uppose Rocky Brands has earnings per share of $2.35 and EBITDA of $31.2 milion. The firm also has 4.7 million shares outstanding and debt of $120 milion (not of ash) You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of 31 and an onterprise value to EBITDA multiple of 7.1, estimate the value of Rocky Brands stock using both multiples Which estimate is ikely to be more accurate? Tocky Brands' stock value by using the P/E ratio is S per share (Round to two decimal places) he value of Rocky Brands by using the PE ratio is $milion (Round to one decimal place)

uppose Rocky Brands has earnings per share of $2.35 and EBITDA of $31.2 milion. The firm also has 4.7 million shares outstanding and debt of $120 milion (not of ash) You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of 31 and an onterprise value to EBITDA multiple of 7.1, estimate the value of Rocky Brands stock using both multiples Which estimate is ikely to be more accurate? Tocky Brands' stock value by using the P/E ratio is S per share (Round to two decimal places) he value of Rocky Brands by using the PE ratio is $milion (Round to one decimal place)

Chapter14: Distributions To Shareholders: Dividends And Repurchases

Section: Chapter Questions

Problem 12P

Related questions

Question

1.

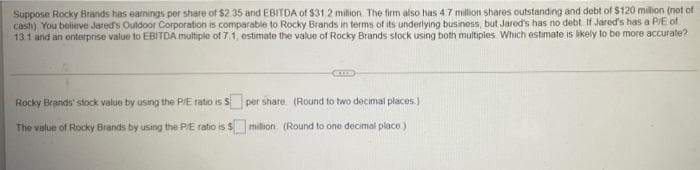

Transcribed Image Text:Suppose Rocky Brands has earmnings per share of $2.35 and EBITDA of $312 million. The firm also has 4.7 million shares outstanding and debt of $120 milion (not of

cash). You believe Jared's Outdoor Corporation is comparable to Rocky Brands in terms of its underlying business, but Jared's has no debt. If Jared's has a P/E of

13.1 and an onterprise value to EBITDA multiple of 7.1, estimate the value of Rocky Brands stock using both multiples Which estimate is ikely to be more accurate?

Rocky Brands' stock value by using the P/E ratio is S per share. (Round to two decimal places.)

The value of Rocky Brands by using the PE ratio is $milion (Round to one decimal place)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT