Purchased 20 Cheese wheels @ R10 each (excluding VAT) as well as 10 boxes of cream @R30 Each (excluding VAT) from J Creamery a local entrepreneur and pay from petty cash. The goods will be used as inventory. PCV01 was used. Purchased coffee and tea for the staff from The Local Café for R80 and paid using petty cash. PCV02 was used. Paid R800 for petrol for the delivery vehicle from petty cash. PCV03 was used. Paid bi-weekly wages of R300 from petty cash. PCV04 was used. 13 20 The owner Mrs Daisy took R200 from the petty cash for her own use. PCVO5 was used. 26 Purchased printing paper for R30 and cooldrinks for the staff of R60, from Pick n Pay and paid using petty cash. PCV06 was used. Paid bi-weekly wages of R300 from petty cash. PCV07 was used. 29 30 To celebrate Mrs. Daisy's birthday a cake was bought for the staff for R250. PCV08 was used.

Purchased 20 Cheese wheels @ R10 each (excluding VAT) as well as 10 boxes of cream @R30 Each (excluding VAT) from J Creamery a local entrepreneur and pay from petty cash. The goods will be used as inventory. PCV01 was used. Purchased coffee and tea for the staff from The Local Café for R80 and paid using petty cash. PCV02 was used. Paid R800 for petrol for the delivery vehicle from petty cash. PCV03 was used. Paid bi-weekly wages of R300 from petty cash. PCV04 was used. 13 20 The owner Mrs Daisy took R200 from the petty cash for her own use. PCVO5 was used. 26 Purchased printing paper for R30 and cooldrinks for the staff of R60, from Pick n Pay and paid using petty cash. PCV06 was used. Paid bi-weekly wages of R300 from petty cash. PCV07 was used. 29 30 To celebrate Mrs. Daisy's birthday a cake was bought for the staff for R250. PCV08 was used.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 20E

Related questions

Question

100%

Please help me fill in this table and answer the question

QUESTION:

OBJstores, a dairy shop, entered into the following Petty Cash transactions during March 2020. The

business is a registered VAT vendor and trades only with other registered vendors. They use a

perpetual inventory system, and all goods are marked up at 40% above cost, before taking into

account any trade discounts. A VAT rate of 15% is applicable

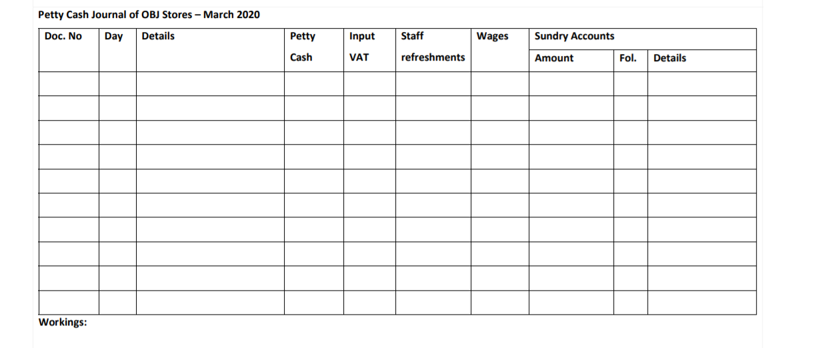

Transcribed Image Text:Petty Cash Journal of OBJ Stores - March 2020

Doc. No

Day

Details

Petty

Input

Staff

Wages

Sundry Accounts

Cash

VAT

refreshments

Amount

Fol.

Details

Workings:

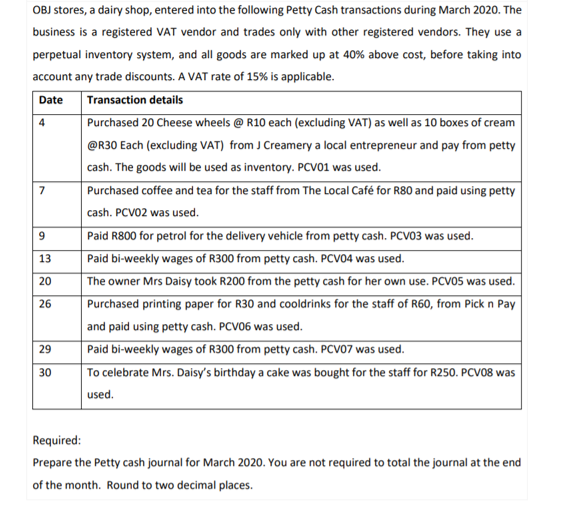

Transcribed Image Text:OBJ stores, a dairy shop, entered into the following Petty Cash transactions during March 2020. The

business is a registered VAT vendor and trades only with other registered vendors. They use a

perpetual inventory system, and all goods are marked up at 40% above cost, before taking into

account any trade discounts. A VAT rate of 15% is applicable.

Transaction details

Purchased 20 Cheese wheels @ R10 each (excluding VAT) as well as 10 boxes of cream

Date

4

@R30 Each (excluding VAT) from J Creamery a local entrepreneur and pay from petty

cash. The goods will be used as inventory. PCV01 was used.

Purchased coffee and tea for the staff from The Local Café for R80 and paid using petty

7

cash. PCV02 was used.

Paid R800 for petrol for the delivery vehicle from petty cash. PCVO3 was used.

Paid bi-weekly wages of R300 from petty cash. PCV04 was used.

The owner Mrs Daisy took R200 from the petty cash for her own use. PCV05 was used.

Purchased printing paper for R30 and cooldrinks for the staff of R60, from Pick n Pay

and paid using petty cash. PCV06 was used.

Paid bi-weekly wages of R300 from petty cash. PCV07 was used.

To celebrate Mrs. Daisy's birthday a cake was bought for the staff for R250. PCV08 was

13

20

26

29

30

used.

Required:

Prepare the Petty cash journal for March 2020. You are not required to total the journal at the end

of the month. Round to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage