net operating income (loss)

$

0

S (80,000)

$ 40,000

< Req 2A

Req 3A >

33333

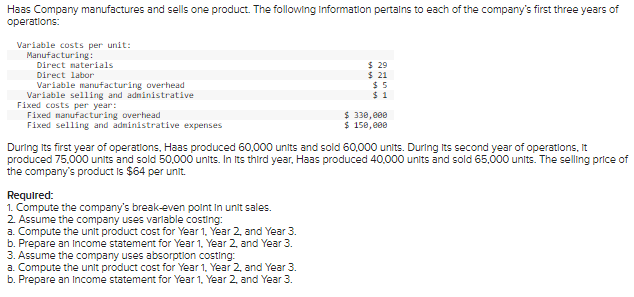

Transcribed Image Text:Haas Company manufactures and sells one product. The following information pertains to each of the company's first three years of

operations:

Variable costs per unit:

Manufacturing:

Direct materials

Direct labor

$ 29

Variable manufacturing overhead

$ 21

$5

$1

Variable selling and administrative

Fixed costs per year:

Fixed manufacturing overhead

$ 330,000

Fixed selling and administrative expenses

$ 150,000

During its first year of operations, Haas produced 60,000 units and sold 60,000 units. During its second year of operations, it

produced 75,000 units and sold 50,000 units. In Its third year, Haas produced 40,000 units and sold 65,000 units. The selling price of

the company's product is $64 per unit.

Required:

1. Compute the company's break-even point in unit sales.

2. Assume the company uses variable costing:

a. Compute the unit product cost for Year 1, Yea

and Year 3.

b. Prepare an Income statement for Year 1, Year 2, and Year 3.

3. Assume the company uses absorption costing:

a. Compute the unit product cost for Year 1, Year 2, and Year 3.

b. Prepare an Income statement for Year 1, Year 2, and Year 3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,