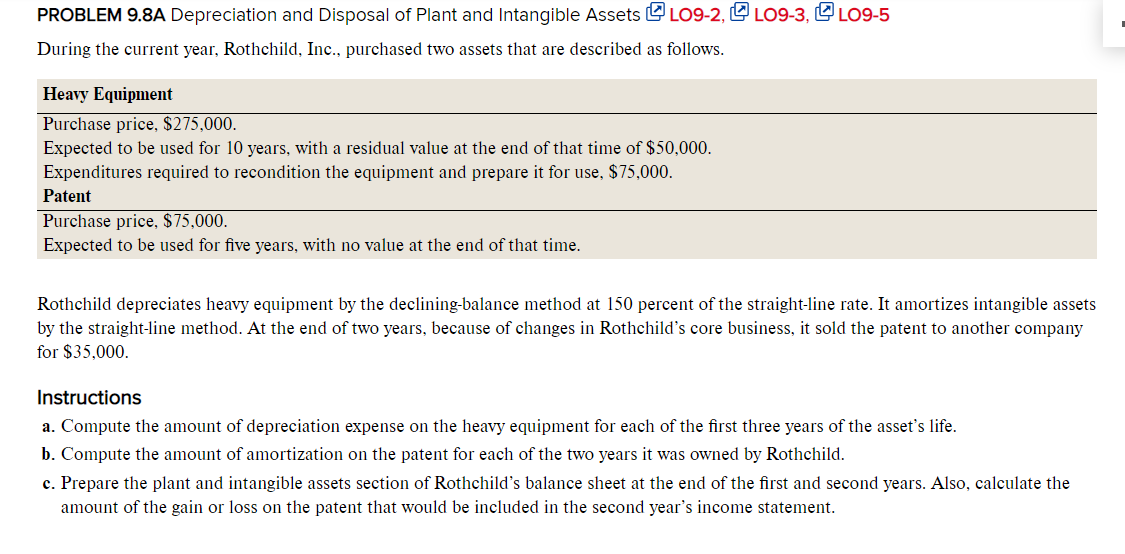

PROBLEM 9.8A Depreciation and Disposal of Plant and Intangible Assets O LO9-2, L LO9-3, O LO9-5 During the current year, Rothchild, Inc., purchased two assets that are described as follows. Heavy Equipment Purchase price, $275,000. Expected to be used for 10 years, with a residual value at the end of that time of $50,000. Expenditures required to recondition the equipment and prepare it for use, $75,000. Patent Purchase price, $75,000. Expected to be used for five years, with no value at the end of that time.

PROBLEM 9.8A Depreciation and Disposal of Plant and Intangible Assets O LO9-2, L LO9-3, O LO9-5 During the current year, Rothchild, Inc., purchased two assets that are described as follows. Heavy Equipment Purchase price, $275,000. Expected to be used for 10 years, with a residual value at the end of that time of $50,000. Expenditures required to recondition the equipment and prepare it for use, $75,000. Patent Purchase price, $75,000. Expected to be used for five years, with no value at the end of that time.

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Fixed Assets And Intangible Assets

Section: Chapter Questions

Problem 10.3CP: Effect of depreciation on net income Tuttle Construction Co. specializes in building replicas of...

Related questions

Question

Transcribed Image Text:PROBLEM 9.8A Depreciation and Disposal of Plant and Intangible Assets O LO9-2, L LO9-3, O LO9-5

During the current year, Rothchild, Inc., purchased two assets that are described as follows.

Heavy Equipment

Purchase price, $275,000.

Expected to be used for 10 years, with a residual value at the end of that time of $50,000.

Expenditures required to recondition the equipment and prepare it for use, $75,000.

Patent

Purchase price, $75,000.

Expected to be used for five years, with no value at the end of that time.

Rothchild depreciates heavy equipment by the declining-balance method at 150 percent of the straight-line rate. It amortizes intangible assets

by the straight-line method. At the end of two years, because of changes in Rothchild's core business, it sold the patent to another company

for $35,000.

Instructions

a. Compute the amount of depreciation expense on the heavy equipment for each of the first three years of the asset's life.

b. Compute the amount of amortization on the patent for each of the two years it was owned by Rothchild.

c. Prepare the plant and intangible assets section of Rothchild's balance sheet at the end of the first and second years. Also, calculate the

amount of the gain or loss on the patent that would be included in the second year's income statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning