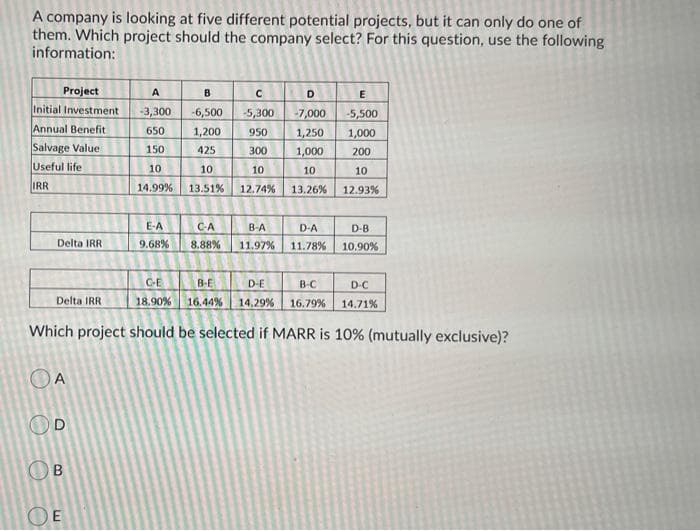

Project B D E Initial Investment 3,300 -6,500 5,300 -7,000 -5,500 Annual Benefit 650 1,200 950 1,250 1,000 Salvage Value 150 425 300 1,000 200 Useful life 10 10 10 10 10 IRR 14.99% 13.51% 12.74% 13.26% 12.93%

Q: Q/ A contractor bought a construction mechanism at a price of $80,000. Records indicate that the…

A: Cost of Machine = $ 80,000 Useful life = 6 years Salvage value = $ 10,000 1. Straight Line Method…

Q: LOGIC COMPANY Comparative Income Statement For Years Ended December 31, 2017 and 2018 2018 2017…

A: The acid-test ratio is calculated by dividing the liquid assets of the company by its current…

Q: -ughout the year vertible into 20 million shares of c e into 18.0 million shares of comn

A: Given as,

Q: Unit VI question 15

A: Total operating cost :- Current copier = 7,300 x 5 = 36,500 New model = 2,100 x 5 = 10,500

Q: As a global citizen, what do you think is your role that can best help in addressing the…

A: Answer:- Definition of pandemic:- A pandemic can be defined as the contagious disease outbreak that…

Q: On 1st January, 2016 Sadhan Sen of Sodepur sent 1,000 units of silk goods to Biren Bose of…

A: This is a case of a Joint venture where two individuals come together for purpose of doing business…

Q: 10-year, 13% bond, December 31, 2013,

A: The interest rate is the amount that a lender charges a borrower in addition to the principal for…

Q: On January 1, 2018, Claude paid the annual rental for 2018 and 2019 including the security deposit…

A: GIVEN Claude leased a facility from ML partnership in January 1, 2018. Terms of the lease were…

Q: Annually (10000) units of a product are sold at a price of (12) $/unit, if the fixed costs is…

A: The question is based on the concept of Cost Accounting.

Q: e beginning of each process. On October 1, 2022, inventories co in Process-Packaging $325,000, and…

A: The answer has been mentioned below.

Q: Give detail definition on operational cost and explain in detail how the operational cost is…

A: Introduction:- The following definition of operational cost as follows under:- Operating costs are…

Q: Why debit the COGS with the 25700 and not inventory of the $19,000. Why was the $19,000 expensed…

A: What is meant by rectification of errors? It might be possible that while preparing books of…

Q: On July 1, 2021, Mickaella Company, an SME, acquired 20% of the outstanding ordinary shares of…

A: It is the method used to treat investments in associate companies. This method is used when an…

Q: Mr Adam wants to sell his car, which he purchased at RM 85,000 after using it for three years. The…

A: Sum of the year digits method: Under this method of depreciation, the depreciation rate percentage…

Q: Beginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 Inventory…

A: Last In First Out (LIFO) : Under this method ,materials last received are issued first. Thus…

Q: orth Company ,000 for P1,000,00 00 and signed a r :eh is

A: Accounts Payable: Accounts payable is recognized in the accounting books of a company to indicate…

Q: your sister bought a condominuim unit for 9,300,000 peso through a condominium loan which she avaied…

A: The monthly amortization is the payment that has to be paid or received at the end of every month.

Q: 2 Varch-2A Time left 0:29:02 Fairfield Company management has budgeted the following amounts for its…

A: Break even point in units = Fixed cost/contribution margin per unit

Q: The ledgerof VW Co. in 20x1 includes the following: Cash 200,000 Accounts receivable 400,000…

A: Rectification of Errors: It is the method of revising mistakes made in recorded transactions.…

Q: create 2 problems (required must vary) for each type of depreciation. 1. Straight Line Method 2.…

A: You have posted multiple-part questions, so as per Bartleby policy only the first three parts are…

Q: A Company has been operating for one year. On January 1, at the start of its second year, its income…

A: Journal entry is the process of recording the transaction in the books of account. Journal entry has…

Q: P600,000 and P200,000, respectively. What is the income tax due to John Wick in his quarterly income…

A: It is given in the question that Mr. John Wick who is the taxpayer has failed to signify his…

Q: ired of the probl

A: Note:- Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Anders Company used the moving average method to determine the cost of the inventory. During January…

A: It is method of Perpetual Inventory Costing System where in the unit cost is calculated every time…

Q: After analyzing the data, prepare a bank reconciliation for M Park Corporation at March 31st.…

A: Bank reconciliation refers to the method used by the company to match the bank statement as well as…

Q: Complete the following data taken from the condensed income statements for merchandising Companies…

A: Gross profit = Sales - Cost of goods sold Net income = Gross profit - Operating expenses

Q: Campbell Corporation uses the retail method to value its inventory. The following information is…

A: The cost to retail ratio is calculated as goods available for sale at cost divided by goods…

Q: Make-or-Buy Decision for a Service Company The Theater Arts Guild of Dallas (TAG-D) employs five…

A: Relevant costing is simply eliminate irrelevant financial costs in the management decisions which…

Q: During the current year, Maine Salvage Company took out new loans of $19 million. In addition, the…

A: Cash flow statement includes: Cash flows from operating activities Cash flows from investing…

Q: per year will accum

A: Deposit = 33047 $ Interest rate = 10 % Time = 10 years

Q: Please define what centralized and decentralized operations are within the context of Chapter 24

A: Centralized Operations mean operations are managed by higher authorities. thus have a centralized…

Q: Jackson Inc. purchased 30,000 shares of common stock of the Pixel Corporation $10 per share on…

A: calculation of revenue from investment and investment shown in balance sheet are as follows

Q: An increase in the interest rate will cause A an increase in planned investment and an increase in…

A: Interest Rate: An interest rate is the amount of money that a lender charges a borrower in exchange…

Q: At the beginning of period, Ammar Co. had balances in account receivable of $ 400,000 and allowance…

A: Account receivable means the amount due from outsider for the goods or services rendered on account.…

Q: Unit v question 12

A: Manufacturing overhead (MOH) is the total of all indirect costs incurred during the production of a…

Q: Suppose Dean has $500 and there are two companies he could invest X dollars in: Dog Gone Salon,…

A: In the context of the given question, Dean has $ 500 to invest in two companies. If he invests $ 500…

Q: Decision on Accepting Additional Business Country Jeans Co. has an annual plant capacity of 65,400…

A: The differential analysis is performed to analyze the different alternatives available with the…

Q: The amount available under the line of credit is Prepare the appropriate journal entries through th-…

A: A journal entry is an accounting entry that is used to document a business transaction in the…

Q: Variable-Costing and Absorption-Costing IncomeBorques Company produces and sells wooden pallets that…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: All direct materials are placed in process at the beginning of the process and the average cost…

A: Conversion Costs Conversion costs are those costs that convert raw materials into a finished…

Q: A Company has been operating for one year. On January 1, at the start of its second year, its income…

A: The journal keeps the record for day to day transactions of the business on regular basis. The…

Q: The following information is available for Leah Company: 12.31.2021 12.31.2020 Cash P1,400,000…

A: The cash flow from operating activities is calculated from the change in cash equation

Q: Dec 31' Dec 31' Period Ending 2019 2020 Current Assets Cash And Cash Equivalents 3,803,377.00…

A: Accounting is a process of recording, summarising and analysing financial information so that…

Q: The unadjusted trial balance of Lakota Freight Co. at March 31, 20Y4, the end of the year, follows:…

A: 1, 3, and 6: Prepare T-accounts:

Q: On January 1, 2021, West Company acquired a tract of lana for P1,000,000. The entity paid P100,000…

A: Accrued interest on December 31,2021 = (P1000, 000 - P100000) ×10% = P90000

Q: On January 2, 2020, Tuao Company purchased 10% of Abulug Company's outstanding ordinary shares for…

A: GIVEN On January 2, 2020, Tuao Company purchased 10% of Abulug Company's outstanding ordinary…

Q: Eva received $77,000 in compensation payments from JAZZ Corporation during 2021. Eva incurred…

A: Computation of Tax liability of EVA Particulars Amount ($) Received 77,000 less :…

Q: COBT Ketail Merchandise inventory, January 1, 2021 $260,000 544,420 10,800 $350,000 910,000…

A: Calculation of above requirement are as follows

Q: Klutlan Industries began construction of a warehouse on July 1, 2018. The project was completed on…

A: GIVEN Klutlan Industries began construction of a warchouse on July 1, 2018. The project was…

Q: $45,300, 7-month, 6% note dated October 31, 2021 with Q Tile LLC. All of the note's interest is due…

A: Notes receivable are claims for which formal instruments of credit, such as a promissory note, are…

Step by step

Solved in 2 steps

- Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?Determine the best alternatives for a government project with the following data: PROJECT A B C ANNUAL BENEFIT P250,000.00 P320,000.00 P350,000.00 ANNUAL COSTS P100,000.00 P135,000.00 p180,000.00 B/C RATIO 2.5 2.37 1.94 What is the best Project and its incremental ratio? a. A = 1.2 b. A = 2 c. B = 2.0 d. B = 1.18The Webex Corporation is trying to choose between the following two mutually exclusive designprojects: Year Net Cash Flow Project - I($) Net Cash Flow Project - II($) 0 (53,000) (16,000) 1 27000 9100 2 27000 9100 3 27000 9100 (a) If the required return is 10% and the company applies the Profitability Index decision rule,which project should the firm accept?(b) If the company applies the Net Present Value decision rule, which project should it take?(c) Explain why your answers in (a) and (b) are different(d) Calculate the Internal Rate of Return of both projects.

- Perkins Corporation is considering several investment proposals, as shown below: Investment Proposal A B C D Investment required $ 100,000 $ 125,000 $ 75,000 $ 93,750 Present value of future net cash flows $ 120,000 $ 187,500 $ 105,000 $ 180,000 If the project profitability index is used, the ranking of the projects from most to least profitable would be: Multiple Choice D, B, C, A B, D, C, A B, D, A, C A, C, B, DThe Weiland Computer Corporation is trying to choose between the following mutually exclusive design projects, P1 and P2:Year 0123 Cash flows (P1) -$53,000 27,000 27,000 27,000 Cash flow (P2) -$16,000 9,100 9,100 9,100a. If the discount rate is 10 percent and the company applies the profitability index (PI) decision rule, which project should the firm accept?b. If the firm applies the Net Present Value (NPV) decision rule, which project should it take?c. Are your answers in (a) and (b) different? Explain why?Connor Corporation is considering two projects (see below). For your analysis, assume these projects are mutually exclusive with a required rate of return of 12%. Project 1 Project 2 Initial investment $(684,000) $(585,000) Cash inflow Year 1 $275,000 $380,000 Should we also use the payback method to assist us in project selection? Why or why not? Explain.

- A firm evaluates all of its projects by applying the IRR rule. If the required return is 18 percent, will the firm accept the following project?CF0 = -$30,000CO1 = $20,000C02 = $14,000C03 = $11,000 yes or noGama industry has the amount of $ 600000 for investment at MARR= 15%. The manager of this company considered three different projects with rates of return as project 1 = 24% , project 2 = 18% and project 3= 30%). these projects have initial investments as $100,000 ,$ 300000, and $200000 respectively. The overall rate of return will be: Select one: a. 0.23 b. 0.26 c. 0.45 d. 0.20The manager of a small firm wants to know which among the three different projects should the company enter into. Details of the three projects are as follows: JOJO GINA MARIA LORINDA KANOR Initial investment P 120,000 P 125,000 P 180,000 P160,000 P35,000 Net present value 25,000 24,000 45,000 35,000 10,000 Internal rate of return 10% 15% 12% 8% 9% Profitability index 1.21 1.19 1.25 1.22 1.29 If the management has a budget of P500,000 only, which projects would be undertaken? a. Jojo, Gina, Lorinda, and Kanor b. Gina, Maria, Lorinda, and Kanor c. Jojo, Maria, Lorinda, and Kanor d. Jojo, Gina, Maria, and Kanor

- The Michner corporation is trying is trying to choose between the following 2 mutually exclusive design project: Cash Flow 1 Cash Flow 2 Year 0: -82000 -21700 Year 1: 37600 11200 Year 2: 37600 11200 Year 3: 37600 11200 If the required return is 10% and the company applies the profitability index decision rule, which project should the firm accept? If the company applies the NPV decision rule, which project should it take? why are a & b are differentLewis Services is evaluating six investment opportunities (projects). The following table reflects each project’s net present value NPV and the respective initial investments required. All of these projects are independent. Project NPV Investment I 2,500 2,500 II 4,000 20,000 III 7,500 30,000 IV 8,000 40,000 V 2,000 10,000 VI 2,500 5,000 Lewis has an investment constraint of P50,000. Which combination of projects would represent the optimal investment that should be recommended to Lewis Services’ management? Choices a. I, II, III, IV, V, and VI b. I, III, and VI c. I, III, V, and VI d. I, II, III, V, and VIA company needs to decide if it will move forward with two new products that it is evaluating. The two initiatives have the following cash flow projections: Project A Year 0 1 2 3 4 Cash Flow -800,000 220,000 265,000 292,000 317,000 Project B Year 0 1 2 3…