Pronghorn Hammocks is considering the purchase of a new weaving machine to prepare fabric for its hammocks. The machine under consideration costs $58,880 and will save the company $8,000 in direct labor costs. It is expected to last 10 years. Click here to view the factor table. (a) Calculate the internal rate of return on the weaving machine. (Round answer to O decimal place, eg. 15.) Internal rate of return 9 % (b) If Pronghorn uses a 8% hurdle rate, should the company invest in the machine? No

Pronghorn Hammocks is considering the purchase of a new weaving machine to prepare fabric for its hammocks. The machine under consideration costs $58,880 and will save the company $8,000 in direct labor costs. It is expected to last 10 years. Click here to view the factor table. (a) Calculate the internal rate of return on the weaving machine. (Round answer to O decimal place, eg. 15.) Internal rate of return 9 % (b) If Pronghorn uses a 8% hurdle rate, should the company invest in the machine? No

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 17EB: Caduceus Company is considering the purchase of a new piece of factory equipment that will cost...

Related questions

Question

Chapter 9 Question 6

Please help me with this question- Its my last try!

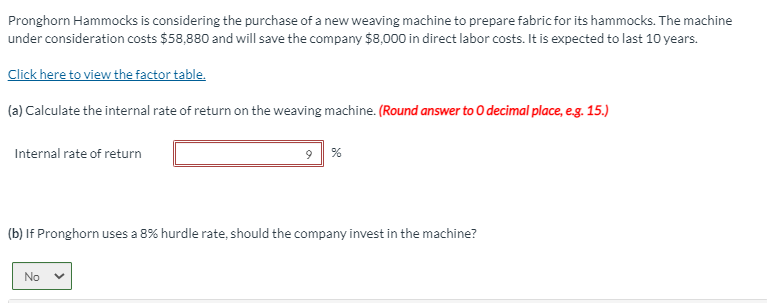

Transcribed Image Text:Pronghorn Hammocks is considering the purchase of a new weaving machine to prepare fabric for its hammocks. The machine

under consideration costs $58,880 and will save the company $8,000 in direct labor costs. It is expected to last 10 years.

Click here to view the factor table.

(a) Calculate the internal rate of return on the weaving machine. (Round answer to O decimal place, eg. 15.)

Internal rate of return

9 %

(b) If Pronghorn uses a 8% hurdle rate, should the company invest in the machine?

No

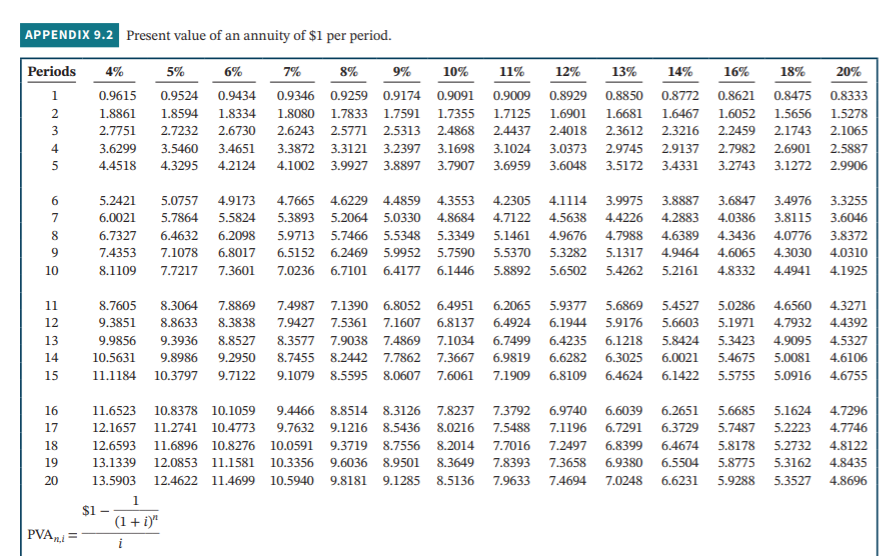

Transcribed Image Text:APPENDIX 9.2 Present value of an annuity of $1 per period.

Periods

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

14%

16%

18%

20%

1.

0.9615

0.9524

0.9434

0.9346

0.9259

0.9174

0.9091

0.9009

0.8929

0.8850

0.8772

0.8621

0.8475

0.8333

1.8861

1.8594

1.8334

1.8080

1.7833

1.7591

1.7355

1.7125

1.6901

1.6681

1.6467

1.6052

1.5656

1.5278

2.7751

2.7232

2.6730

2.6243 2.5771 2.5313

2.4868

2.4437

2.4018

2.3612

2.3216

2.2459

2.1743

2.1065

4

3.6299

3.5460

3.4651

3.3872 3.3121 3.2397

3.1698

3.1024 3.0373

2.9745

2.9137

2.7982

2.6901

2.5887

4.4518

4.3295

4.2124

4.1002 3.9927 3.8897

3.7907

3.6959

3.6048

3.5172

3.4331

3.2743

3.1272

2.9906

5.2421

5.0757

4.9173

4.7665 4.6229

4.4859

4.3553

4.2305

4.1114

3.9975

3.8887

3.6847

3.4976

3.3255

7

6.0021

5.7864

5.5824

5.3893 5.2064

5.0330

4.8684

4.7122

4.5638

4.4226

4.2883

4.0386

3.8115

3.6046

8.

6.7327

6.4632

6.2098

5.9713 5.7466 5.5348

5.3349

5.1461

4.9676

4.7988

4.6389

4.3436

4.0776

3.8372

9.

7.4353

7.1078

6.8017

6.5152 6.2469 5.9952

5.7590

5.5370

5.3282

5.1317 4.9464

4.6065 4.3030 4.0310

10

8.1109

7.7217 7.3601

7.0236 6.710i 6.4177

6.1446

5.8892

5.6502

5.4262 5.2161 4.8332 4.4941

4.1925

11

8.7605

8.3064

7.8869

7.4987

7.1390

6.8052

6.4951

6.2065

5.9377

5.6869

5.4527

5.0286

4.6560

4.3271

12

9.3851

8.8633

8.3838

7.9427 7.5361 7.1607

6.8137

6.4924 6.1944

5.9176

5.6603 5.1971 4.7932 4.4392

13

9.9856

9.3936

8.8527

8.3577 7.9038 7.4869 7.1034

6.7499

6.4235

6.1218

5.8424 5.3423 4.9095 4.5327

14

10.5631

9.8986

9.2950

8.7455

8.2442

7.7862

7.3667

6.9819

6.6282

6.3025

6.0021

5.4675 5.0081

4.6106

15

11.1184 10.3797

9.7122

9.1079 8.5595 8.0607

7.6061

7.1909

6.8109

6.4624

6.1422

5.5755

5.0916

4.6755

16

11.6523 10.8378 10.1059

9.4466 8.8514 8.3126

7.8237

7.3792

6.9740

6.6039

6.2651

5.6685

5.1624

4.7296

17

12.1657 11.2741 10.4773

9.7632 9.1216 8.5436

8.0216

7.5488

7.1196

6.7291

6.3729

5.7487

5.2223

4.7746

18

12.6593

11.6896 10.8276 10.0591

9.3719

8.7556

8.2014

7.7016

7.2497

6,8399

6.4674

5.8178

5.2732

4.8122

19

13.1339

12.0853 11.1581 10.3356 9.6036 8.9501

8.3649

7.8393

7.3658

6.9380

6.5504

5.8775

5.3162

4.8435

20

13.5903

12.4622 11.4699 10.5940 9.8181 9.1285

8.5136

7.9633

7.4694

7.0248

6.6231

5.9288

5.3527

4.8696

1

(1+ i)"

PVA ni

i

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning