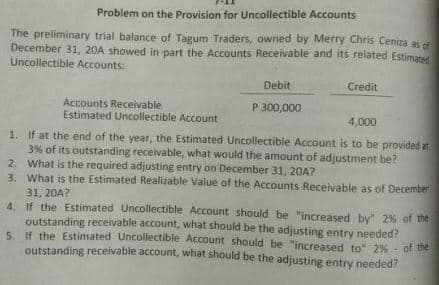

Problem on the Provision for Uncollectible Accounts The preliminary trial balance of Tagum Traders, owned by Merry Chris Ceniza as December 31, 20A showed in part the Accounts Receivable and its related Estimated Uncollectible Accounts: Debit Credit Accounts Receivable Estimated Uncollectible Account P 300,000 4,000 1. If at the end of the year, the Estimated Uncollectible Account is to be provided at 3% of its outstanding receivable, what would the amount of adjustment be? 2. What is the required adjusting entry on December 31, 20A? 3. What is the Estimated Realizable Value of the Accounts Receivable as of December 31, 20A?

Problem on the Provision for Uncollectible Accounts The preliminary trial balance of Tagum Traders, owned by Merry Chris Ceniza as December 31, 20A showed in part the Accounts Receivable and its related Estimated Uncollectible Accounts: Debit Credit Accounts Receivable Estimated Uncollectible Account P 300,000 4,000 1. If at the end of the year, the Estimated Uncollectible Account is to be provided at 3% of its outstanding receivable, what would the amount of adjustment be? 2. What is the required adjusting entry on December 31, 20A? 3. What is the Estimated Realizable Value of the Accounts Receivable as of December 31, 20A?

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter14: Accounting For Uncollectible Accounts Receivable

Section14.1: Uncollectible Accounts Receivable

Problem 1WT

Related questions

Question

PROBLEM ON THE PROVISION FOR UNCOLLECTIBLE ACCOUNTS

Thank youu soo mucchh!

Transcribed Image Text:Problem on the Provision for Uncollectible Accounts

The preliminary trial balance of Tagum Traders, owned by Merry Chris Ceniza as

December 31, 20A showed in part the Accounts Receivable and its related Estimated

Uncollectible Accounts:

Debit

Credit

Accounts Receivable

Estimated Uncollectible Account

P 300,000

4,000

1. If at the end of the year, the Estimated Uncollectible Account is to be provided at

3% of its outstanding receivable, what would the amount of adjustment be?

2. What is the required adjusting entry on December 31, 20A?

3. What is the Estimated Realizable Value of the Accounts Receivable as of December

31, 20A?

4. If the Estimated

outstanding receivable account, what should be the adjusting entry needed?

5 If the Estimated Uncollectible Account should be "increased to" 2% - of the

outstanding receivable account, what should be the adjusting entry needed?

Uncollectible Account should be "increased by" 2% of the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,