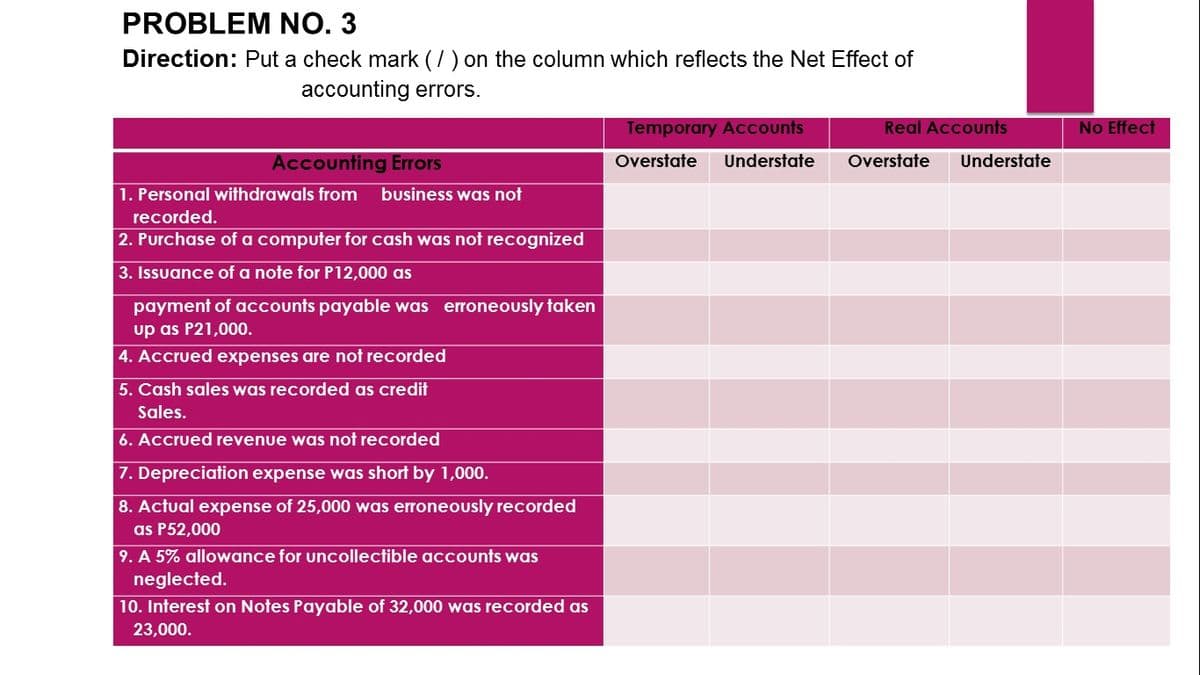

PROBLEM NO 3 Direction: Put a check mark (/) on the column which reflects the Net Effect of accounting errors. Temporary Accounts Real Accounts No Effect Accounting Errors Overstate Understate Overstate Understate 1. Personal withdrawals from business was not recorded. 2. Purchase of a computer for cash was not recognized 3. Issuance of a note for P12,000 as payment of accounts payable was erroneously taken up as P21,000. 4. Accrued expenses are not recorded 5. Cash sales was recorded as credit Sales. 6. Accrued revenue was not recorded 7. Depreciation expense was short by 1,000. 8. Actual expense of 25,000 was erroneously recorded as P52,000 9. A 5% allowance for uncollectible accounts was neglected. 10. Interest on Notes Payable of 32,000 was recorded as 23,000.

PROBLEM NO 3 Direction: Put a check mark (/) on the column which reflects the Net Effect of accounting errors. Temporary Accounts Real Accounts No Effect Accounting Errors Overstate Understate Overstate Understate 1. Personal withdrawals from business was not recorded. 2. Purchase of a computer for cash was not recognized 3. Issuance of a note for P12,000 as payment of accounts payable was erroneously taken up as P21,000. 4. Accrued expenses are not recorded 5. Cash sales was recorded as credit Sales. 6. Accrued revenue was not recorded 7. Depreciation expense was short by 1,000. 8. Actual expense of 25,000 was erroneously recorded as P52,000 9. A 5% allowance for uncollectible accounts was neglected. 10. Interest on Notes Payable of 32,000 was recorded as 23,000.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 72E

Related questions

Question

Transcribed Image Text:PROBLEM NO. 3

Direction: Put a check mark (/) on the column which reflects the Net Effect of

accounting errors.

Temporary Accounts

Real Accounts

No Effect

Accounting Errors

Overstate

Understate

Overstate

Understate

1. Personal withdrawals from

business was not

recorded.

2. Purchase of a computer for cash was not recognized

3. Issuance of a note for P12,000 as

payment of accounts payable was erroneously taken

up as P21,000.

4. Accrued expenses are not recorded

5. Cash sales was recorded as credit

Sales.

6. Accrued revenue was not recorded

7. Depreciation expense was short by 1,000.

8. Actual expense of 25,000 was erroneously recorded

as P52,000

9. A 5% allowance for uncollectible accounts was

neglected.

10. Interest on Notes Payable of 32,000 was recorded as

23,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage