Purchased a new printing machine on Dec. 2 at an invoice price of P4,000,000 with terms 2/10, n/30. On Dec. 15, the entity paid the required amount for the machine

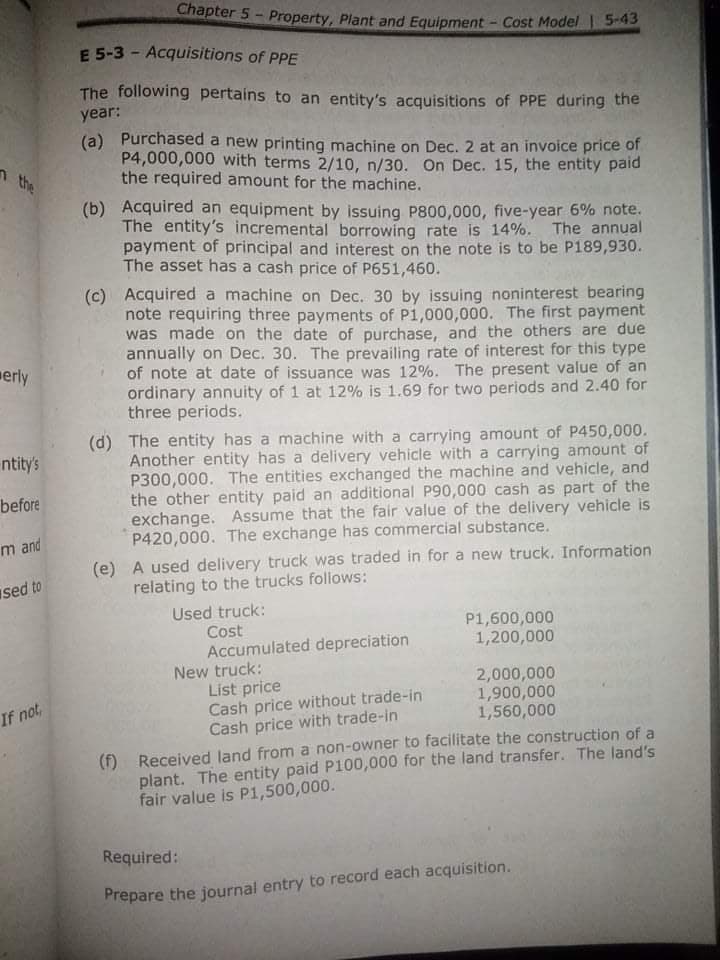

The following pertains to an entity's acquisitions of PPE during the year:

(a) Purchased a new printing machine on Dec. 2 at an invoice price of P4,000,000 with terms 2/10, n/30. On Dec. 15, the entity paid the required amount for the machine. (b) Acquired an equipment by issuing P800,000, five-year 6% note. The entity's incremental borrowing rate is 14%. The annual

payment of principal and interest on the note is to be P189,930.

The asset has a cash price of P651,460.

(c) Acquired a machine on Dec. 30 by issuing noninterest bearing note requiring three payments of P1,000,000. The first payment was made on the date of purchase, and the others are due annually on Dec. 30. The prevailing rate of interest for this type of note at date of issuance was 12%. The present value of an ordinary annuity of 1 at 12% is 1.69 for two periods and 2.40 for three periods.

(d) The entity has a machine with a carrying amount of P450,000.

Another entity has a delivery vehicle with a carrying amount of

P300,000. The entities exchanged the machine and vehicle, and

the other entity paid an additional P90,000 cash as part of the

exchange. Assume that the fair value of the delivery vehicle is P420,000. The exchange has commercial substance. (e) A used delivery truck was traded in for a new truck. Information relating to the trucks follows:

Used truck:

Cost

Accumulated

P1,600,000

New truck: List price

1,200,000

1,900,000

Cash price without trade-in Cash price with trade-in

1,560,000

(f) Received land from a non-owner to facilitate the construction of a plant. The entity paid P100,000 for the land transfer. The land's fair value is P1,500,000.

Required:

Prepare the

Trending now

This is a popular solution!

Step by step

Solved in 2 steps