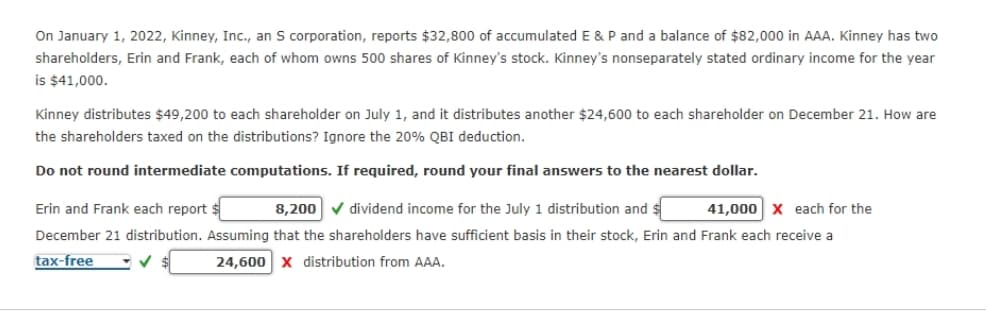

On January 1, 2022, Kinney, Inc., an S corporation, reports $32,800 of accumulated E & P and a balance of $82,000 in AAA. Kinney has two shareholders, Erin and Frank, each of whom owns 500 shares of Kinney's stock. Kinney's nonseparately stated ordinary income for the year is $41,000. Kinney distributes $49,200 to each shareholder on July 1, and it distributes another $24,600 to each shareholder on December 21. How are the shareholders taxed on the distributions? Ignore the 20% QBI deduction. Do not round intermediate computations. If required, round your final answers to the nearest dollar. Erin and Frank each report $ 8,200 ✓ dividend income for the July 1 distribution and 41,000 X each for the December 21 distribution. Assuming that the shareholders have sufficient basis in their stock, Erin and Frank each receive a tax-free X distribution from AAA. ✓ $ 24,600

On January 1, 2022, Kinney, Inc., an S corporation, reports $32,800 of accumulated E & P and a balance of $82,000 in AAA. Kinney has two shareholders, Erin and Frank, each of whom owns 500 shares of Kinney's stock. Kinney's nonseparately stated ordinary income for the year is $41,000. Kinney distributes $49,200 to each shareholder on July 1, and it distributes another $24,600 to each shareholder on December 21. How are the shareholders taxed on the distributions? Ignore the 20% QBI deduction. Do not round intermediate computations. If required, round your final answers to the nearest dollar. Erin and Frank each report $ 8,200 ✓ dividend income for the July 1 distribution and 41,000 X each for the December 21 distribution. Assuming that the shareholders have sufficient basis in their stock, Erin and Frank each receive a tax-free X distribution from AAA. ✓ $ 24,600

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 22CE

Related questions

Question

Acco

Transcribed Image Text:On January 1, 2022, Kinney, Inc., an S corporation, reports $32,800 of accumulated E & P and a balance of $82,000 in AAA. Kinney has two

shareholders, Erin and Frank, each of whom owns 500 shares of Kinney's stock. Kinney's nonseparately stated ordinary income for the year

is $41,000.

Kinney distributes $49,200 to each shareholder on July 1, and it distributes another $24,600 to each shareholder on December 21. How are

the shareholders taxed on the distributions? Ignore the 20% QBI deduction.

Do not round intermediate computations. If required, round your final answers to the nearest dollar.

Erin and Frank each report $

8,200✔ dividend income for the July 1 distribution and $ 41,000 X each for the

December 21 distribution. Assuming that the shareholders have sufficient basis in their stock, Erin and Frank each receive a

tax-free

24,600 X distribution from AAA.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you