independent appraiser at P3,000,000. Boom shares are currently traded at the stock exchange at P170. May 9, 2022 Collected fully half of the subscribed ordinary share capital for which issued the stock certificate. May 25, 2022 Reacquired 12,000 ordinary shares at P120 per share. Jun 1, 2022 Sold 5,000 Treasury shares at P100. The company uses FlIFO method. Jun 30, 2022 Shareholders approved a 2 for 1 ordinary share split. Received full payment of the subscribed preference share for which stock certificates were issued. Sep 30, 2022 Sold 7,500 treasury shares at P100 per share. Dec 1, 2022 Retired 5,000 of the remaining treasury shares. Dec 31,2022 Net income for the year is 2 million. Dec 31, 2022 Appropriated the retained earnings for the treasury shares cost. Requirements: A. Journalize the 2022 transactions. B. Prepare the shareholders' equity section in good form.

independent appraiser at P3,000,000. Boom shares are currently traded at the stock exchange at P170. May 9, 2022 Collected fully half of the subscribed ordinary share capital for which issued the stock certificate. May 25, 2022 Reacquired 12,000 ordinary shares at P120 per share. Jun 1, 2022 Sold 5,000 Treasury shares at P100. The company uses FlIFO method. Jun 30, 2022 Shareholders approved a 2 for 1 ordinary share split. Received full payment of the subscribed preference share for which stock certificates were issued. Sep 30, 2022 Sold 7,500 treasury shares at P100 per share. Dec 1, 2022 Retired 5,000 of the remaining treasury shares. Dec 31,2022 Net income for the year is 2 million. Dec 31, 2022 Appropriated the retained earnings for the treasury shares cost. Requirements: A. Journalize the 2022 transactions. B. Prepare the shareholders' equity section in good form.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 10MC

Related questions

Question

please help me

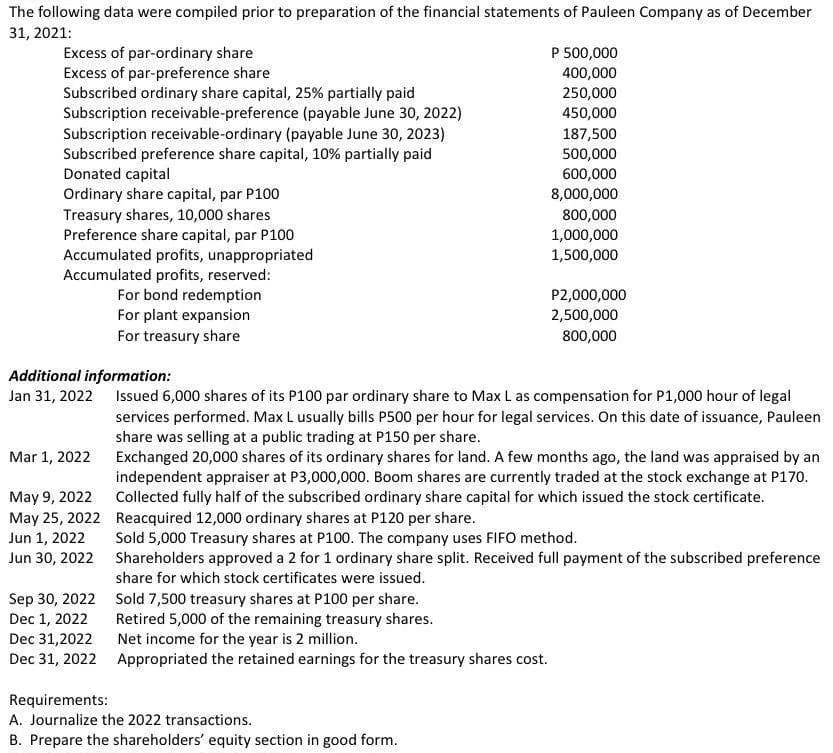

Transcribed Image Text:The following data were compiled prior to preparation of the financial statements of Pauleen Company as of December

31, 2021:

Excess of par-ordinary share

Excess of par-preference share

Subscribed ordinary share capital, 25% partially paid

Subscription receivable-preference (payable June 30, 2022)

Subscription receivable-ordinary (payable June 30, 2023)

Subscribed preference share capital, 10% partially paid

Donated capital

Ordinary share capital, par P100

Treasury shares, 10,000 shares

Preference share capital, par P100

Accumulated profits, unappropriated

Accumulated profits, reserved:

P 500,000

400,000

250,000

450,000

187,500

500,000

600,000

8,000,000

800,000

1,000,000

1,500,000

For bond redemption

For plant expansion

For treasury share

P2,000,000

2,500,000

800,000

Additional information:

Jan 31, 2022 Isued 6,000 shares of its P100 par ordinary share to Max L as compensation for P1,000 hour of legal

services performed. Max L usually bills P500 per hour for legal services. On this date of issuance, Pauleen

share was selling at a public trading at P150 per share.

Exchanged 20,000 shares of its ordinary shares for land. A few months ago, the land was appraised by an

independent appraiser at P3,000,000. Boom shares are currently traded at the stock exchange at P170.

Collected fully half of the subscribed ordinary share capital for which issued the stock certificate.

Mar 1, 2022

May 9, 2022

May 25, 2022 Reacquired 12,000 ordinary shares at P120 per share.

Jun 1, 2022

Sold 5,000 Treasury shares at P100. The company uses FIFO method.

Jun 30, 2022 Shareholders approved a 2 for 1 ordinary share split. Received full payment of the subscribed preference

share for which stock certificates were issued.

Sep 30, 2022 Sold 7,500 treasury shares at P100 per share.

Dec 1, 2022

Dec 31,2022

Dec 31, 2022 Appropriated the retained earnings for the treasury shares cost.

Retired 5,000 of the remaining treasury shares.

Net income for the year is 2 million.

Requirements:

A. Journalize the 2022 transactions.

B. Prepare the shareholders' equity section in good form.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning