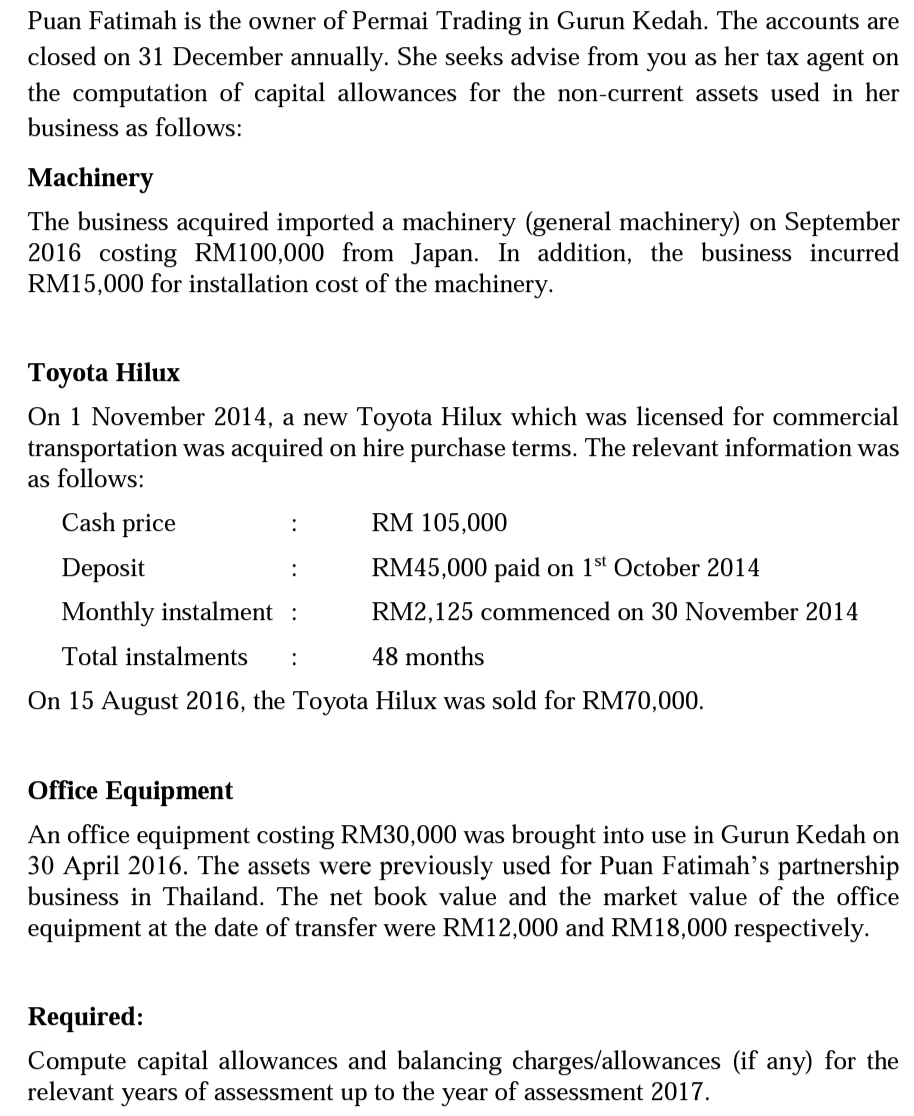

Puan Fatimah is the owner of Permai Trading in Gurun Kedah. The accounts are closed on 31 December annually. She seeks advise from you as her tax agent on the computation of capital allowances for the non-current assets used in her business as follows: Machinery The business acquired imported a machinery (general machinery) on September 2016 costing RM100,000 from Japan. In addition, the business incurred RM15,000 for installation cost of the machinery. Тоyota Hilux On 1 November 2014, a new Toyota Hilux which was licensed for commercial transportation was acquired on hire purchase terms. The relevant information was as follows: Cash price RM 105,000 Deposit RM45,000 paid on 1st October 2014 : Monthly instalment : RM2,125 commenced on 30 November 2014 Total instalments : 48 months On 15 August 2016, the Toyota Hilux was sold for RM70,000. Office Equipment An office equipment costing RM30,000 was brought into use in Gurun Kedah on 30 April 2016. The assets were previously used for Puan Fatimah's partnership business in Thailand. The net book value and the market value of the office equipment at the date of transfer were RM12,000 and RM18,000 respectively. Required: Compute capital allowances and balancing charges/allowances (if any) for the relevant years of assessment up to the year of assessment 2017.

Puan Fatimah is the owner of Permai Trading in Gurun Kedah. The accounts are closed on 31 December annually. She seeks advise from you as her tax agent on the computation of capital allowances for the non-current assets used in her business as follows: Machinery The business acquired imported a machinery (general machinery) on September 2016 costing RM100,000 from Japan. In addition, the business incurred RM15,000 for installation cost of the machinery. Тоyota Hilux On 1 November 2014, a new Toyota Hilux which was licensed for commercial transportation was acquired on hire purchase terms. The relevant information was as follows: Cash price RM 105,000 Deposit RM45,000 paid on 1st October 2014 : Monthly instalment : RM2,125 commenced on 30 November 2014 Total instalments : 48 months On 15 August 2016, the Toyota Hilux was sold for RM70,000. Office Equipment An office equipment costing RM30,000 was brought into use in Gurun Kedah on 30 April 2016. The assets were previously used for Puan Fatimah's partnership business in Thailand. The net book value and the market value of the office equipment at the date of transfer were RM12,000 and RM18,000 respectively. Required: Compute capital allowances and balancing charges/allowances (if any) for the relevant years of assessment up to the year of assessment 2017.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Transcribed Image Text:Puan Fatimah is the owner of Permai Trading in Gurun Kedah. The accounts are

closed on 31 December annually. She seeks advise from you as her tax agent on

the computation of capital allowances for the non-current assets used in her

business as follows:

Machinery

The business acquired imported a machinery (general machinery) on September

2016 costing RM100,000 from Japan. In addition, the business incurred

RM15,000 for installation cost of the machinery.

Тоyota Hilux

On 1 November 2014, a new Toyota Hilux which was licensed for commercial

transportation was acquired on hire purchase terms. The relevant information was

as follows:

Cash price

RM 105,000

Deposit

RM45,000 paid on 1st October 2014

:

Monthly instalment :

RM2,125 commenced on 30 November 2014

Total instalments

:

48 months

On 15 August 2016, the Toyota Hilux was sold for RM70,000.

Office Equipment

An office equipment costing RM30,000 was brought into use in Gurun Kedah on

30 April 2016. The assets were previously used for Puan Fatimah's partnership

business in Thailand. The net book value and the market value of the office

equipment at the date of transfer were RM12,000 and RM18,000 respectively.

Required:

Compute capital allowances and balancing charges/allowances (if any) for the

relevant years of assessment up to the year of assessment 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 11 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you