*PROVIDE THE ADJUSTING ENTRIES. *PREPARE THE WORKSHEET UP TO BALANCE SHEET

Business/Professional Ethics Directors/Executives/Acct

8th Edition

ISBN:9781337485913

Author:BROOKS

Publisher:BROOKS

Chapter8: Subprime Lending Fiasco-ethics Issues

Section: Chapter Questions

Problem 3.7EC

Related questions

Question

*PROVIDE THE ADJUSTING ENTRIES .

*PREPARE THE WORKSHEET UP TO BALANCE SHEET.

(On November 10, 2014, Tuttie Bee Cargo Services started its operations. The following are: the transaction of the company for 2014.

Nov. - 10 - Mr. Tuttie Bee invested 1,000,000 and two trucks with fair market value of 750,000 each in the business

12 - Paid taxes and licenses, 6,500

15 - Paid office rent up to December in advance, 96,000

16 - Hired a driver with 6,000 monthly salary to start work tomorrow

17 - Called Success Builder to order paints for the office amounting to 2,500

18 - Purchased furniture and fixtures on account, 18,000

20 - Bought office supplies, 2,000 cash

25 - Delivered cargo to Pampanga for Ms Sue Bah. Cash of 24,000 was

received for this transaction as payment.

29 - Paid driver's salary, 6, 000

30 - Paid the December insurance premium for the two trucks, 10,000.

Dec. - 3 - The company received 30,000 from Mr. Tee Wah for delivery services.

7 - Paid furniture and fixtures bought on account.

10 - Bought computer from Oktagon on account, 45,000.

15 - Delivered cargo to Isabela for Mr. Teh Ngot 45,000 cash.

18 - Paid 3,000 for utilities.

20 - Delivered cargo to Nueva Ecija 30,000 cash.

22 - Proceeds of loan from Bankkrupt Bank 200,000.

24 - Mr. Tuttie Bee withdrew 20,000 for personal used.

29 - Paid driver’s salary 6,000.

30 - Received utilities bill for payment on January 5, 3,000.

Additional information: Office supplies showed zero balance at the end of the year. Depreciation of Plant, Plant and Equipment will start at January.

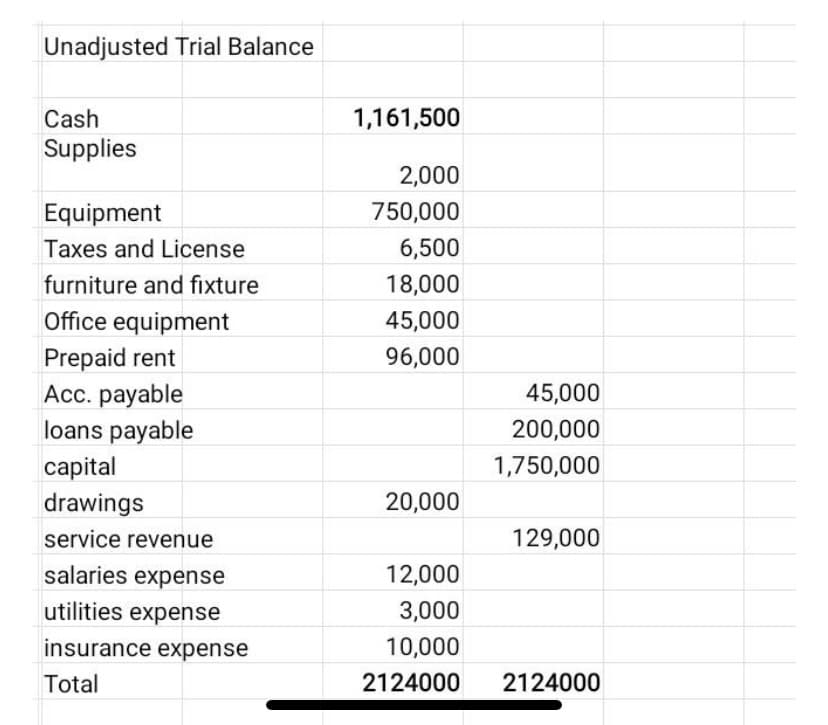

Transcribed Image Text:Unadjusted Trial Balance

Cash

Supplies

Equipment

Taxes and License

furniture and fixture

Office equipment

Prepaid rent

Acc. payable

loans payable

capital

drawings

service revenue

salaries expense

utilities expense

insurance expense

Total

1,161,500

2,000

750,000

6,500

18,000

45,000

96,000

45,000

200,000

1,750,000

20,000

129,000

12,000

3,000

10,000

2124000 2124000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning