i) Calculate the IRR of the project by discounting the cashflows by 4% and 8% and then applying the IRR formula - perform your workings on excel including formulas. A copy of the data above is provided in the "Task 7- Data" tab of the Excel file "MBF Summative data.xlsx". There is also a present value table on the last tab of the same excel file. ii) Check your answer using the IRR function in excel Supera Ltd has a set hurdle rate of 7.5% for projects. Assess whether or not it should accept the project based on your calculations and other information provided.

i) Calculate the IRR of the project by discounting the cashflows by 4% and 8% and then applying the IRR formula - perform your workings on excel including formulas. A copy of the data above is provided in the "Task 7- Data" tab of the Excel file "MBF Summative data.xlsx". There is also a present value table on the last tab of the same excel file. ii) Check your answer using the IRR function in excel Supera Ltd has a set hurdle rate of 7.5% for projects. Assess whether or not it should accept the project based on your calculations and other information provided.

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 21P

Related questions

Question

| Year | Net cashflows |

| 0 | -575,000 |

| 1 | £125,000 |

| 2 | £248,000 |

| 3 | £176,000 |

| 4 | £146,000 |

Transcribed Image Text:Task 7

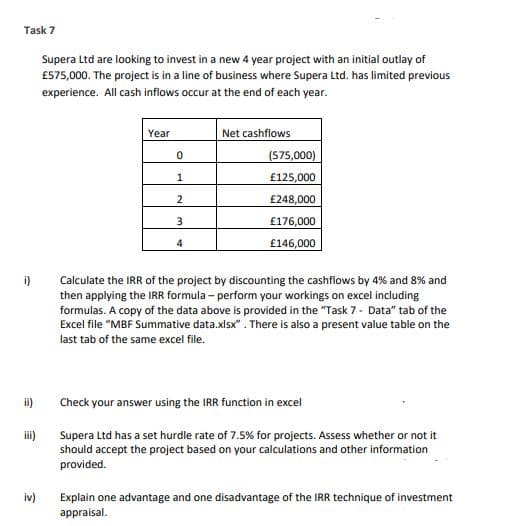

Supera Ltd are looking to invest in a new 4 year project with an initial outlay of

£575,000. The project is in a line of business where Supera Ltd. has limited previous

experience. All cash inflows occur at the end of each year.

Year

Net cashflows

0

(575,000)

1

£125,000

2

£248,000

3

£176,000

4

£146,000

i)

Calculate the IRR of the project by discounting the cashflows by 4% and 8% and

then applying the IRR formula - perform your workings on excel including

formulas. A copy of the data above is provided in the "Task 7 - Data" tab of the

Excel file "MBF Summative data.xlsx". There is also a present value table on the

last tab of the same excel file.

Check your answer using the IRR function in excel

iii)

Supera Ltd has a set hurdle rate of 7.5% for projects. Assess whether or not it

should accept the project based on your calculations and other information

provided.

iv)

Explain one advantage and one disadvantage of the IRR technique of investment

appraisal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning