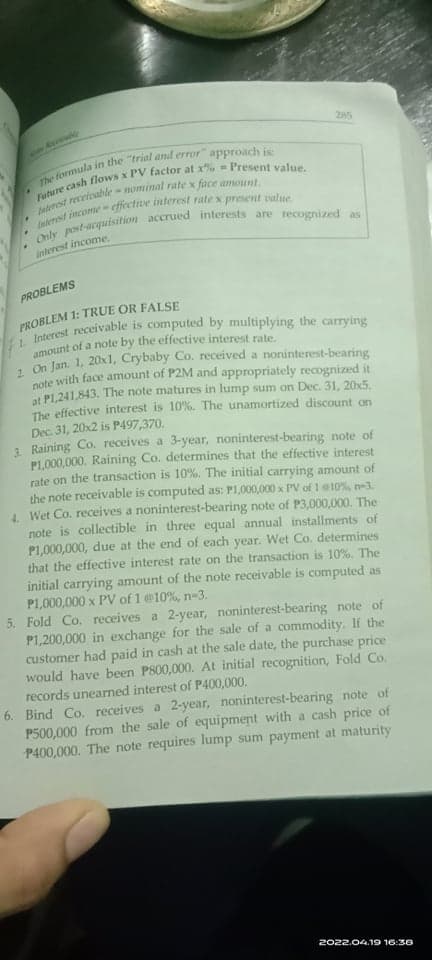

PROBLEMS PROBLEM 1: TRUE OR FALSE . On Jan. 1, 20x l, Crybaby Co. received a noninterest-bearing e with face amount of P2M and appropriately recognized it at PI,241,843. The note matures in lump sum on Dec. 31, 20x5. The effective interest is 10%. The unamortized discount on Dec. 31, 20x2 is P497,370. 1 Raining Co. receives a 3-year, noninterest-bearing note of P1,000,000. Raining Co. determines that the effective interest rate on the transaction is 10%. The initial carrying amount of the note receivable is computed as: P1,000,000 x PV of 1e10%, n-3. 4. Wet Co. receives a noninterest-bearing note of P3,000,000. The note is collectible in three equal annual installments of P1,000,000, due at the end of each year. Wet Co. determines that the effective interest rate on the transaction is 10%. The initial carrying amount of the note receivable is computed as P1,000,000 x PV of 1 @10%, n-3. 5. Fold Co. receives a 2-year, noninterest-bearing note of P1,200,000 in exchange for the sale of a commodity. If the customer had paid in cash at the sale date, the purchase price would have been P800,000. At initial recognition, Fold Co. records unearned interest of P400,000. 6. Bind Co. receives a 2-year, noninterest-bearing note of P500,000 from the sale of equipment with a cash price of P400,000. The note requires lump sum payment at maturity

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Step by step

Solved in 2 steps