Problem with explanation.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter13: The Balanced Scorecard: Strategic-based Control

Section: Chapter Questions

Problem 9E: Computador has a manufacturing plant in Des Moines that has the theoretical capability to produce...

Related questions

Question

Problem with explanation.

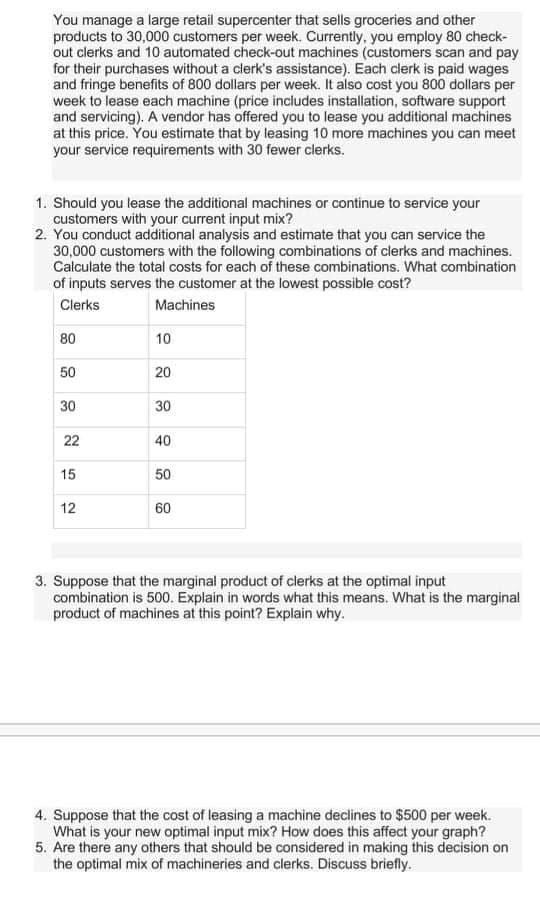

Transcribed Image Text:You manage a large retail supercenter that sells groceries and other

products to 30,000 customers per week. Currently, you employ 80 check-

out clerks and 10 automated check-out machines (customers scan and pay

for their purchases without a clerk's assistance). Each clerk is paid wages

and fringe benefits of 800 dollars per week. It also cost you 800 dollars per

week to lease each machine (price includes installation, software support

and servicing). A vendor has offered you to lease you additional machines

at this price. You estimate that by leasing 10 more machines you can meet

your service requirements with 30 fewer clerks.

1. Should you lease the aditional machines or continue to service your

customers with your current input mix?

2. You conduct additional analysis and estimate that you can service the

30,000 customers with the following combinations of clerks and machines.

Calculate the total costs for each of these combinations. What combination

of inputs serves the customer at the lowest possible cost?

Clerks

Machines

80

10

50

20

30

30

22

40

15

50

12

60

3. Suppose that the marginal product of clerks at the optimal input

combination is 500. Explain in words what this means. What is the marginal

product of machines at this point? Explain why.

4. Suppose that the cost of leasing a machine declines to $500 per week.

What is your new optimal input mix? How does this affect your graph?

5. Are there any others that should be considered in making this decision on

the optimal mix of machineries and clerks. Discuss briefly.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT