PROBLEM A Distribution of Profits or Losses Based on Partners' Agreement Mandatory Problem to be solved by every group Lucas, Thomas, and Stephen are partners in an architectural firm. Their capital accounts were as follows: Partner Date Debit Credit Lucas Lucas Lucas January 1, 2021 May 1, 2021 September 1, 2021 300,000.00 60,000.00 80,000.00 Thomas Thomas January 1, 2021 March 1, 2021 400,000.00 90,000.00 Thomas July 1 2021 50.000 0o

PROBLEM A Distribution of Profits or Losses Based on Partners' Agreement Mandatory Problem to be solved by every group Lucas, Thomas, and Stephen are partners in an architectural firm. Their capital accounts were as follows: Partner Date Debit Credit Lucas Lucas Lucas January 1, 2021 May 1, 2021 September 1, 2021 300,000.00 60,000.00 80,000.00 Thomas Thomas January 1, 2021 March 1, 2021 400,000.00 90,000.00 Thomas July 1 2021 50.000 0o

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 2SEB

Related questions

Question

Hi! Good day.

Please answer it in detailed and comprehensively with explanation. Please use proper accounting format.

I appreciate the updated solution you provided to my other 2 questions.

Thank you

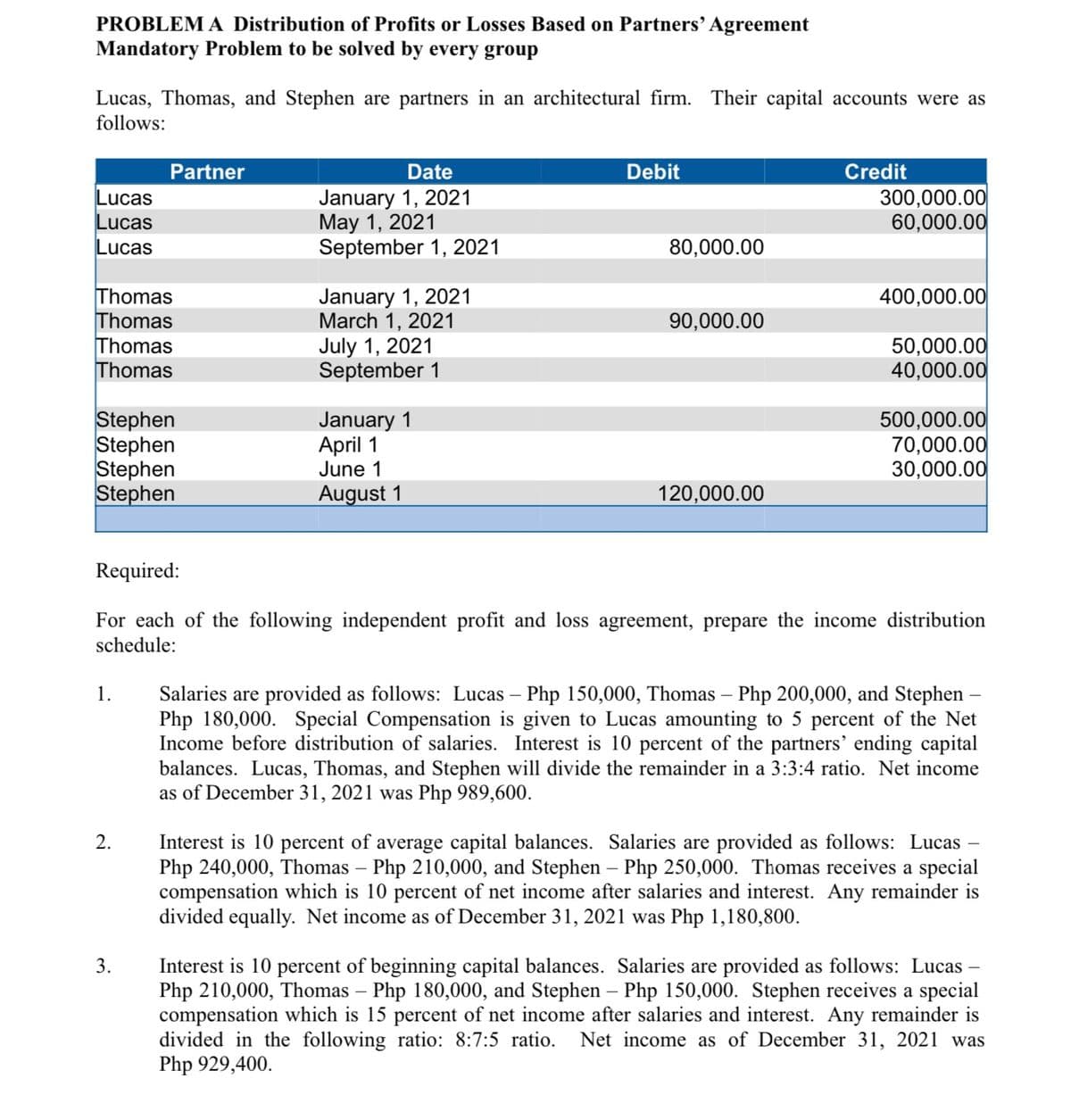

Transcribed Image Text:PROBLEM A Distribution of Profits or Losses Based on Partners’ Agreement

Mandatory Problem to be solved by every group

Lucas, Thomas, and Stephen are partners in an architectural firm. Their capital accounts were as

follows:

Partner

Date

Debit

Credit

Lucas

Lucas

Lucas

January 1, 2021

May 1, 2021

September 1, 2021

300,000.00

60,000.00

80,000.00

Thomas

Thomas

Thomas

Thomas

January 1, 2021

March 1, 2021

July 1, 2021

September 1

400,000.00

90,000.00

50,000.00

40,000.00

Stephen

Stephen

Stephen

Stephen

January 1

April 1

June 1

500,000.00

70,000.00

30,000.00

August 1

120,000.00

Required:

For each of the following independent profit and loss agreement, prepare the income distribution

schedule:

Salaries are provided as follows: Lucas – Php 150,000, Thomas – Php 200,000, and Stephen-

Php 180,000. Special Compensation is given to Lucas amounting to 5 percent of the Net

Income before distribution of salaries. Interest is 10 percent of the partners' ending capital

balances. Lucas, Thomas, and Stephen will divide the remainder in a 3:3:4 ratio. Net income

as of December 31, 2021 was Php 989,600.

1.

Interest is 10 percent of average capital balances. Salaries are provided as follows: Lucas

Php 240,000, Thomas – Php 210,000, and Stephen – Php 250,000. Thomas receives a special

compensation which is 10 percent of net income after salaries and interest. Any remainder is

divided equally. Net income as of December 31, 2021 was Php 1,180,800.

2.

Interest is 10 percent of beginning capital balances. Salaries are provided as follows: Lucas

Php 210,000, Thomas – Php 180,000, and Stephen – Php 150,000. Stephen receives a special

compensation which is 15 percent of net income after salaries and interest. Any remainder is

divided in the following ratio: 8:7:5 ratio.

Php 929,400.

3.

Net income as of December 31, 2021 was

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 10 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning