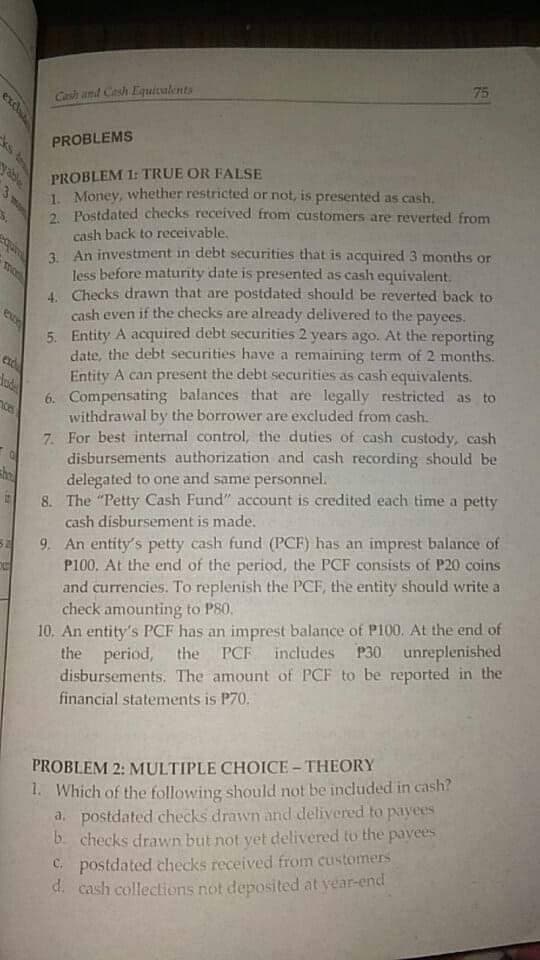

PROBLEMS PROBLEM 1: TRUE OR FALSE 1. Money, whether restricted or not, is presented as cash. 2 Postdated checks received from customers are reverted from cash back to receivable, 3. An investment in debt securities that is acquired 3 months or less before maturity date is presented as cash equivalent. 4. Checks drawn that are postdated should be reverted back to cash even if the checks are already delivered to the payees. 5. Entity A acquired debt securities 2 years ago. At the reporting date, the debt securities have a remaining term of 2 months. Entity A can present the debt securities as cash equivalents. 6. Compensating balances that are legally restricted as to withdrawal by the borrower are excluded from cash. 7. For best internal control, the duties of cash custody, cash disbursements authorization and cash recording should be delegated to one and same personnel. 8. The "Petty Cash Fund" account is credited each time a petty cash disbursement is made. 9. An entity's petty cash fund (PCF) has an imprest balance of P100, At the end of the period, the PCF consists of P20 coins and currencies. To replenish the PCF, the entity should write a check amounting to P80. 10. An entity's PCF has an imprest balance of P100. At the end of the period, disbursements., The amount of PCF to be reported in the financial statements is P70. the PCF includes P30 unreplenished

PROBLEMS PROBLEM 1: TRUE OR FALSE 1. Money, whether restricted or not, is presented as cash. 2 Postdated checks received from customers are reverted from cash back to receivable, 3. An investment in debt securities that is acquired 3 months or less before maturity date is presented as cash equivalent. 4. Checks drawn that are postdated should be reverted back to cash even if the checks are already delivered to the payees. 5. Entity A acquired debt securities 2 years ago. At the reporting date, the debt securities have a remaining term of 2 months. Entity A can present the debt securities as cash equivalents. 6. Compensating balances that are legally restricted as to withdrawal by the borrower are excluded from cash. 7. For best internal control, the duties of cash custody, cash disbursements authorization and cash recording should be delegated to one and same personnel. 8. The "Petty Cash Fund" account is credited each time a petty cash disbursement is made. 9. An entity's petty cash fund (PCF) has an imprest balance of P100, At the end of the period, the PCF consists of P20 coins and currencies. To replenish the PCF, the entity should write a check amounting to P80. 10. An entity's PCF has an imprest balance of P100. At the end of the period, disbursements., The amount of PCF to be reported in the financial statements is P70. the PCF includes P30 unreplenished

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 21E

Related questions

Question

100%

problem 1: true or false (only)

Transcribed Image Text:Cah amd Cash Equitulents

75

PROBLEMS

PROBLEM 1: TRUE OR FALSE

1. Money, whether restricted or not, is presented as cash.

2 Postdated checks received from customers are reverted from

cash back to receivable,

3. An investment in debt securities that is acquired 3 months or

Jess before maturity date is presented as cash equivalent.

4. Checks drawn that are postdated should be reverted back to

cash even if the checks are already delivered to the payees.

5. Entity A acquired debt securities 2 years ago. At the reporting

date, the debt securities have a remaining term of 2 months.

Entity A can present the debt securities as cash equivalents.

6. Compensating balances that are legally restricted as to

withdrawal by the borrower are excluded from cash.

7. For best internal control, the duties of cash custody, cash

disbursements authorization and cash recording should be

delegated to one and same personnel.

8. The "Petty Cash Fund" account is credited each time a petty

mon

ex

cash disbursement is made.

9. An entity's petty cash fund (PCF) has an imprest balance of

P100. At the end of the period, the PCF consists of P20 coins

and currencies. To replenish the PCF, the entity should write a

check amounting to P80.

10, An entity's PCF has an imprest balance of Pl100. At the end of

the period,

disbursements, The amount of PCF to be reported in the

financial statements is P70.

the PCF includes P30 unreplenished

PROBLEM 2: MULTIPLE CHOICE - THEORY

1. Which of the following should not be included in cash?

a. postdated checks drawn and delivered to payees

b. checks drawn but not vet delivered to the pavees

C. postdated checks received from customers

d. cash collections not deposited at vear-end

exclu

ys te

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning