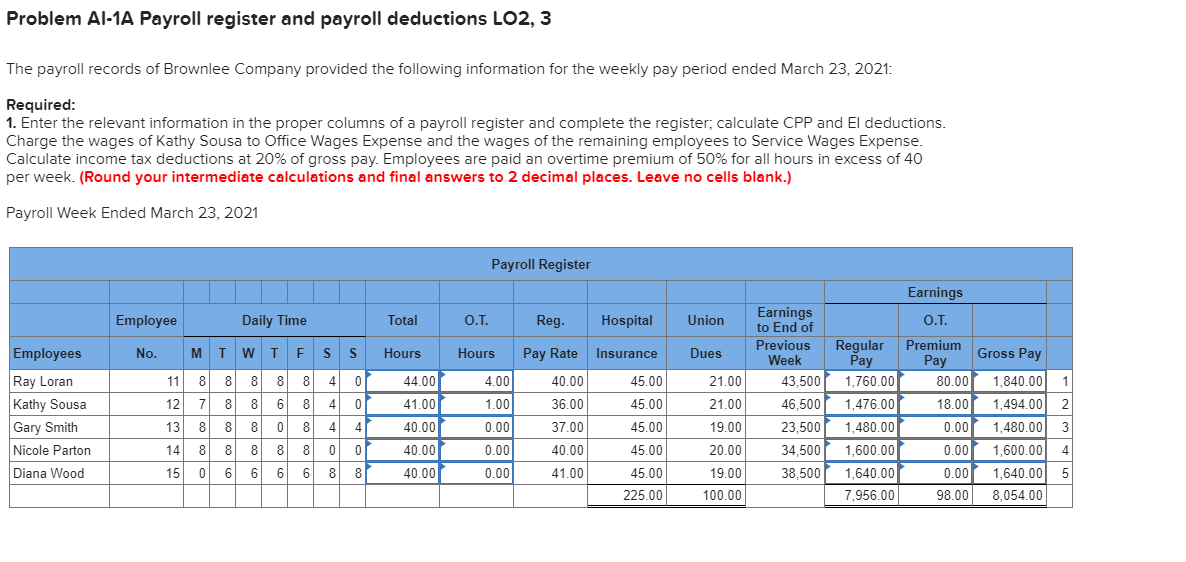

Problem Al-1A Payroll register and payroll deductions LO2, 3 The payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 2021: Required: 1. Enter the relevant information in the proper columns of a payroll register and complete the register; calculate CPP and El deductions. Charge the wages of Kathy Sousa to Office Wages Expense and the wages of the remaining employees to Service Wages Expense. Calculate income tax deductions at 20% of gross pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per week. (Round your intermediate calculations and final answers to 2 decimal places. Leave no cells blank.) Payroll Week Ended March 23, 2021 Employees Employee No. Daily Time MTWTFSS Total Hours O.T. Payroll Register Hours Reg. Hospital Union Pay Rate Insurance Dues Earnings to End of Previous Week Earnings O.T. Regular Premium Pay Pay Gross Pay

Problem Al-1A Payroll register and payroll deductions LO2, 3 The payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 2021: Required: 1. Enter the relevant information in the proper columns of a payroll register and complete the register; calculate CPP and El deductions. Charge the wages of Kathy Sousa to Office Wages Expense and the wages of the remaining employees to Service Wages Expense. Calculate income tax deductions at 20% of gross pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per week. (Round your intermediate calculations and final answers to 2 decimal places. Leave no cells blank.) Payroll Week Ended March 23, 2021 Employees Employee No. Daily Time MTWTFSS Total Hours O.T. Payroll Register Hours Reg. Hospital Union Pay Rate Insurance Dues Earnings to End of Previous Week Earnings O.T. Regular Premium Pay Pay Gross Pay

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter11: Current Liabilities And Payroll

Section: Chapter Questions

Problem 11.9EX: Calculate payroll Diego Company has three employeesa consultant, a computer programmer, and an...

Related questions

Question

if someone can check my work please! thank you! :)

Transcribed Image Text:Problem Al-1A Payroll register and payroll deductions LO2, 3

The payroll records of Brownlee Company provided the following information for the weekly pay period ended March 23, 2021:

Required:

1. Enter the relevant information in the proper columns of a payroll register and complete the register; calculate CPP and El deductions.

Charge the wages of Kathy Sousa to Office Wages Expense and the wages of the remaining employees to Service Wages Expense.

Calculate income tax deductions at 20% of gross pay. Employees are paid an overtime premium of 50% for all hours in excess of 40

per week. (Round your intermediate calculations and final answers to 2 decimal places. Leave no cells blank.)

Payroll Week Ended March 23, 2021

Employees

Ray Loran

Kathy Sousa

Gary Smith

Nicole Parton

Diana Wood

Employee

No.

Daily Time

M T W T F

8

8

6

8

0

8

6

11 8 8

12 7 8

13

8 8

14 8 8

15 0

8

8

8

8

8

6 6

8

8

6

S

4

4

4

0

8

S

0

0

4

0

8

Total

Hours

44.00

41.00

40.00

40.00

40.00

O.T.

Payroll Register

Hours

4.00

1.00

0.00

0.00

0.00

Reg.

Hospital

Pay Rate Insurance

40.00

36.00

37.00

40.00

41.00

45.00

45.00

45.00

45.00

45.00

225.00

Union

Dues

21.00

21.00

19.00

20.00

19.00

100.00

Earnings

to End of

Previous Regular

Week

Pay

43,500 1,760.00

46,500 1,476.00

23,500 1,480.00

34,500 1,600.00

38,500

M

1,640.00

7,956.00

J

Earnings

O.T.

Premium

Pay

80.00

18.00

0.00

0.00

0.00

98.00 8,054.00

Gross Pay

1,840.00 1

1,494.00 2

1,480.00 3

1,600.00 4

1,640.00 5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning