1. A resident citizen taxpayer sold a vacant lot (held as investment) in the Philippines. Other data regarding the sale are as follows: Selling price Fair market value Zonal value P5,500,000 6,000,000 5,850,000

1. A resident citizen taxpayer sold a vacant lot (held as investment) in the Philippines. Other data regarding the sale are as follows: Selling price Fair market value Zonal value P5,500,000 6,000,000 5,850,000

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Please answer 2-9. Numbers 1 to 4. thank you.

Transcribed Image Text:P380 00

me and

1st Q

P300,000

120,000

2, a resident citizen:

2nd Q

P650,000

262,000

OPE

P910,000 P1,200,000

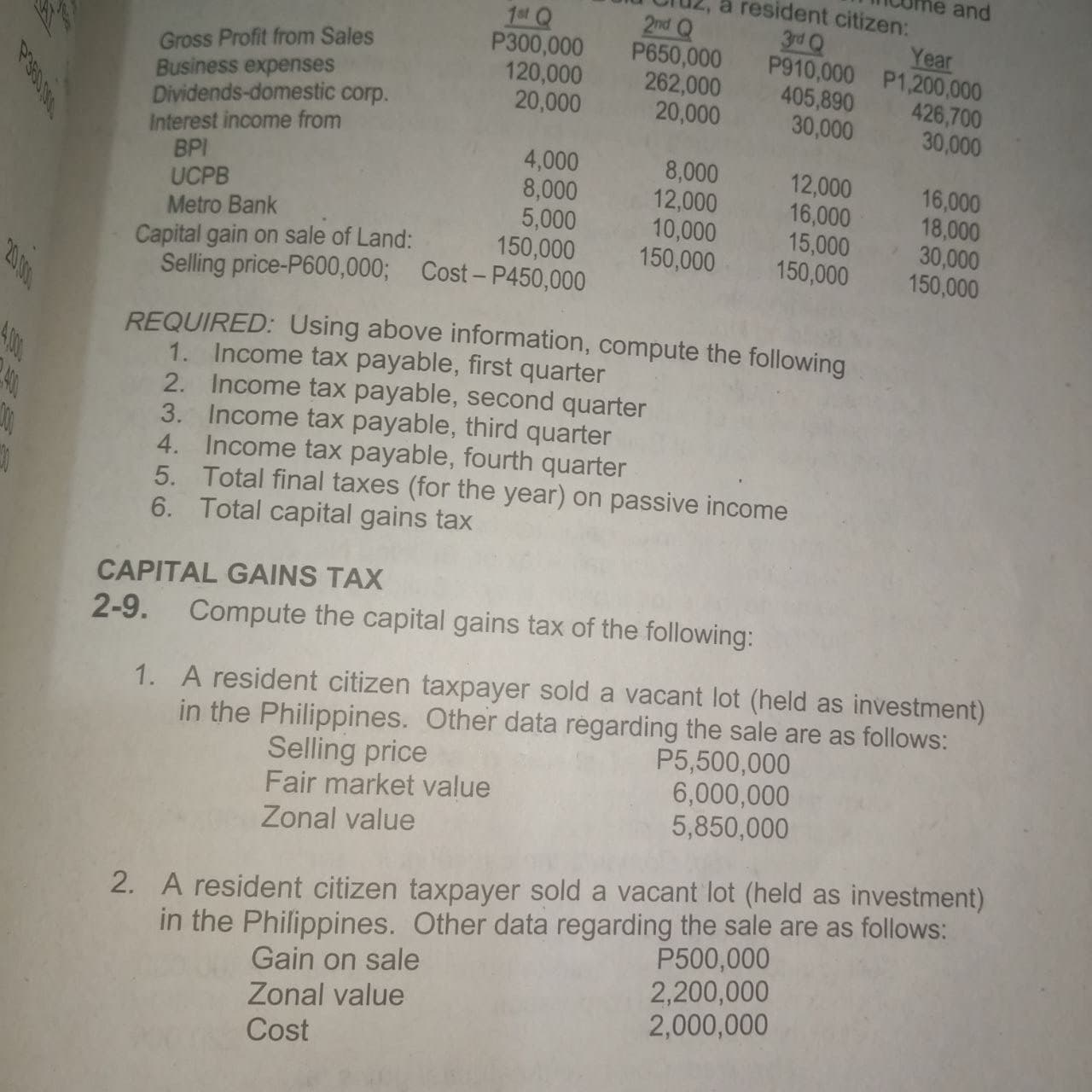

Gross Profit from Sales

Business expenses

Dividends-domestic corp.

Interest income from

BPI

UCPB

Metro Bank

Year

405,890 426,700

000'0

12,000

30,000

000'

000'

000'

000

000'0

000'0

150,000

000'

000

000'

000'0E

150,000

Capital gain on sale of Land:

150,000

Selling price-P600,000; Cost-P450,000

REQUIRED: Using above information, compute the following

1. Income tax payable, first quarter

2. Income tax payable, second quarter

3. Income tax payable, third quarter

4. Income tax payable, fourth quarter

5. Total final taxes (for the year) on passive income

6. Total capital gains tax

CAPITAL GAINS TAX

2-9. Compute the capital gains tax of the following:

1. A resident citizen taxpayer sold a vacant lot (held as investment)

in the Philippines. Other data regarding the sale are as follows:

Selling price

Fair market value

P5,500,000

6,000,000

5,850,000

Zonal value

2. A resident citizen taxpayer sold a vacant lot (held as investment)

in the Philippines. Other data regarding the sale are as follows:

Gain on sale

Zonal value

Cost

P500,000

2,200,000

2,000,000

Transcribed Image Text:(principal residence) in the Philippines. Other data regarding the

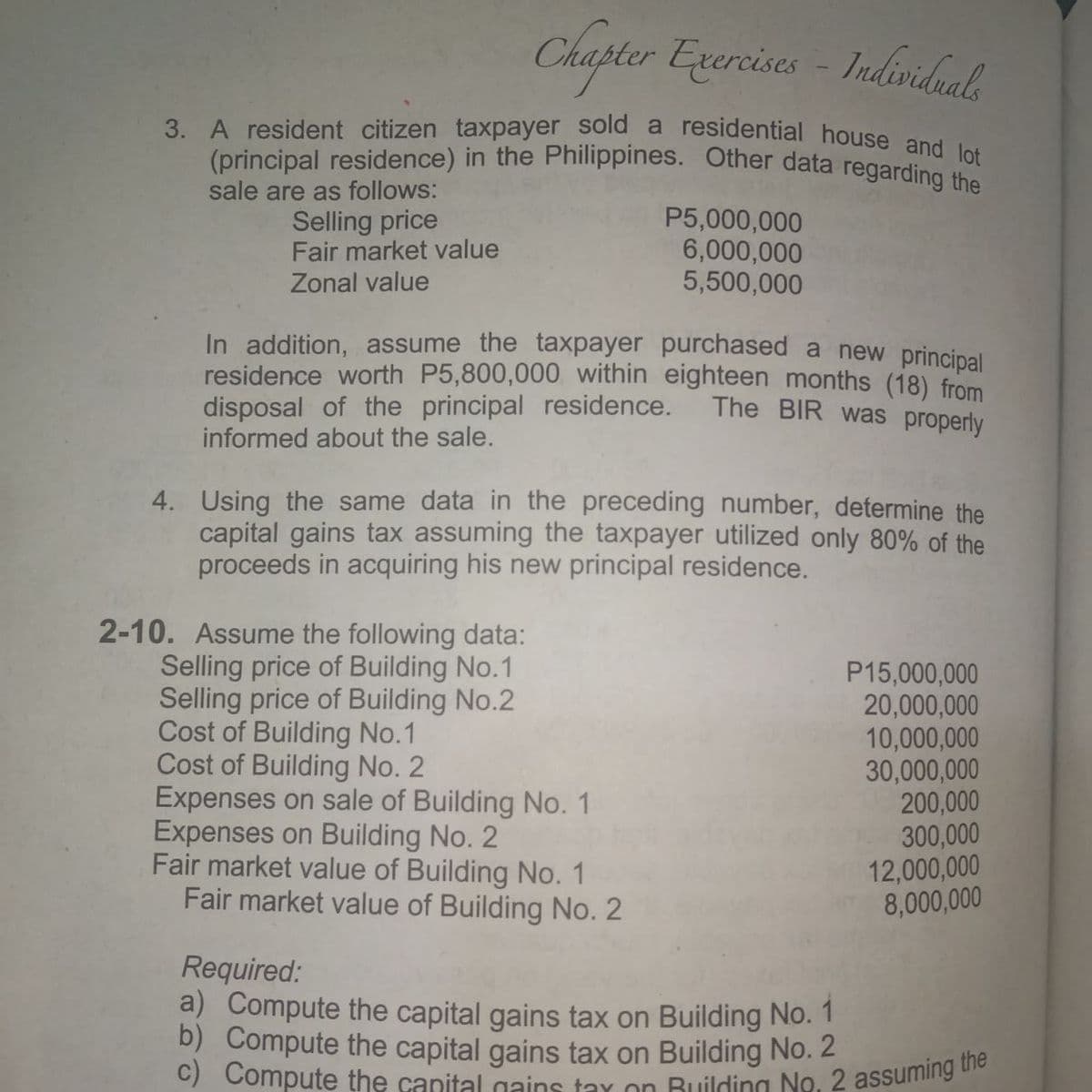

3. A resident citizen taxpayer sold a residential house and lot

Chapter Exercises

Tndividuals

sale are as follows:

Selling price

Fair market value

Zonal value

P5,000,000

6,000,000

5,500,000

In addition, assume the taxpayer purchased a new principal

residence worth P5,800,000 within eighteen months (18) from

disposal of the principal residence.

informed about the sale.

The BIR was properly

4. Using the same data in the preceding number, determine the

capital gains tax assuming the taxpayer utilized only 80% of the

proceeds in acquiring his new principal residence.

2-10. Assume the following data:

Selling price of Building No.1

Selling price of Building No.2

Cost of Building No.1

Cost of Building No. 2

Expenses on sale of Building No. 1

Expenses on Building No. 2

Fair market value of Building No. 1

Fair market value of Building No. 2

P15,000,000

20,000,000

10,000,000

30,000,000

200,000

300,000

12,000,000

8,000,000

Required:

a) Compute the capital gains tax on Building No. 1

b) Compute the capital gains tax on Building No. 2

C) Compute the capital gains tay on Building No. 2 assuming

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education