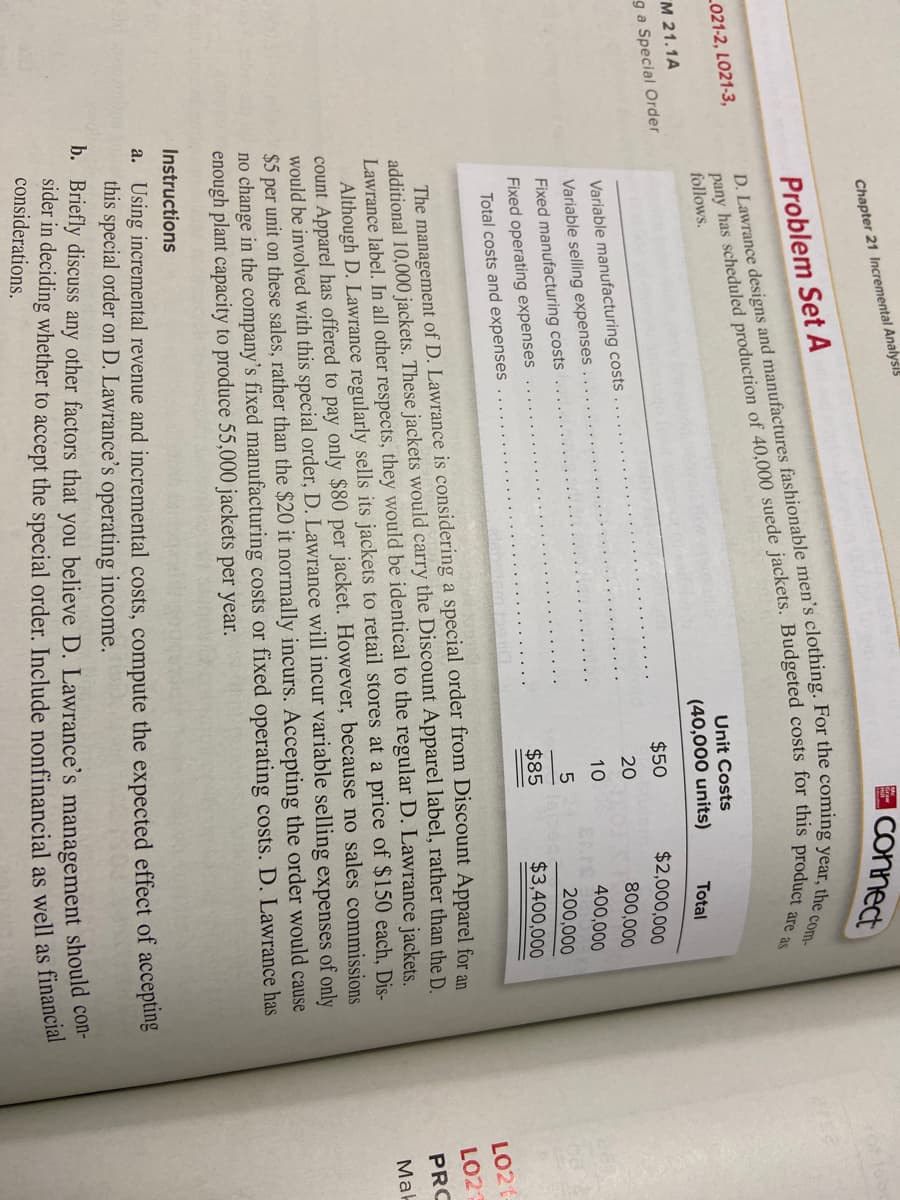

Problem Set A D. Lawrance designs and manufactures fashionable men's clothing. For the coming year, the com- pany has scheduled production of 40,000 suede jackets. Budgeted costs for this product are as follows. Unit Costs (40,000 units) Total $50 $2,000,000 20 800,000 Variable manufacturing costs Variable selling expenses. 10 400,000 Fixed manufacturing costs 200,000 Fixed operating expenses $85 $3,400,000 Total costs and expenses The management of D. Lawrance is considering a special order from Discount Apparel for an additional 10,000 jackets. These jackets would carry the Discount Apparel label, rather than the D Lawrance label. In all other respects, they would be identical to the regular D. Lawrance jackets. Although D. Lawrance regularly sells its jackets to retail stores at a price of $150 each, Dis- count Apparel has offered to pay only $80 per jacket. However, because no sales commissions would be involved with this special order, D. Lawrance will incur variable selling expenses of only $5 per unit on these sales, rather than the $20 it normally incurs. Accepting the order would cause no change in the company's fixed manufacturing costs or fixed operating costs. D. Lawrance has enough plant capacity to produce 55,000 jackets per year. Instructions a. Using incremental revenue and incremental costs, compute the expected effect of accepting this special order on D. Lawrance's operating income. b. Briefly discuss any other factors that you believe D. Lawrance's management should con sider in deciding whether to accept the special order. Include nonfinancial as well as financia. considerations.

Problem Set A D. Lawrance designs and manufactures fashionable men's clothing. For the coming year, the com- pany has scheduled production of 40,000 suede jackets. Budgeted costs for this product are as follows. Unit Costs (40,000 units) Total $50 $2,000,000 20 800,000 Variable manufacturing costs Variable selling expenses. 10 400,000 Fixed manufacturing costs 200,000 Fixed operating expenses $85 $3,400,000 Total costs and expenses The management of D. Lawrance is considering a special order from Discount Apparel for an additional 10,000 jackets. These jackets would carry the Discount Apparel label, rather than the D Lawrance label. In all other respects, they would be identical to the regular D. Lawrance jackets. Although D. Lawrance regularly sells its jackets to retail stores at a price of $150 each, Dis- count Apparel has offered to pay only $80 per jacket. However, because no sales commissions would be involved with this special order, D. Lawrance will incur variable selling expenses of only $5 per unit on these sales, rather than the $20 it normally incurs. Accepting the order would cause no change in the company's fixed manufacturing costs or fixed operating costs. D. Lawrance has enough plant capacity to produce 55,000 jackets per year. Instructions a. Using incremental revenue and incremental costs, compute the expected effect of accepting this special order on D. Lawrance's operating income. b. Briefly discuss any other factors that you believe D. Lawrance's management should con sider in deciding whether to accept the special order. Include nonfinancial as well as financia. considerations.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

21.1A

Transcribed Image Text:connect

Chapter 21 Incremental Analysis

Problem Set A

L021-2, LO21-3,

follows.

Unit Costs

M 21.1A

(40,000 units)

Total

ga Special Order

$50

$2,000,000

Variable manufacturing costs

20

800,000

Variable selling expenses

10

400,000

Fixed manufacturing costs

200,000

Fixed operating expenses

$3,400,000

$85

Total costs and expenses

LO21

LO21

The management of D. Lawrance is considering a special order from Discount Apparel for an

additional 10,000 jackets. These jackets would carry the Discount Apparel label, rather than the D

Lawrance label. In all other respects, they would be identical to the regular D. Lawrance jackets.

Although D. Lawrance regularly sells its jackets to retail stores at a price of $150 each, Dis-

count Apparel has offered to pay only $80 per jacket. However, because no sales commissions

would be involved with this special order, D. Lawrance will incur variable selling expenses of only

$5 per unit on these sales, rather than the $20 it normally incurs. Accepting the order would cause

no change in the company's fixed manufacturing costs or fixed operating costs. D. Lawrance has

enough plant capacity to produce 55,000 jackets per year.

PRC

Mak

Instructions

a. Using incremental revenue and incremental costs, compute the expected effect of accepting

this special order on D. Lawrance's operating income.

b. Briefly discuss any other factors that you believe D. Lawrance's management should co

Sider in deciding whether to accept the special order. Include nonfinancial as well as financial

considerations.

pany has of suede jackets. costs for this are as

D. designs and men's For year, the com-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education