PSb 3-8 Calculate Federal (Wage-Bracket Method - Pre-2020 Form W-4), State, and Local Income Tax Withholding For each employee listed, use the wage-bracket method to calculate federal income tax withholding, assuming that each has submitted a pre-2020 Form W-4. Then calculate both the state income tax withholding (assuming a state tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax withholding. Refer to Publication 15-T. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

PSb 3-8 Calculate Federal (Wage-Bracket Method - Pre-2020 Form W-4), State, and Local Income Tax Withholding For each employee listed, use the wage-bracket method to calculate federal income tax withholding, assuming that each has submitted a pre-2020 Form W-4. Then calculate both the state income tax withholding (assuming a state tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local income tax withholding. Refer to Publication 15-T. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EB: Reference Figure 12.15 and use the following information to complete the requirements. A. Determine...

Related questions

Question

Please answer. Follow instructions carefully

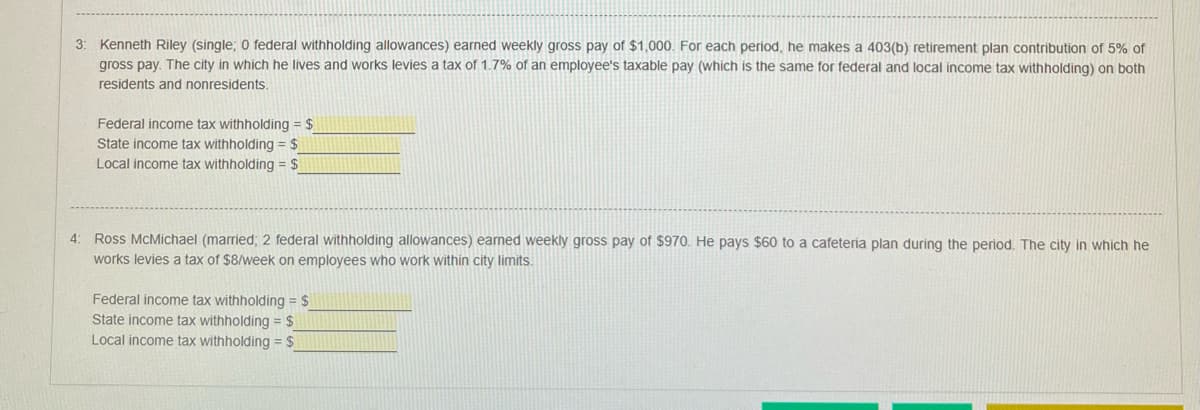

Transcribed Image Text:3: Kenneth Riley (single; O federal withholding allowances) earned weekly gross pay of $1,000. For each period, he makes a 403(b) retirement plan contribution of 5% of

gross pay. The city in which he lives and works levies a tax of 1.7% of an employee's taxable pay (which is the same for federal and local income tax withholding) on both

residents and nonresidents.

Federal income tax withholding = $

State income tax withholding = $

Local income tax withholding = $

4: Ross McMichael (married; 2 federal withholding allowances) eamed weekly gross pay of $970. He pays $60 to a cafeteria plan during the period. The city in which he

works levies a tax of $8/week on employees who work within city limits.

Federal income tax withholding = $

State income tax withholding = $

Local income tax withholding = $

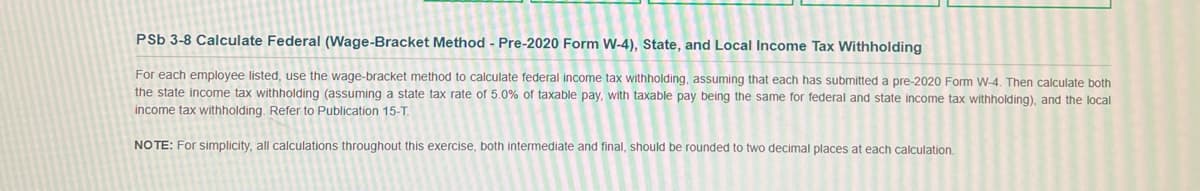

Transcribed Image Text:PSb 3-8 Calculate Federal (Wage-Bracket Method - Pre-2020 Form W-4), State, and Local Income Tax Withholding

For each employee listed, use the wage-bracket method to calculate federal income tax withholding, assuming that each has submitted a pre-2020 Form W-4. Then calculate both

the state income tax withholding (assuming a state tax rate of 5.0% of taxable pay, with taxable pay being the same for federal and state income tax withholding), and the local

income tax withholding. Refer to Publication 15-T.

NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning