Project 1: Retooling Manufacturing Facility This project would require an initial investment of $4,920,000. It would generate $928,000 in additional net cash flow eac year. The new machinery has a useful life of eight years and a salvage value of $1,870,000. Project 2: Purchase Patent for New Product The patent wóuld cost $3,645,000, which would be fully amortized over five years. Production of this product would gener $583,200 additional annual net income for Hearne. Project 3: Purchase a New Fleet of Delivery Trucks Hearne could purchase 25 new delivery trucks at a cost of $141,600 each. The fleet would have a useful life of 10 years, am each truck would have a salvage value of $5,700. Purchasing the fleet would allow Hearne to expand its customer territory resulting in $234,000 of additional nét income per year. Required: 1. Determine each project's accounting rate of return. 2. Determine each project's payback period. 3. Using a discount rate ofț10 percent, calculate the net present value of each project. 4. Determine the profitabilîty index of each project and prioritize the projects for Hearne.

Project 1: Retooling Manufacturing Facility This project would require an initial investment of $4,920,000. It would generate $928,000 in additional net cash flow eac year. The new machinery has a useful life of eight years and a salvage value of $1,870,000. Project 2: Purchase Patent for New Product The patent wóuld cost $3,645,000, which would be fully amortized over five years. Production of this product would gener $583,200 additional annual net income for Hearne. Project 3: Purchase a New Fleet of Delivery Trucks Hearne could purchase 25 new delivery trucks at a cost of $141,600 each. The fleet would have a useful life of 10 years, am each truck would have a salvage value of $5,700. Purchasing the fleet would allow Hearne to expand its customer territory resulting in $234,000 of additional nét income per year. Required: 1. Determine each project's accounting rate of return. 2. Determine each project's payback period. 3. Using a discount rate ofț10 percent, calculate the net present value of each project. 4. Determine the profitabilîty index of each project and prioritize the projects for Hearne.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 5BE

Related questions

Question

In my class I am also having trouble finding payback period. When I initially tried this, I divided the cost of the patent by 5 years. What steps should I take to get the correct answer.

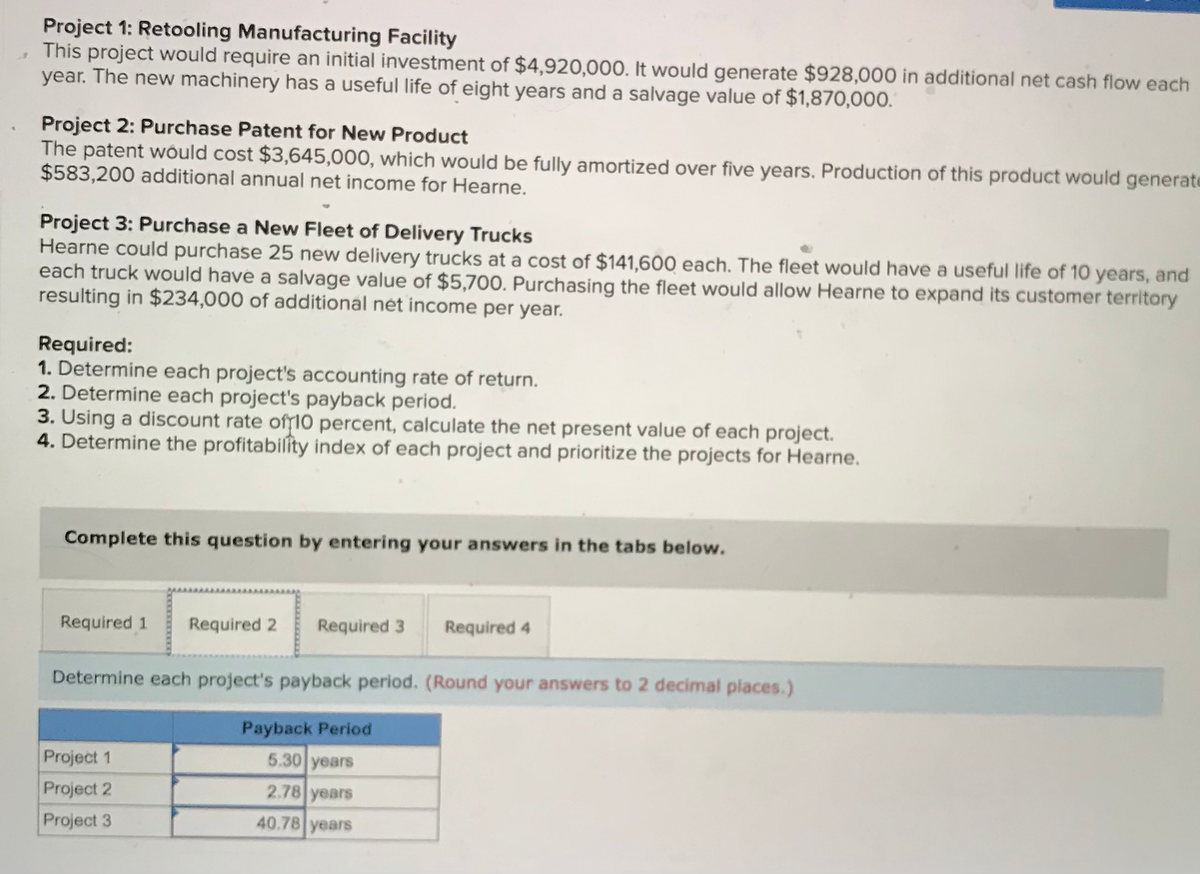

Transcribed Image Text:Project 1: Retooling Manufacturing Facility

This project would require an initial investment of $4,920,000. It would generate $928,000 in additional net cash flow each

year. The new machinery has a useful life of eight years and a salvage value of $1,870,000.

Project 2: Purchase Patent for New Product

The patent wóuld cost $3,645,000, which would be fully amortized over five years. Production of this product would generate

$583,200 additional annual net income for Hearne.

Project 3: Purchase a New Fleet of Delivery Trucks

Hearne could purchase 25 new delivery trucks at a cost of $141,600 each. The fleet would have a useful life of 10 years, and

each truck would have a salvage value of $5,700. Purchasing the fleet would allow Hearne to expand its customer territory

resulting in $234,000 of additional nét income per year.

Required:

1. Determine each project's accounting rate of return.

2. Determine each project's payback period.

3. Using a discount rate offi0 percent, calculate the net present value of each project.

4. Determine the profitability index of each project and prioritize the projects for Hearne.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Determine each project's payback period. (Round your answers to 2 decimal places.)

Payback Period

Project 1

5.30 years

Project 2

2.78 years

Project 3

40.78 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,