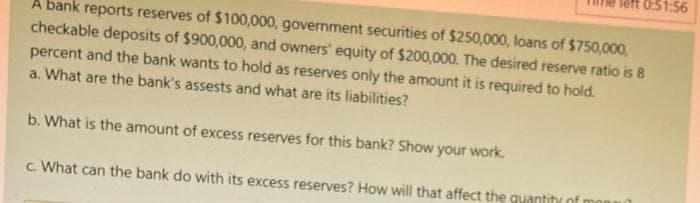

eports reserves of $100,000, government securities of $250,000, loans of $750,000, checkable deposits of $900,000, and owners' equity of $200,000. The desired reserve ratio is 8 percent and the bank wants to hold as reserves only the amount it is required to hold. . What are the bank's assests and what are its liabilities? . What is the amount of excess reserves for this bank? Show your work. What can the bank do with its excess reserves? How will that affert the

Q: Franklin Company established a predetermined fixed overhead cost rate of $36 per unit of product.…

A: Fixed overhead spending variance- The fixed cost spending variance is the distinction among the…

Q: PNW company issues 6% 5-year bonds with a total face amount of $1,000,000 with interest paid…

A: “Since you have posted a question with many sub-parts, we will solve three sub-parts for you. To get…

Q: How much is the primary balance?

A: Primary balance to the government is the balance which the government is having when all the…

Q: 1.D Balance off the accounts and prepare a Trial Balance On June 2019, Started Business with capital…

A: A trial balance is a bookkeeping worksheet in which all ledger balances are aggregated into equal…

Q: California Inc., through no fault of its own, lost an entire plant due to an earthquake on May 1,…

A: COGS % = 1 - Gross profit% Cost of goods available for sale = Beginning inventory + purchases Ending…

Q: On January 1, Pope Enterprises’ inventory was $625,000. Pope made $950,000 of net purchases during…

A: Cost of goods sold = Beginning Inventory + Purchases - Ending Inventory Ending Inventory = Beginning…

Q: Opening Cash Balance Required Minimum Cash Balance Payment of Income taxes – 2nd Quarter…

A: A cash budget is an estimation of the future cash inflows and outflows of a business over a specific…

Q: d industry target?

A: From the cash budget, it is explained as,

Q: 2) Troy Ltd purchased a new machine on 1 October 2016 at a cost of $114,000. The entity estimated…

A: Formula: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life

Q: Sheridan’s journal entries

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: Write a concise answer between 350 to 400 words for each question.

A: Audit refers to the process of checking the financial records of a company. The process of auditing…

Q: A and B form the equal AB partnership on January 1 of year 1. A contributes depreciable equipment…

A: A partnership is a positioning between two or more people to look after business operations and…

Q: Bailey Delivery Company, Inc., was organized in 2018 in Wisconsin. The following transactions…

A: Trial balance: Trial balance is a record prepared to ascertain that debit balances are equivalent to…

Q: Using the table in Exercise 10, calculate the net present value for each project shown below at the…

A: NPV means net present value.We can calculate NPV by- Present value of cash outflow-Present value of…

Q: If you were employed by the venture capital fund, based on this information alone, would you…

A: Venture Capital fund considering investment proposal for investing $ 1500000 Venture capital fund…

Q: Apex Chemicals Ltd acquires a delivery truck at a cost of $36,500 on 1 January 2016. The truck is…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: An advantage of the scattergraph method is that ita. is objective.b. is easier to use than the…

A: The scattergraph approach seems to be a visual depiction of an expense's cost as well as activity…

Q: Apex Chemicals Ltd acquires a delivery truck at a cost of $36,500 on 1 January 2016. The truck is…

A: Depreciation is systematic allocation of the cost of an asset throughout it's useful life.

Q: 1. (For items 1 and 2). Read and analyze the following transactions taken from the book of XYZ…

A: Journal entries: Journal entries are recorded for showing the monetary transactions initiated by a…

Q: MedServices Inc. is divided into two operating departments: Laboratory and Tissue Pathology.The…

A: Answer 1) Direct Method: Under direct method, service department costs are allocated to production…

Q: 3:41 ull LTE True/False Question 3.25 Answered Net Due Dates of invoices being paid will display in…

A: (Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: Charges for water services rendered$ 1,800,000 Charges for sewer services rendered2,000,000…

A: Operating Revenues: Revenue generated by a business from its primary business activities are called…

Q: FIFO and weighted average. But what if a company wants to use LIFO to report its inventory because…

A: Introduction Dollar value of LIFO is an accounting method for valuation of inventory, this method…

Q: Trillian Ltd. is considering replacing a piece of old machinery. The machine has a book value of…

A: Lets understand the basics. When there is two alternatives available then management always choose…

Q: Debt-to-Capital = 0.27 + .15(PPE/Assets). If Krent Foods as a PPE/Assets ratio of 30% (and other…

A: Debt to Capital = 0.27+0.15 ( PPE/Assets) PPE/Assets Ratio=30% needs to calculate optimal debt…

Q: On May 1, Soriano Co. reported the following account balances along with their estimated fair…

A: Answer- Journal Entry to record the Soriano Acquisition - S.no Particular Debit Credit…

Q: The following book and fair values were available for Westmont Company as of March 1. Fair Value $…

A: based on the data given in the problem we need to provide with the journal entry on acquisition o…

Q: Which of the following is a capital expenditure? Select one: a. Cleaning, waxing, and polishing a…

A: EXPENSES CAN BE DEFINED AS REVENUE AND CAPITAL EXPENDITURE . REVENUE EXPENDITURE ARE THISE WHICH ARE…

Q: Troy Engines, Limited, manufactures a variety of engines for use in heavy equipment. The company has…

A: 1. Determination of financial advantage or Disadvantage of buying 15,000 carburetors from outside…

Q: explain the difference between the net income and net income available for common shareholders.

A: Introduction:- i)Net income means as follows under:- Net income means deduction of all expenses…

Q: rporation Modern Stores, Inc. 1. Total assets. . . . . . . . . . . . . . . . . . . . . . . . . .…

A: ratio analysis is considered to be important part for in decision making decision making as it…

Q: Variable and Fixed Costs, Cost Formula, High-Low MethodLi Ming Yuan and Tiffany Shaden are the…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: What are some effective procedures for handling petty cash

A: The expression 'petty cash' alludes to a reserve of money set aside to pay little, day-to-day office…

Q: Barnett Products manufactures three types of remote-control devices: Economy, Standard, and Deluxe.…

A: Under activity based costing, the overhead rate is calculated as estimated overhead cost for…

Q: Of vital importance to the company’s operations is the efficient management of its cash resources.…

A: Cash budget: The cash budget refers to the forecasting of cash flows of an organization over a…

Q: Below are transactions completed by Bijan Sdn Bhd in August 2019. Bijan Sdn Bhd uses the perpetual…

A: Journal entries are the primary step of recording the transaction in the books of account. Journal…

Q: Task 9. The company produces product A. | Calculate the next month's costs, taking into account that…

A: Calculation of next month's costs: Direct Materials (see note) 1512.00 Direct Labour Costs (see…

Q: Swift Company purchased a machine on January 1, 2016, for $300,000. At the date of acquisition, the…

A: Depreciation Depreciation refers to the allocation of the cost of an asset to its estimated life.…

Q: Apex Chemicals Ltd acquires a delivery truck at a cost of $36,500 on 1 January 2016. The truck is…

A: Fixed assets are those assets which are being held or acquired by the business for a long period of…

Q: The following describes the job responsibilities of two employees of Barney Manufacturing.Joan…

A: The duties that an individual does at work in accordance with their specific function are referred…

Q: For each of the following projects calculate: i. Payback period ii. Net present value when…

A: i. Calculation of Payback Period Project A Year Cashflows Cumulative Cashflows Payback period 0…

Q: 1) A monthly depreciation expense of $600 is recorded on a truck that was purchased for $27 000 and…

A: Depreciation rate = Annual depreciation / Depreciable value of the assets where, Depreciable value…

Q: Barnett Products manufactures three types of remote-control devices: Economy, Standard, and Deluxe.…

A: Calculation of Pool rate for Automatic Machinery Activity Pool rate for Automatic Machinery Activity…

Q: Can you help me with the match terms, please? Thank u :) Modified retrospective approach Prospective…

A: There are different method of accounting changes terminologies are used to measure the financial…

Q: M/s. Green Channel purchased a second-hand machine on 1st January, 2015 for 1,60,000. Overhauling…

A: Working Note - Book Value of Machine (Straight Line Method) Particular Machine I…

Q: Refer to the information for Roberts Company above and on the previous page.Required:Prepare a…

A: The cash flow statement is a statement that shows the flow of cash and cash equivalents during the…

Q: Your uncle has a taxable income of $85,142 last year. If he files as a head of household, what is…

A: As per 2021 tax rates Tax liability if status is head of household = $ 6220 + (85142-54201)*22% = $…

Q: Karim Corporation requires a minimum $9,000 cash balance. Loans taken to meet this requirement cost…

A: In the given question, Karim Corporation's cash receipts and payments are mentioned. We have to…

Q: 1. A company, extends credit to its customers. Total Sales is 2 Million, credit Sales is 850,000,…

A: The allowance for doubtful accounts is contra asset account which is maintained to record estimated…

Q: a) Prepare all journal entries necessary for the investment-related transactions in 2021. 1. b)…

A: Fair value is the price agreed upon by a willing buyer and seller. The fair value of the stock is…

Step by step

Solved in 2 steps

- 1. SaKanya Company provided the following information on December 31, 2020: Cash in Bank (net of bank overdraft of P500,000) P5,000,000, Petty cash fund (unreplenished PCF P10,000) 50,000, Notes Receivable P4,000,000. Accounts receivable (net of customers credit balance of P1,500,000) P6,000,000, Inventory P3,000,000, Bond Sinking fund P3,000,000, Total current assets P21,050,000. Accounts payable (net of suppliers debit balances of P1,000,000) P7,000,000, Notes payable P4,000,000, Bonds payable due June 20, 2021 P3,000,000, Accrued expenses P2,000,000. Total current liabilities P16,000,000. What amount should be reported as total current liabilities on December 31, 2020?The first California Bank has $1.5 million in total reserves and $4 million in checking account balances. What is the bank’s reserve position if the required reserve ratio (rD) is 20%? (i.e., What is the level of required reserves and the level of excess reserves?)SaKanya Company provided the following information on December 31, 2020: Cash in Bank (net of bank overdraft of P500,000) P5,000,000, Petty cash fund (unreplenished PCF P10,000) 50,000, Notes Receivable P4,000,000. Accounts receivable (net of customers credit balance of P1,500,000) P6,000,000, Inventory P3,000,000, Bond Sinking fund P3,000,000, Total current assets P21,050,000. Accounts payable (net of suppliers debit balances of P1,000,000) P7,000,000, Notes payable P4,000,000, Bonds payable due June 20, 2021 P3,000,000, Accrued expenses P2,000,000. Total current liabilities P16,000,000. What amount should be reported as total current assets on December 31, 2020?

- Assume that the following balance sheet portrays the state of the banking system. The banks currently have no excess reserves. Assets Liabilities and Net Worth (Billions of Dollars) Total reserves 5 Checkable deposits 100 Loans 45 Securities 50 Total 100 Total 100 What is the required reserve ratio? 25% 40% 10% 5% Suppose that the Federal Reserve (the "Fed") buys $8 million of bonds from a bond dealer, who immediately deposits the funds in her checking account. What is the initial impact of this transaction? Checkable deposits rise by $8 million, and the banking system's holdings of securities rise by $8 million. The banking system's holdings of securities rise by $8 million, and the banking system's total reserves fall by $8 million. The banking system's holdings of securities fall by $8 million, and the banking system's total reserves rise by $8 million. Checkable deposits rise by $8…A bank has $770 million in checkable deposits. The bank has $85 million in reserves. If the reserve requirement is 10%, the bank's required reserves are _____________ and its excess reserves are _____________. A. $85 million; $0 B. $770 million; $85 million C. $89 million; $21 million D. $77 million; $8 millionA local bank policy is to hold 12.77% of its deposits as reserves. With current deposits of $8 million and excess reserves of $200,000, calculate the necessary reserve on a fresh deposit of $30,000. Required reserve for new deposit =$ (The answer should be rounded to Zero (0) decimals without the $ sign.)

- A new bank has vault cash of $1.7 million and $5 million in deposits held at its Federal Reserve District Bank. a) the required reserves ratio is 8 percent, approximately what dollar amount of deposits can the bank hold? (Answer in millions) Bank deposits $Type your answer here million b) If the bank holds $72 million in deposits and currently holds bank reserves such that excess reserves are zero, what required reserves ratio is implied? (Round answer to 1 decimal place, e.g. 5.1.) Required reserves ratio Type your answer hereXYZ bank currently has 600 million in transaction deposits on its balance sheet. The current reserve requirement, set by the central bank, is 8%. The central bank has decided to increase the reserve requirement from 8% to 10%. Show the effect of their decision on: Required reserve. Excess reserve. Change in bank deposit.If a bank has $200,000 of checkable deposits, a required reserve ratio of 20 percent, and it holds $80,000 in reserves, then the maximum deposit outflow it can sustain without altering its balance sheet is A) $50,000. B) $40,000. C) $30,000. D) $25,000. Answer: A How to solve it?

- Your bank has the following balance sheet: Assets Liabilities Reserves $50 million Checkable deposits $200 million Securities $50 million Loans $150 million Bank capital $50 million If we assume that the required reserve ratio is 10%, please provide a detailed write-up of what actions could (should) the bank manager take if there is an unexpected deposit outflow of $50 million? Please rank the feasible courses of action from the most desired to least desired and thoroughly explain the reasoning behind your ranking systemSuppose that a bank holds cash in its vault of $1.4 million, short-term government securities of $12.4 million, privately issued money market instruments of $5.2 million, deposits at the Federal Reserve banks of $20.1 million, cash items in the process of collection of $0.6 million, and deposits placed with other banks of $16.4 million. How much in primary reserves does this bank hold? In secondary reserves?Use T-accounts to show how balance sheets (assets and liabilities) of the Federal Reserve, the banks, and the public change after each of the following events. You should assume the required reserves ratio is 10%. 1. The Fed provides an emergency loan to a bank for $1,000,000. 2. First National Bank borrows $500,000 in overnight loans from Bank of America.