Q: n dealing with IRR and NPV project evaluations, there is something called a crossover rate. Using…

A: To Find: Crossover rate

Q: Consider two projects: A) with casháows in years 0-4 of -300$, 120$, 120$, 120$ and respectively…

A: Since you have asked a question with multiple parts, we will solve the first 3 parts for you. Please…

Q: Connor Corporation is considering two projects (see below). For your analysis, assume these projects…

A:

Q: Comparing Investment Criteria [LO1, 2, 3, 5, 7] Consider the following two mutually exclusive…

A: Following is the answer to the given question

Q: Consider the following mutually exclusive project below. Whichever project chosen, a 15 percent…

A: Capital budgeting is the process a business undertakes to evaluate potential major projects or…

Q: a) Assume an opportunity cost of capital of 11%. Which of these projects would you accept, if you…

A: Net Present Value is the difference in the present value of Cash Inflow and Cash Outflow…

Q: Project X has the following cash flows: C0 = +2,000, C1 = -1,150, and C2 = -1,150. If the IRR of the…

A: PLEASE LIKE THE ANSWER information given in question cost of capital is 12.00 percent IRR of the…

Q: e with a required rate of return of 10% project 1 Initial investment =$465,000 cash inflow Year 1=…

A: Given information : Year Project 1 Project 2 0 $ (465,000.00) $ (700,000.00) 1 $…

Q: A firm evaluates all of its projects by applying the IRR rule. A project under consideration has the…

A: Internal Rate of Return: The internal rate of return (IRR) is a discounting cash flow technique…

Q: A firm evaluates all of its projects by applying the NPV decision rule. A project under…

A: Net present value is the sum of value of cash flows discounted to present value at a given discount…

Q: You must analyze two projects, X and Y. Each project costs $10,000, and the firm’s WACC is 12%. The…

A: “Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: ider two projects: A) with casháows in years 0-4 of -300$, 120$, 120$, 120$ and respectively 120$,…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Whichever project Consider the following mutually exclusive project below. chosen, a 15 percent…

A: NPV is the present value of future cash flows. It is a tool which is used to decide whether the…

Q: Perkins Corporation is considering several investment proposals, as shown below: Investment…

A: Formula: Profitability index = Total present value of cash inflows / Total present value of cash…

Q: You are considering the following two mutually exclusive projects. The required rate of return is…

A: Required return for project A = 11.25% Required return for project B = 10.75%

Q: If the required return is 10 percent, what is the profitability index for both projects? (Do not…

A: Formulas:

Q: Project 1 requires an initial investment on $50,000 and has an internal rate of return (IRR) of 18%.…

A: The internal rate of return is measures of a project's attractiveness and profitability. The…

Q: A company is considering three alternative investment projects with different net cash flows. The…

A: >Present value of net cash flows are the discounted future net cash flows that were converted to…

Q: Five alternatives are being evaluated by the incremental rate of return method. Incremental Rate of…

A: The IRR (internal rate of return ) and the MARR (minimum acceptable rate of return) means the rates…

Q: Consider the following two investment alternatives: The firm's MARR is known to be 15%.(a) Compute…

A: IRR is a tool for making investment decisions. It measures whether an investment is profitable or…

Q: Consider the two mutually exclusive investment projects given in the table below for which MARR =…

A: The internal rate of return (IRR) is the rate of return that equates the present value of future…

Q: Consider the two mutually exclusive investment projects given in the table below for which MARR =…

A: Project A's initial cost is less than Project B's initial cost. As a result, consider A to be the…

Q: Consider the following projects, X and Y where the firm can only choose one. Project X costs $1500…

A: Here, WACC is 11% Cost of Project X is $1,500 Cash Flows of Project X are as follows: Year Cash…

Q: Consider the following two mutually exclusive projects: Year Cash flow project A (RM) -54,000 12,700…

A: Pay Back period is the method under Capital budgeting which help in decision making in this Capital…

Q: The Weiland Computer Corporation is trying to choose between the following mutually exclusive design…

A: Part (a) Computation of NPV and PI: Answer: Net present value for P1 and P2 are $14,145.00 and…

Q: Given the following cash +pws for project X and project Y, Year Project X Project Y -62000 -105000 1…

A: GIVEN, year X Y 0 -62000 -105000 1 27000 10000 2 13500 18000 3 11000 22000 4 10000…

Q: You must analyze two projects, X and Y. Each project costs $10,000 and the firm's WACC is 14%. The…

A: Hi! Thank you for the question, As per the honor code, we are allowed to answer three sub-parts at a…

Q: Project Q requires an initial outlay at t = 0 of $20,000, and its expected cash flows would be…

A: Here we will use the capital budgeting tools of NPV and IRR. These tools will help us to ascertain…

Q: A firm whose cost of capital is 10% is considering two mutually exclusive projects A and B, the cash…

A: Net present value refers to the capital budgeting technique that is used by the management to…

Q: A firm evaluates all of its projects by applying the NPV decision rule. A project under…

A: Net Present value is the sum of the present value of all cash out flows and inflows. If NPV is…

Q: You are considering the following two mutually exclusive projects. Using the replacement chain…

A: For Project-A; Cost of capital is 10% To Find: NPV of the project

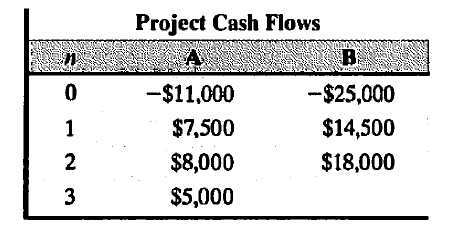

Q: Consider the following two mutually exclusive investment projects:Project Cash Flowsn A…

A: NPW are calculated as follows

Q: Consider a project with the following cash flows. Year Cash Flow 0 -$17,000 1 45,000 2…

A: Using excel IRR function

Q: Consider the following two mutually exclusive alternatives: (a) Determine the IRR on the incremental…

A: IRR is a parameter which is used in financial analysis to measure the feasibility of potential…

Q: Consider the following two projects: (a) Calculate the profitability index for A1 and A2 at an…

A: Profitability Index(PI) is used for ranking ventures, it is a valuable tool because it enables you…

Q: The following information is available on two mutually exclusive projects. Project…

A: Project A; Cash flow; Year 0 = - $700 Year 1 = $200 Year 2 = $300 Year 3 = $400 Year 4 = $500…

Q: The following information is available on two mutually exclusive projects. All numbers are in ‘000s.…

A: NPV Method: Working in '000s and calculation are done in excel so there is no intermediate rounding:…

Q: Daisy's Creamery Inc. is considering one of two investment options. Option 1 is a $75,000 investment…

A: The present value of cash flows, $81,344 is computed by adding the product of the cash inflows,…

Q: Yokam Company is considering two alternative projects. Project 1 requires an initial investment of…

A: Profitability index = Present value of cash flows/Initial investment

Q: Consider the following two mutually exclusive projects: Year Cash Flow (X) Cash Flow (Y) 0…

A: Net Present Value(NPV) is excess of present value(PV) of cash inflows over initial outlay of…

Q: You are considering the following two mutually exclusive projects. The required return on each…

A:

Consider the following two mutually exclusive investment projects:

Which project would you select if you used the infinite planning horizon with

project repeatability likely (same costs and benefits) based on the PW criterion? Assume that i = 12%.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Project A has the following information: Year 0 1 2 3 4 5 Initial investment outlay 125,000 Cash inflows 75,000 80,000 95,000 95,000 86,250 Personnel expenses 22,500 22,500 22,500 22,500 22,500 Material expesnes 15,000 20,000 22,500 22,500 22,500 Maintenance expenses 2,500 2,500 5,000 8,750 10,000 Other cash outflows 3,750 3,750 3,750 5,000 5,625 Liquidation value 12,500 Project B has the following information: Year 0 1 2 3 4 5 Initial investment outlay 225,000 Cash inflows 155,000 140,000 108,750 93,750 125,000 Personnel expenses 27,500 27,500 27,500 27,500 27,500 Material expenses 25,000 22,500 22,500 22,500 24,000 Maintenance expesnses 8,750 11,250 17,500 15,000 14,000 Other cash outflows 6,250 3,750 3,750 3,750 4,000 Liquidation value 15,000 The Discount Rate is 8%Assess the relative profitability of the two options using the following methods:(i) The Annuity Method(ii) The Net…Year Net cashflows 0 -575,000 1 £125,000 2 £248,000 3 £176,000 4 £146,000ind the IRR for the following cash flows assuming a WACC of 10%. YR CF 0 -15,000 1 6,000 2 4,000 3 2,000 4 3,000 5 2,000

- Question Content Area A project is estimated to cost $273,840 and provide annual net cash inflows of $60,000 for 7 years. Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 6 4.917 4.355 4.111 7 5.582 4.868 4.564 8 6.210 5.335 4.968 9 6.802 5.759 5.328 10 7.360 6.145 5.650 Determine the internal rate of return for this project by using the above present value of an annuity table.fill in the blank 1 of 1%I. Operating ActivitiesNet income $ 50,000II. Long-Term Investing ActivitiesAdditions to property, plant, and equipment $ (250,000)III. Financing ActivitiesNet cash provided by financing activities $ 170,000IV. SummaryNet decrease in cash (30,000)Cash and equivalents at beginning of the year 55,000Cash and equivalents at the end of the year $ 25,000If accruals increased by $25,000, receivables and inventories increased by $100,000, and depreciation and amortization totaled $10,000, what was the firm’s net income?Assets 2001 2000 Cash 7,282 9,000 Short term investment 0 48,600 Acc. Receivable 632,160 351,200 Inventories 1,287,360 715,200 Total current assets 1,926,802 1,124,000 Fixed Assets Plant & Equipment 1,202,950 491,000 Less: Acc dep 263,160 146,200 939,790 344,800 Total assets 2,866,592 1,468,800 Liabilities & Equities Current liability A/c Payable 524,160 145,600 Notes payable 720,000 200,000 Accruals 489,600 136,000 total Current liability 1,733,760 481,600 Long-term debt 1,000,000 323,432 Common Stock 460,000 460,000 Retained Earning -327,168 203,768 1,132,832 987,200 Total equities 2,866,592 1,468,800 Income Statement Sales 5,834,400 3,432,000 Cost of Goods Sold 5,728,000 2,864,000 Other expense 680,000 340,000 dep 116,960 18,900…

- The following project has cash flows as follows: Year Project A 0 -$705,000 1 $225,000 2 $421,500 3 $275,000 What is the IRR?Q15. For the cash flows shown, determine the incremental cash flow between machines B and A (a) in year 0, (b) in year 3, and (c) in year 6. Machine A B First Cost, $ -13,000 –25,000 AOC, $ per Year -1,300 –400 Salvage Value, $ 5,000 6,000 Life, Years 3 6 a) The incremental cash flow between machines B and A in year 0 is $ . b) The incremental cash flow between machines B and A in year 3 is $ . c) The incremental cash flow between machines B and A in year 6 is $ .PROJECT A PROJECT BInitial Outlay -60,000 -80,000Inflow year 1 17,000 18,000Inflow year 2 17,000 18,000Inflow year 3 17,000 18,000Inflow year 4 17,000 18,000Inflow year 5 17,000 18,000Inflow year 6 17,000 18,000

- Ch 5. The following project has cash flows as follows: Year Project A 0 -$705,000 1 $225,000 2 $421,500 3 $275,000 What is the IRR? Round to one place past the decimal point and format as "XX.X"Year Initial Cost & Carrying amount Annual net cash flows Annual net profit 0 $ 150,000.00 1 $ 70,000.00 $ 50,000.00 $ 15,000.00 2 $ 42,000.00 $ 45,000.00 $ 17,000.00 3 $ 21,000.00 $ 40,000.00 $ 19,000.00 4 $ 7,000.00 $ 35,000.00 $ 21,000.00 5 $ - $ 30,000.00 $ 23,000.00 1. Terrys titles ltd is reviewing a capital investment proposal.The inital cost of the project and the net cash flows for every year presented in the schedule above. It is estimate that there would be no salvage value at the end of the investments life.Terry's uses a required rate of return of 10 per cent to evaluate new capital investment proposals. a. Calculate the…Relevant Cash Flow Data for Year 2:Sales revenues Year 2 $100,000Cost of Goods Sold 20,000Depreciation Expense 10,000Tax Rate 40% Based on the above cash flow data: What is the operating cash flow for year two of this capital budgeting project? A.130,000 B.52,000 C.42,000 D. 78,000