Prudent commercial bank is trying to estimate the liquidity requirements today (last day of February) for the month of March Assume legal reserve requirements are s Currently the bank's total deposits are soo0 million and are expected to grow by 8 percent during the month of March The bank has estimated that zo% of the total deposits are hot money deposits, 30% are vulnerable deposits and the rest are stable (core) deposits The liquidity manager would tike to keep a liquidity reserve of B0% for hot money, 35% liquidity reserve for vulnerable deposits and 106 liquidity reserve for core deposits Currently the bank's total loans are at 4000 million The bank expects a 200 million increase in the level of loans during March

Prudent commercial bank is trying to estimate the liquidity requirements today (last day of February) for the month of March Assume legal reserve requirements are s Currently the bank's total deposits are soo0 million and are expected to grow by 8 percent during the month of March The bank has estimated that zo% of the total deposits are hot money deposits, 30% are vulnerable deposits and the rest are stable (core) deposits The liquidity manager would tike to keep a liquidity reserve of B0% for hot money, 35% liquidity reserve for vulnerable deposits and 106 liquidity reserve for core deposits Currently the bank's total loans are at 4000 million The bank expects a 200 million increase in the level of loans during March

Chapter17: The Management Of Cash And Marketable Securities

Section: Chapter Questions

Problem 2P

Related questions

Question

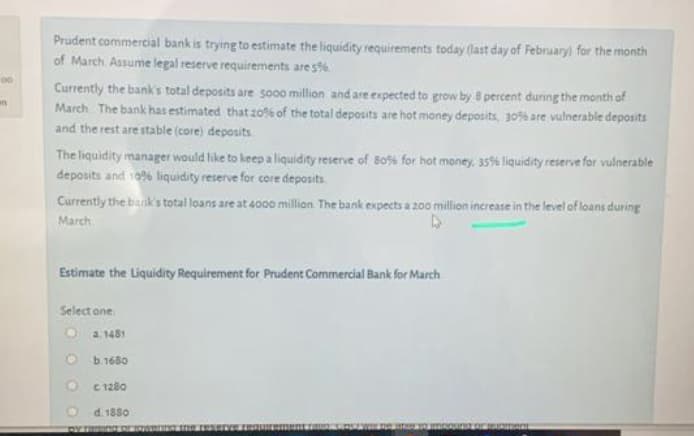

Transcribed Image Text:Prudent commercial bank is trying to estimate the liquidity requirements today (last day of February) for the month

of March Assume legal reserve requirements are s%

00

Currently the bank's total deposits are so00 millian and are expected to grow by 8 percent during the month of

March The bank has estimated that z0% of the total deposits are hot money deposits, 30% are vulnerable deposits

and the rest are stable (core) deposits

an

The liquidity manager would like to keep a liquidity reserve of Bo%% for hot money, 35% liquidity reserve for vulnerable

deposits and 1096 liquidity reserve for core deposits

Currently the bank's total loans are at 4000 million The bank expects a 200 million increase in the level of loans during

March

Estimate the Liquidity Requirement for Prudent Commercial Bank for March

Select one

O a 1481

O b.1680

C 1280

d. 1880

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning