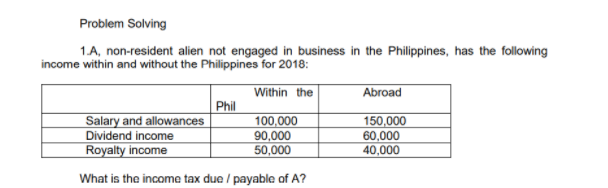

Problem Solving 1A, non-resident alien not engaged in business in the Philippines, has the following income within and without the Philippines for 2018: Within the Phil 100,000 90,000 50,000 Abroad Salary and allowances Dividend income Royalty income 150,000 60,000 40,000 What is the income tax due / payable of A?

Q: Mrs A (aged 66), a South African tax resident, earns the following income for the year ending 28…

A: Given, 1. Salary per month -R125 000 2. Dividends from a foreign listed company -R30 000 3. Interest…

Q: Assuming World Data is a resident foreign corporation, what is the income tax payable for the…

A: A tax is a compulsory charge paid to the government by everyone who is generating any kind of…

Q: An alien received P400,000.00 rental income from his property abroad and P200,000.00 compensation…

A: Income tax is the amount which is to be paid by the income earner as per the tax brackets. These tax…

Q: Business Income-Philippines 1,000,000.00 Business Income-Abroad 500,000.00 Rent Income on property…

A: The taxability of income in Philippines is based on the following rules:- Source of Income…

Q: 1. Ana (resident citizen), earning compensation income and from self-employment, provided the…

A: The income of an individual generated from compensation and self-employment is calculated on a…

Q: Compute the total income in the hands of an individual, considering the following particulars ,being…

A: Taxable income:-These is that income that is liable for tax payment after providing deductions as…

Q: Gross income: Philippines - P700,000 Foreign - 400,000 Expenses: Philippines - 380,000 Foreign -…

A:

Q: Manny Pacquiao borrowed money from Mayweather in the amount of Php 1 Million with an interest rate…

A: The source of the interest income of Mayweather is Within Total income considered under Total…

Q: Katya Corporation had the following data in 2022: Gross Income, Philippines 600,000 Gross Income,…

A: 1) Domestic Corporation Particulars Amount (P) Gross income, Phillipines 600000 Less:…

Q: tan a resident citizen, won P 2,000,000 in a raffle draw held in Singapore. The tax on the above…

A: The tax on prizes and winnings is calculated using a flat rate as specified by the tax laws of…

Q: 1. A resident citizen taxpayer sold a vacant lot (held as investment) in the Philippines. Other data…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: What is the foreign tax credit X Corp, a US Corp, is able to take on its current year return based…

A: The following calculations are done in the records of X Corporation which is based in the US.

Q: Jane received $1,530 of dividends from a foreign public corporation. $270 in foreign tax was…

A: Canadian residents getting the DTC against the dividend. Which they were getting from the government…

Q: Which of the following person’s income is chargeable to Hong Kong salaries tax for the year of…

A: The question is related to taxabity of salary based on residential status. Income from services…

Q: ,000 and a net income from business of P700,000 for a year. Compute for the total income subject to…

A: Income is the sum value of money collected by an entity through multiple sources in a particular…

Q: 1. On each transaction below, determine the tax type whether it is subject to Basic Income Tax…

A: Graduated tax refers to the system of charging taxation in which the individuals with higher income…

Q: How much is the income from sources within? Gross Income from the practice of profession as CPA in…

A: The income which has derived from the properties held in or any kind of activities undertaken in the…

Q: Problem 1: A non-resident alien not engaged in trade or business derived P50,000 interest income…

A: Government charges tax from individuals and other entities with a view to finance the…

Q: Mr. Jin, a non-resident alien stockholder, received a dividend income from a resident foreign…

A:

Q: S Corporation provided the following data for calendar year ending December 31, 2016: (1$ = P50)…

A: Income Tax : It is the charge on income of the individual or group or company levied by the…

Q: Ana, a self-employed resident citizen provided the following data for 2018 taxable year: Sales…

A: Income tax is the tax levied on the total income generated during the accounting period by the state…

Q: A non-resident alien not engaged in trade or business derived P 50,000 interest income from his…

A: The benefits of tax exemption is not applicable in case of non resident alien not engaged in…

Q: Assuming Emman is a domestic corporation, compute the total income subject to Philippine income tax.…

A: Total income Subject to philippine income tax assuming Jasmine is a resident Citizen.... So, the…

Q: . S1: Minimum corporate income tax (MCIT) is imposable on all domestic and resident foreign…

A: Mimimum corporation Income tax is chargeable @ 2% (if MCIT is greater than regular income tax) on…

Q: A resident and citizen of the Philippines who has the below income. Compute for the total income…

A: Taxable income refers to the income assessed by the tax authorities in order to subject the…

Q: The financial account in the U.S. balance of payments includes O everything that is included in the…

A: In a balance of payments (BOP), each transaction would have a debit and credit entry, resulting in…

Q: 3. A resident citizen of the Philippines had the following data for the calendar year 2019: * Gross…

A: Tax is considered as the amount that is paid by the taxpayer to the state or local government from…

Q: a. Determine the amount of Minor's net income for the year. b. Determine the total amount of Minor's…

A: Solution:- a). Calculation of Net Income:- Revenue $5,72,000 Less:- Expenses $2,82,000…

Q: Compute for the tax due of the following self-employed individuals: PHILIPPINES 1. John Wick…

A: 1. John Wick operates books stores and renders services as professional broker. In 2018, Gross sales…

Q: QUESTION ONE Mr Stephen Ncube is a resident of Zambia. The following detail relate to his…

A: Introduction: The entire amount of taxes that individuals and businesses owe to the federal, state,…

Q: Question no. 01: A. According to the Turkish tax legislation, there are two main types of tax…

A: Mathematical model is representation of mathematical figures, language and concepts. It uses…

Q: 20. A resident citizen has a compensation income of P1,250,000 within the Philippines and P150,000…

A: The resident citizen taxed worldwide income. The compensation income is taxable on the progressive…

Q: An alien received P200,000 compensation income in the Philippines and P300,000 rental income from…

A: Income tax is a form of direct tax which is being payable on amount of income earned by the…

Q: How much is the total income tax expense of Ana for the year? *

A: NOTE : As per BARTLEBY guidelines, when multiple independent questions are given, then first…

Q: 9. A Filipino citizen has P400,000 Philippine income and P300,000 foreign income. He paid P55,000…

A: 9. A citizen of the Philippines is allowed a full tax credit of the foreign tax paid by the citizen…

Q: An individual (Resident citizen) earning compensation and business income provided the following…

A: GIVEN An individual (Resident citizen) earning compensation and business income provided the…

Q: Which of the following would not count as part of US GDP in 2019 A. Paul paid rent of…

A: The GDP stands for the Gross Domestic Product. The Us GDP means the value of the goods and the…

Q: Compensation income, Philippines 200,000.00 Rental income, Philippines 100,000.00 Net sales,…

A: Taxable net income is the amount of earnings on which tax liability is determined. The taxable…

Q: what is the income tax due if Sandbox is a non-resident foreign corporation? P75,000…

A: Non Resident Foreign Corporation A Non Resident Foreign Corporation is one which does not have any…

Q: 22. A domestic corporation has a net income of P1,200,000 in the Philippines and P800,000 from…

A:

Q: Assuming Emman is a resident alien, compute the total income subject to Philippine income tax. *…

A: Resident Citizen receiving income from sources within or outside the Philippines will be included in…

Q: A resident citizen provided the following information for 2018: Compensation income Gross business…

A: Taxable Income For calculating the taxable income in Philippines first to taken up the gross income…

Q: Dividends received from a domestic corporation 50,000 Dividends received from a resident foreign…

A: Step 1 Dividends distributed by a Philippine company to a resident individual are taxed at a rate of…

Q: 21. A resident alien has a net business net income of P2,200,000 in the Philippines and P1,250,000…

A: A resident of the Philippines has to pay income tax on worldwide income. The income tax is payable…

Q: YOU, single, Filipino citizen, and a resident of N. Reyes St., Sampaloc, Manila, borrowed money from…

A: Documentary stamp Tax is the tax used in philippine country to charge tax on execution of documents.…

Q: Based on the below data, answer as required: WITHIN OUTSIDE Gross…

A:

Q: A, non-resident alien not engaged in business in the Philippines, has the following income within…

A: A non-resident alien engaged in trade or business If a person stays for an aggregate period of…

Q: Corporation reported the following gross income and expenses: Gross income in the Philippines is…

A: Private educational institution in the Philippines are subject to tax because they are making…

Q: Phils. Corporation reported the following gross income and expenses Philippines Overseas Gross…

A: A domestic corporation is taxed @25% from july 1,2020. Previously rate of tax was 30%. A domestic…

Step by step

Solved in 2 steps with 1 images

- 1.A, non-resident alien not engaged in business in the Philippines, has the following income within and without the Philippines for 2018: Within the Phil Abroad Salary and allowances 100,000 150,000 Dividend income 90,000 60,000 Royalty income 50,000 40,000 What is the income tax due / payable of A?A non-resident alien not engaged in trade or business derived the following income from the Philippines: Interest income on his long-term bank deposit here in the Philippines, P50,000Interest income on his bank deposit under the EFCDS ($1 = P50), $500How much is the income tax due?Ghana has not entered into Double Taxation Agreement (DTA) with the government of Nigeria. Kumuga, a resident person of Ghana approached you this morning to explain to him whether foreign tax credit relief covers those residents trading in Nigeria.RequiredState your responses to Kumuga on the above issue? b. Amafiman Rural Bank commenced operation on 1st January, 2018, preparing account to 31st December each year. The Income statement for the year ended 31st December, 2019 is shown below.Income statement for the year ended 31st December, 2019 GH¢Profit before tax 700,000

- Problem 1: A non-resident alien not engaged in trade or business derived P50,000 interest income from his long-term bank deposit here in the Philippines. How much is the income tax due of the said alien?Using the same data in the previous question, what is the income tax due if Sandbox is a resident foreign corporation? P50,000 P40,000 P87,500 P70,000Which of the following income derived from within the Philippines by a resident individual is not subject to the rates in Section 24(A) of the NIRC? Which of the following income derived from within the Philippines by a resident individual is not subject to the rates in Section 24(A) of the NIRC? a. A gain from sale of a motor vehicle as another income of a taxpayer who is a compensation income earner b. A passive income in the form of prize won in a raffle amounting to PHP 4,000 c. Salary received by a managing partner of a general professional partnership d. A gain on sale of a real property for private use of the family of the taxpayer

- A _____________________________ is a means of ensuring that the expatriate’s after-tax income in the host country is similar to what the person’s after-tax income would be in the home country A) International tax management system B) HRM system C) Nucor sytem D) Tax deduction system E) Tax equalization systemWhich of the following is true? A. Long term interest earned by a resident foreign corporation on its deposits in banks in the Philippines shall be subject to a 20% final tax. B. Long term interest earned by a resident foreign corporation on its deposits in banks in the Philippines shall be exempt from income tax. C. Long term interest earned by a resident foreign corporation on its deposits in banks in the Philippines shall be subject to regular income tax. D. None of the above. E. Individual and Corporate taxpayers must declare their intention to avail of the OSD in their annual income tax Return. F. The option to avail of the OSD shall be irrevocable for the whole taxable year. G. The option to avail of the OSD is applicable to taxpayers subject to regular income tax on their net incomeA non-resident alien not engaged in business in the Philippines, but with income from the Philippines: Statement 1. is taxed at 25% of gross income from within the Philippines. Statement 2. is entitled to personal exemptions on the basis of reciprocity. Both statements are true Both statements are false Only the first statement is true. Only the second statement is true.

- INSTRUCTIONS: Read carefully, analyze and understand the problem. For your answers, provide the solution and "double-rule" your final answer (Accountant's style) Case problem An individual taxpayer provided the following information in 2020 as follows: Gross business income, Philippines - P 7,000,000 Gross business income, USA - 4,000,000 Gross business income, Australia - 2,000,000 Business expenses, Philippines - 5,000,000 Business expenses, USA - 2,500,000 Business expenses, Australia - 1,200,000 REQUIREMENT: How much is the taxable income if the taxpayer is a nonresident citizen ?INSTRUCTIONS: Read carefully, analyze and understand the problem. For your answers, provide the solution and "double-rule" your final answer (Accountant's style) Case problem An individual taxpayer provided the following information in 2020 as follows: Gross business income, Philippines - P 7,000,000 Gross business income, USA - 4,000,000 Gross business income, Australia - 2,000,000 Business expenses, Philippines - 5,000,000 Business expenses, USA - 2,500,000 Business expenses, Australia - 1,200,000 REQUIREMENTS: How much is the taxable income if the taxpayer is a resident citizen ?Qalvin Corporation, a MSME, reported the following gross income and expenses in 2022: Philippines Abroad Total Gross income P400,000 P300,000 P700,000 Deductions 200,000 150,000 350,000 Taxable income P200,000 P150,000 P350,000 Compute the income tax due if Qalvin is an International Carrier.