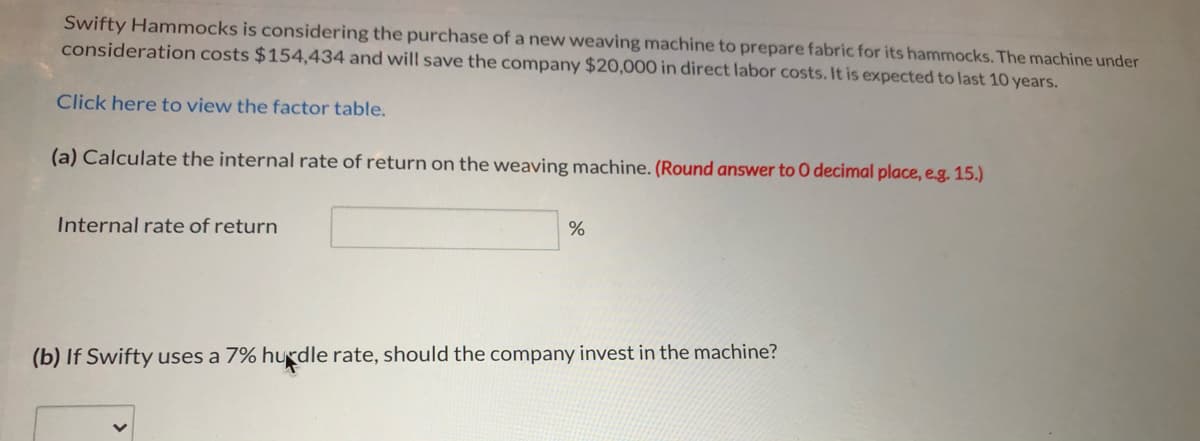

Swifty Hammocks is considering the purchase of a new weaving machine to prepare fabric for its hammocks. The machine under consideration costs $154,434 and will save the company $20,000 in direct labor costs. It is expected to last 10 years. Click here to view the factor table. (a) Calculate the internal rate of return on the weaving machine. (Round answer to 0 decimal place, e.g. 15.) Internal rate of return (b) If Swifty uses a 7% hurdle rate, should the company invest in the machine?

Q: Waterway’s Hair Salon is considering opening a new location in French Lick, California. The cost of…

A: >Annual rate of return measures the net income earned from a given investment. >The result…

Q: The production department of Y Company is planning to purchase a new machine to improve product…

A: Decision-making process: Decision making can be defined as the process of making choices through the…

Q: A small manufacturing company is evaluating trucks for delivering their products. Truck A has a…

A: A method of capital budgeting that helps to evaluate the present worth of cash flow and a series of…

Q: The plant manager at a company would like to perform an analysis for a new $250,000 machine. If she…

A: Payback period method is a traditional method used in capital budgeting decisions which is used to…

Q: Thornton Painting Company is considering whether to purchase a new spray paint machine that costs…

A: Unadjusted rate of return is computed by dividing the increase average income with the initial cost…

Q: Pronghorn Hammocks is considering the purchase of a new weaving machine to prepare fabric for its…

A: Discount factor = Initial investment / Annual savings = $58880/8000 = 7.3600

Q: In a bio-based material recycling company, the operation managers are considering a twin-screw…

A: Before investing in new projects or assets, profitability is evaluated by using various methods like…

Q: Nancy's Notions pays a delivery firm to distribute its products in the metro area. Delivery costs…

A: Internal rate of return (IRR) of an alternative refers to the rate at which the Net present value…

Q: Shonda & Shonda is a company that does land surveys and engineering consulting. They have an…

A: Formula: Contribution margin = Sales price - variable cost.

Q: Masters Machine Shop is considering a four-year project to improve its production efficiency. Buying…

A: Depreciation rates for first 4 years are:20%,32%,19.20%,11.52%.Now,After tax salvage value:

Q: Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a…

A: In the companies that are involved with the manufacture of goods, machinery is an important asset…

Q: Mountain Corporation is considering purchasing one of two photocopiers. The first copier will have…

A:

Q: The production department of Y Company is planning to purchase a new machine to improve product…

A:

Q: The production department of Y Company is planning to purchase a new machine to improve product…

A: Decision-making process: Decision making can be defined as the process of making choices through the…

Q: Rollerblade, a maker of skating gear, is evaluating two alternative presses. Press A costs $88,000,…

A: The press to be chosen is totally dependent on the positive and higher NPV comparatively. Net…

Q: Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a…

A: The different alternatives are compared on the basis of benefits provided by various alternatives.

Q: An auto-part manufacturing company is considering the purchase of an industrial robot to do spot…

A:

Q: Wrangler Western has some of its jeans stone-washed under a contract with an independent contractor,…

A: The present worth of the machine is operating cost is the present value of all future cash outflow

Q: Ferguson Company is considering an investment in computer-aided design equipment. The equipment will…

A: Net Present value (NPV) is used to determine the present value of net adjusted cash flows which are…

Q: Wendell's Donut Shoppe is investigating the purchase of a new $34,600 donut-making machine. The new…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first3. Please resubmit the question…

Q: 4. In addition to the data given previously, assume that the machine will have a $12,630 salvage…

A: Capital Budgeting Techniques are used to choose the most profitable investment alternative. Based on…

Q: Wendell’s Donut Shoppe is investigating the purchase of a new $18,600 donut-making machine. The new…

A: The cost of machine is $18,600 Annual cost savings $3800

Q: Wendell’s Donut Shoppe is investigating the purchase of a new $31,300 donut-making machine. The new…

A: Introduction: Internal rate of return is a method to calculate the returns on an investment. The…

Q: Suppose I would like to buy a new oven for my bakery so that I can make pretzels. Based on my…

A: 1. Depreciation per year = 90000 ÷ 3 = 30000

Q: A manufacturing firm has decided to plan for the purchase of a pickup truck several years from now.…

A: Accumulation of fund or future value of the periodic deposits depends on the interest rate, time of…

Q: The engineering team at Manuel’s Manufacturing, Inc., is planning to purchase an enterprise resource…

A: Annual Worth It is defined as an equivalent uniform AW of all the estimated receipts as well as the…

Q: Wendell's Donut Shoppe is investigating the purchase of a new $48,300 donut-making machine. The new…

A: Since you have posted a question with multiple sub-parts, we will solve the first three subparts for…

Q: Pierre’s Hair Salon is considering opening a new location in French Lick, California. The cost of…

A: Solution: Annual net income from salon = $60,490 - $40,800 = $19,690 Average investment = (Cost +…

Q: b) Magen's Bakery, Inc., is considering the purchase of a new cake mixing equipment for $200,000.…

A: Net working capital Net working capital is required to run the business. It is calculated as shown…

Q: The production department of Y Company is planning to purchase a new machine to improve product…

A: If company decides to buy the machine then the yearly cost would be £4,500 (£4,200+£300) and initial…

Q: Nancy’s Notions pays a delivery firm to distribute its products in the metro area. Shipping costs…

A: A discount rate at which the net present worth of an investment is equal to zero is term as an…

Q: Market Top Investors, Inc., is considering the purchase of a $350,000 computer with an economic life…

A: The initial investment cost is $350,000.According to straight line depreciation, the annual…

Q: Calculate the NPV of this project.

A: It is a method under capital budgeting which includes the computation of the net present value of…

Q: Bartlet Industries is considering a new product line and will need to replace older equipment with…

A: The total capital investment is calculated by adding installation cost, market research cost and…

Q: Wendell’s Donut Shoppe is investigating the purchase of a new $42,800 donut-making machine. The new…

A: 1.Determine the total annual cash inflow.

Q: The production department of a Company is planning to purchase a new machine to improve product…

A: Definition: Decision making process: Decision making can be defined as the process of making…

Q: b) Magen's Bakery, Ic., is considering the purchase of a new cake mixing equipment for $200,000.…

A: Net working capital (NWC) It is calculated as shown below. NWC=Accounts…

Q: Lakeside Inc. is considering replacing old production equipment with state-of-the-art technology…

A: Answer - Part 1 - Calculation of Payback Period = = Initial Investment / Annual Cash inflow Given,…

Q: Wendell’s Donut Shoppe is investigating the purchase of a new $34,600 donut-making machine. The new…

A: The IRR is a statistical calculation that is used to calculate the feasibility of future…

Q: How many fans must be sold to break even if the fans are priced at $150? b. If Hot-Air sells 6,000…

A: Computation of the following is shown below : Break even point ( units) = Fixed cost /…

Q: The Balas Manufacturing Company is considering buying an overhead pulley system. The new system has…

A: 1. Workings:

Q: The engineering team at Manuel’s Manufacturing, Inc., is planning to purchase an enterprise resource…

A: Discounted Payback Period refers to a capital budgeting technique. In this method, the cash flows of…

Q: Wendell’s Donut Shoppe is investigating the purchase of a new $31,300 donut-making machine. The new…

A: As posted multiple sub parts we are answering only first three sub parts kindly repost the…

Q: Lakeside Inc. is considering replacing old production equipment with state-of-the-art technology…

A: Accounting rate of return (ARR) is a kind of capital budgeting approach that helps in evaluating…

Q: Market Top Investors, Inc., is considering the purchase of a $365,000 computer with an economic life…

A: We will work out the cash fows year by year and the use the excel formula NPV to get the desired…

Q: Geary Machine Shop is considering a 4-year project to improve its production efficiency. Buying a…

A: Total Cash Flow - It is the net amount of all cash flowing in and out of business from all over the…

Q: es es Lopez Company is considering replacing one of its old manufacturing machines. The old machine…

A: Lets understand the basics. When more than one alternatives is available, management choose…

Q: A widget manufacturing plant manager decides to purchase a new drill press with borrowed funds in…

A: Solution : Given Purchase cost of drill press 2,000,000 Operating expense for first year…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.At Stardust Gems, a faux gem and jewelry company, the setting department is a bottleneck. The company is considering hiring an extra worker, whose salary will be $67,000 per year, to ease the problem. Using the extra worker, the company will be able to produce and sell 9,000 more units per year. The selling price per unit is $20. The cost per unit currently is $15.85 as shown: What is the annual financial impact of hiring the extra worker for the bottleneck process?Talbot Industries is considering launching a new product. The new manufacturing equipment will cost $17 million, and production and sales will require an initial $5 million investment in net operating working capital. The company’s tax rate is 25%. What is the initial investment outlay? The company spent and expensed $150,000 on research related to the new product last year. What is the initial investment outlay? Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.5 million after taxes and real estate commissions. What is the initial investment outlay?

- Talbot Industries is considering launching a new product. The new manufacturing equipment will cost 17 million, and production and sales will require an initial 5 million investment in net operating working capital. The companys tax rate is 40%. a. What is the initial investment outlay? b. The company spent and expensed 150,000 on research related to the new product last year. Would this change your answer? Explain. c. Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for 1.5 million after taxes and real estate commissions. How would this affect your answer?Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins’ cost of capital is 14%. Should the firm replace its old knitting machine? If so, which new machine should it use? By how much would the value of the company increase if it accepted the better machine? What is the equivalent annual annuity for each machine?Artisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $55,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,000 more units per year. Currently, the selling price per unit is $25 and the cost per unit is $7.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.

- Shonda & Shonda is a company that does land surveys and engineering consulting. They have an opportunity to purchase new computer equipment that will allow them to render their drawings and surveys much more quickly. The new equipment will cost them an additional $1.200 per month, but they will be able to increase their sales by 10% per year. Their current annual cost and break-even figures are as follows: A. What will be the impact on the break-even point if Shonda & Shonda purchases the new computer? B. What will be the impact on net operating income if Shonda & Shonda purchases the new computer? C. What would be your recommendation to Shonda & Shonda regarding this purchase?Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. The information they will use to consider these changes is shown here.

- Mallette Manufacturing, Inc., produces washing machines, dryers, and dishwashers. Because of increasing competition, Mallette is considering investing in an automated manufacturing system. Since competition is most keen for dishwashers, the production process for this line has been selected for initial evaluation. The automated system for the dishwasher line would replace an existing system (purchased one year ago for 6 million). Although the existing system will be fully depreciated in nine years, it is expected to last another 10 years. The automated system would also have a useful life of 10 years. The existing system is capable of producing 100,000 dishwashers per year. Sales and production data using the existing system are provided by the Accounting Department: All cash expenses with the exception of depreciation, which is 6 per unit. The existing equipment is being depreciated using straight-line with no salvage value considered. The automated system will cost 34 million to purchase, plus an estimated 20 million in software and implementation. (Assume that all investment outlays occur at the beginning of the first year.) If the automated equipment is purchased, the old equipment can be sold for 3 million. The automated system will require fewer parts for production and will produce with less waste. Because of this, the direct material cost per unit will be reduced by 25 percent. Automation will also require fewer support activities, and as a consequence, volume-related overhead will be reduced by 4 per unit and direct fixed overhead (other than depreciation) by 17 per unit. Direct labor is reduced by 60 percent. Assume, for simplicity, that the new investment will be depreciated on a pure straight-line basis for tax purposes with no salvage value. Ignore the half-life convention. The firms cost of capital is 12 percent, but management chooses to use 20 percent as the required rate of return for evaluation of investments. The combined federal and state tax rate is 40 percent. Required: 1. Compute the net present value for the old system and the automated system. Which system would the company choose? 2. Repeat the net present value analysis of Requirement 1, using 12 percent as the discount rate. 3. Upon seeing the projected sales for the old system, the marketing manager commented: Sales of 100,000 units per year cannot be maintained in the current competitive environment for more than one year unless we buy the automated system. The automated system will allow us to compete on the basis of quality and lead time. If we keep the old system, our sales will drop by 10,000 units per year. Repeat the net present value analysis, using this new information and a 12 percent discount rate. 4. An industrial engineer for Mallette noticed that salvage value for the automated equipment had not been included in the analysis. He estimated that the equipment could be sold for 4 million at the end of 10 years. He also estimated that the equipment of the old system would have no salvage value at the end of 10 years. Repeat the net present value analysis using this information, the information in Requirement 3, and a 12 percent discount rate. 5. Given the outcomes of the previous four requirements, comment on the importance of providing accurate inputs for assessing investments in automated manufacturing systems.Jonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)Keleher Industries manufactures pet doors and sells them directly to the consumer via their web site. The marketing manager believes that if the company invests in new software, they will increase their sales by 10%. The new software will increase fixed costs by $400 per month. Prepare a forecasted contribution margin income statement for Keleher Industries reflecting the new software cost and associated increase in sales. The previous annual statement is as follows: