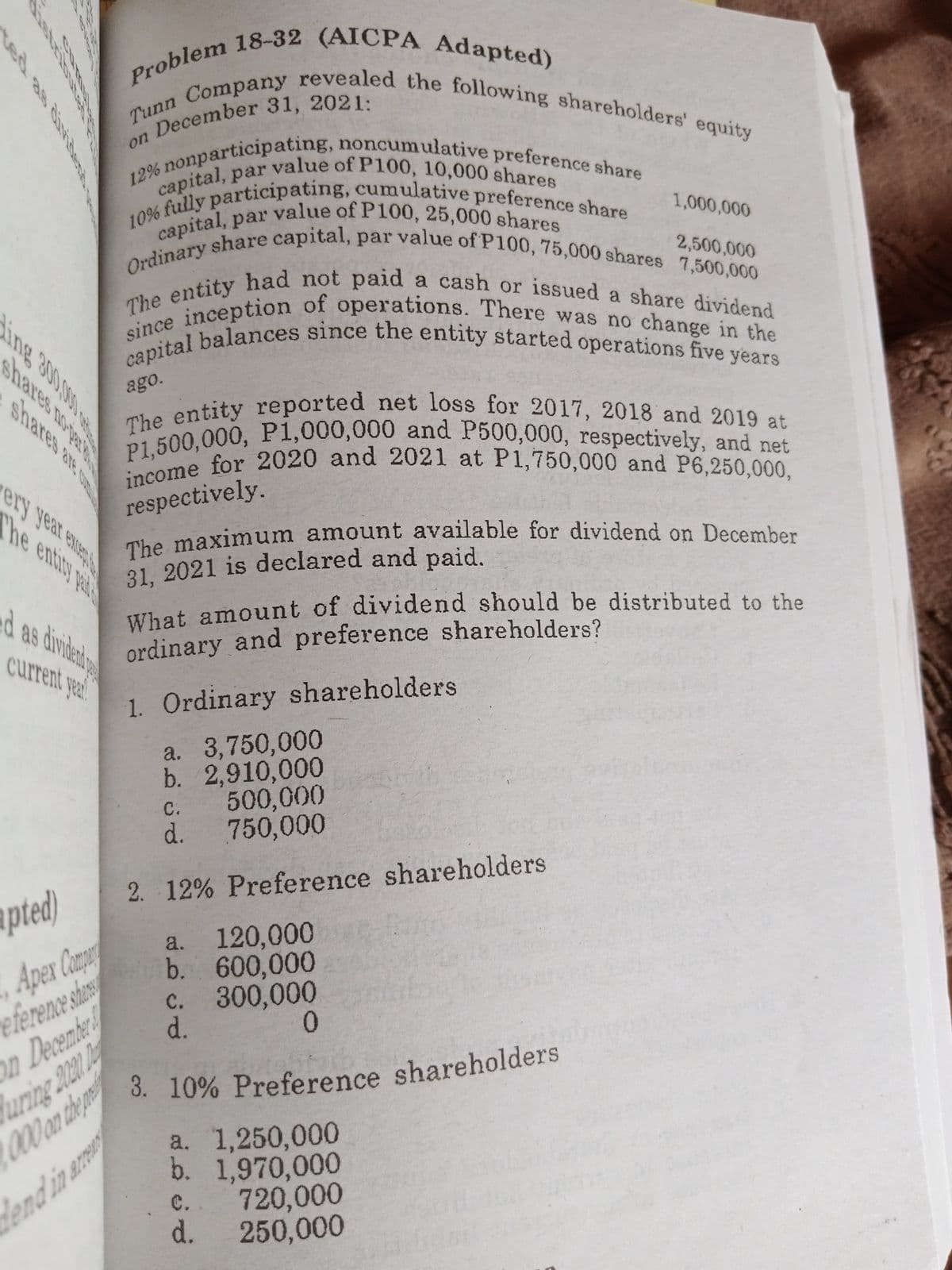

Probler capital, par value of P100, 25,000 shares The maximum amount available for dividend on December capital, par value of P100, 10,000 shares 10% fully participating, cumulative preference share 12% noncumulative preference share income for 2020 and 2021 at P1,750,000 and P6,250,000, P1,500,000, P1,000,000 and P500,000, respectively, and net The entity reported net loss for 2017, 2018 and 2019 at The entity had not paid a cash or issued a share dividend since inception of operations. There was no change in the capital balances since the entity started operations five years Ordinary share capital, par value of P100, 75,000 shares 7,500,000 Tunn Company revealed the following shareholders' equity pted) n December 31, 2021: 1,000,000 2,500,000 ago. respectively. 31, 2021 is declared and paid. What amount of dividend should be distributed to the ordinary and preference shareholders? 1. Ordinary shareholders a. 3,750,000 b. 2,910,000 C. 500,000 d. 750,000 2. 12% Preference shareholders 120,000 b. 600,000 300,000 d. a. с. 3. 10% Preference shareholders a. 1,250,000 b. 1,970,000 720,000 d. с. 250,000

Probler capital, par value of P100, 25,000 shares The maximum amount available for dividend on December capital, par value of P100, 10,000 shares 10% fully participating, cumulative preference share 12% noncumulative preference share income for 2020 and 2021 at P1,750,000 and P6,250,000, P1,500,000, P1,000,000 and P500,000, respectively, and net The entity reported net loss for 2017, 2018 and 2019 at The entity had not paid a cash or issued a share dividend since inception of operations. There was no change in the capital balances since the entity started operations five years Ordinary share capital, par value of P100, 75,000 shares 7,500,000 Tunn Company revealed the following shareholders' equity pted) n December 31, 2021: 1,000,000 2,500,000 ago. respectively. 31, 2021 is declared and paid. What amount of dividend should be distributed to the ordinary and preference shareholders? 1. Ordinary shareholders a. 3,750,000 b. 2,910,000 C. 500,000 d. 750,000 2. 12% Preference shareholders 120,000 b. 600,000 300,000 d. a. с. 3. 10% Preference shareholders a. 1,250,000 b. 1,970,000 720,000 d. с. 250,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 21P

Related questions

Question

Transcribed Image Text:capital, par value of P100, 25,000 shares

Tunn Company revealed the following shareholders' equity

since inception of operations. There was no change in the

31, 2021 is declared and paid.

P1,500,000, P1,000,000 and P500,000, respectively, and net

Problem 18-32 (AICPA Adapted)

The maximum amount available for dividend on December

The entity reported net loss for 2017, 2018 and 2019 at

10% fully participating, cumulative preference share

Ordinary share capital, par value of P100, 75,000 shares 7,500,000

capital balances since the entity started operations five years

12% nonparticipating, noncumulative preference share

income for 2020 and 2021 at P1,750,000 and P6,250,000,

The entity had not paid a cash or issued a share dividend

an December 31, 2021-

on

value of P100, 10,000 shares

capital, par

1,000,000

2,500,000

The eneption of operati1ons. There was no change in the

capital b

ago.

respectively.

The maximum amount available for dividend on December

31. 2021 is declared and paid.

d as diviedy

What amount of dividend should be distributed to the

ordinary and preference shareholders?

current yeai

1. Ordinary shareholders

a. 3,750,000

b. 2,910,000

500,000

d.

C.

750,000

2. 12% Preference shareholders

pted)

Aper Camp

eference.

a. 120,000

b. 600,000

c. 300,000

an December

d.

uring 20201 De

O00 an the n

arey

end in

0.

a. 1,250,000

b. 1,970,000

720,000

d.

C.

250,000

cumu

रो

ing 300A00

Shares no-par

ల

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub