PTS: 1 BUSPROG: Analytic DIF: Easy KEY: Bloom's: Knowledge In 2012 Robert Corporation had net income of $250,000 and paid dividends to common year. Robert Corporation's common stock is selling for $50 per share on the New York Stock OBJ: LO: 17-03 54. stockholders of $50,000. They had S0,000 shares of common stock outstanding during the entire Exchange. Robert Corporation's price-earnings ratio is 10 times. b. 5 times. 2 times. a. c. d. 8 times. ANS: A NAT: BUSPROG: Analytic LO: 17-03 PTS: 1 OBJ: DIF: Moderate KEY: Bloom's: Knowledge 55. Leveraging implies that a company contains debt financing a. b. contains

PTS: 1 BUSPROG: Analytic DIF: Easy KEY: Bloom's: Knowledge In 2012 Robert Corporation had net income of $250,000 and paid dividends to common year. Robert Corporation's common stock is selling for $50 per share on the New York Stock OBJ: LO: 17-03 54. stockholders of $50,000. They had S0,000 shares of common stock outstanding during the entire Exchange. Robert Corporation's price-earnings ratio is 10 times. b. 5 times. 2 times. a. c. d. 8 times. ANS: A NAT: BUSPROG: Analytic LO: 17-03 PTS: 1 OBJ: DIF: Moderate KEY: Bloom's: Knowledge 55. Leveraging implies that a company contains debt financing a. b. contains

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter13: Financial Statement Analysis

Section: Chapter Questions

Problem 13.16E

Related questions

Question

100%

Transcribed Image Text:PTS: 1

BUSPROG: Analytic

DIF:

Easy

KEY: Bloom's: Knowledge

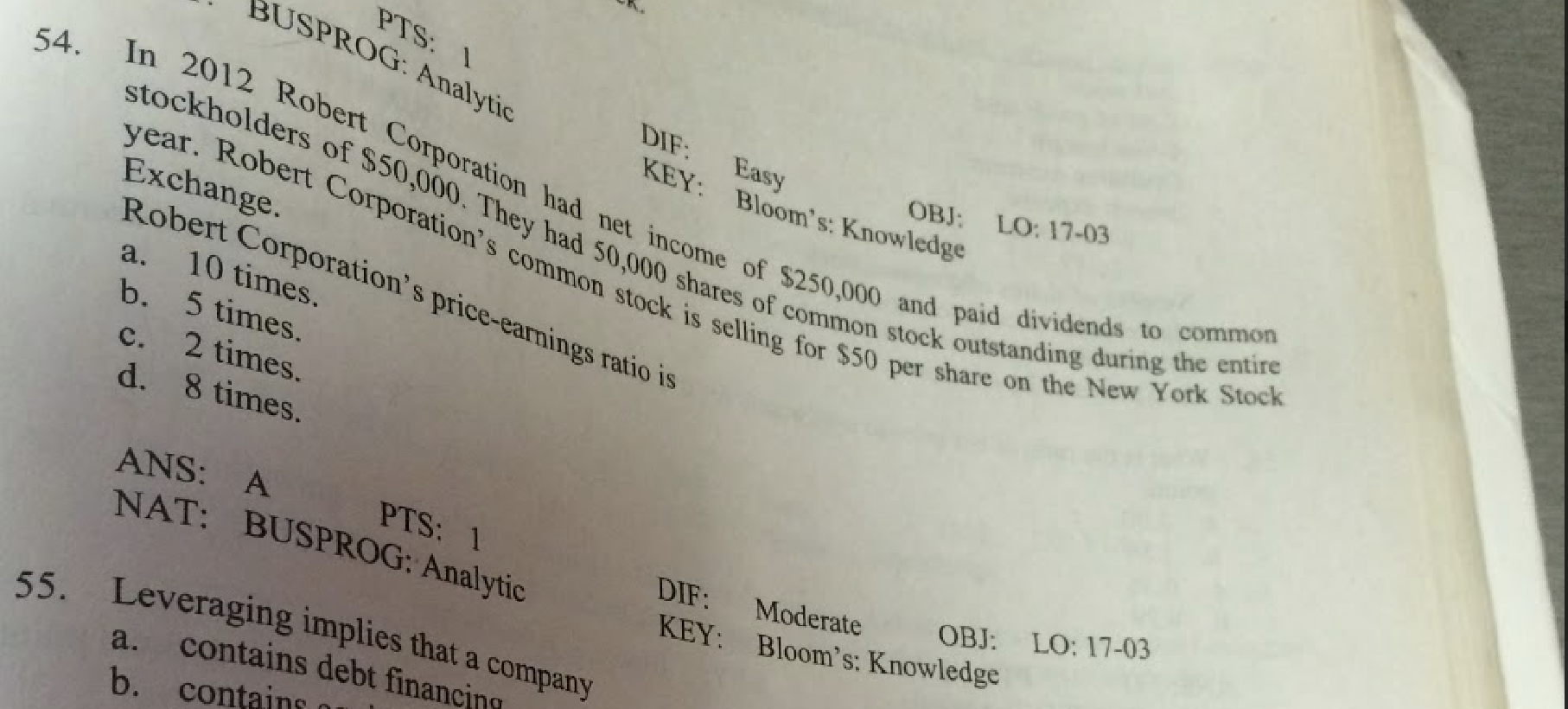

In 2012 Robert Corporation had net income of $250,000 and paid dividends to common

year. Robert Corporation's common stock is selling for $50 per share on the New York Stock

OBJ: LO: 17-03

54.

stockholders of $50,000. They had S0,000 shares of common stock outstanding during the entire

Exchange.

Robert Corporation's price-earnings ratio is

10 times.

b. 5 times.

2 times.

a.

c.

d. 8 times.

ANS: A

NAT: BUSPROG: Analytic

LO: 17-03

PTS: 1

OBJ:

DIF:

Moderate

KEY: Bloom's: Knowledge

55. Leveraging implies that a company

contains debt financing

a.

b. contains

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning