Leprechan Inc. had the following stock and convertible securities outstanding on January 1: • 750,000 shares of $3 par common stock • 13,000 shares of 6% $75 par cumulative convertible preferred stock • Stock options for the purchase of 60,000 common shares at $20 per share The following stock transactions occurred during the year: • March 1: purchased 45,000 treasury shares with cash • June 1: stock split (2:1) • November 1: issued an additional 240,000 shares of common stock for cash The preferred stock is convertible into 200,000 shares of common stock (after adjustment for the stock split.) The average price of the common stock during the year was $30 per share. None of the securities

Leprechan Inc. had the following stock and convertible securities outstanding on January 1: • 750,000 shares of $3 par common stock • 13,000 shares of 6% $75 par cumulative convertible preferred stock • Stock options for the purchase of 60,000 common shares at $20 per share The following stock transactions occurred during the year: • March 1: purchased 45,000 treasury shares with cash • June 1: stock split (2:1) • November 1: issued an additional 240,000 shares of common stock for cash The preferred stock is convertible into 200,000 shares of common stock (after adjustment for the stock split.) The average price of the common stock during the year was $30 per share. None of the securities

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 10MC

Related questions

Question

Transcribed Image Text:Signature

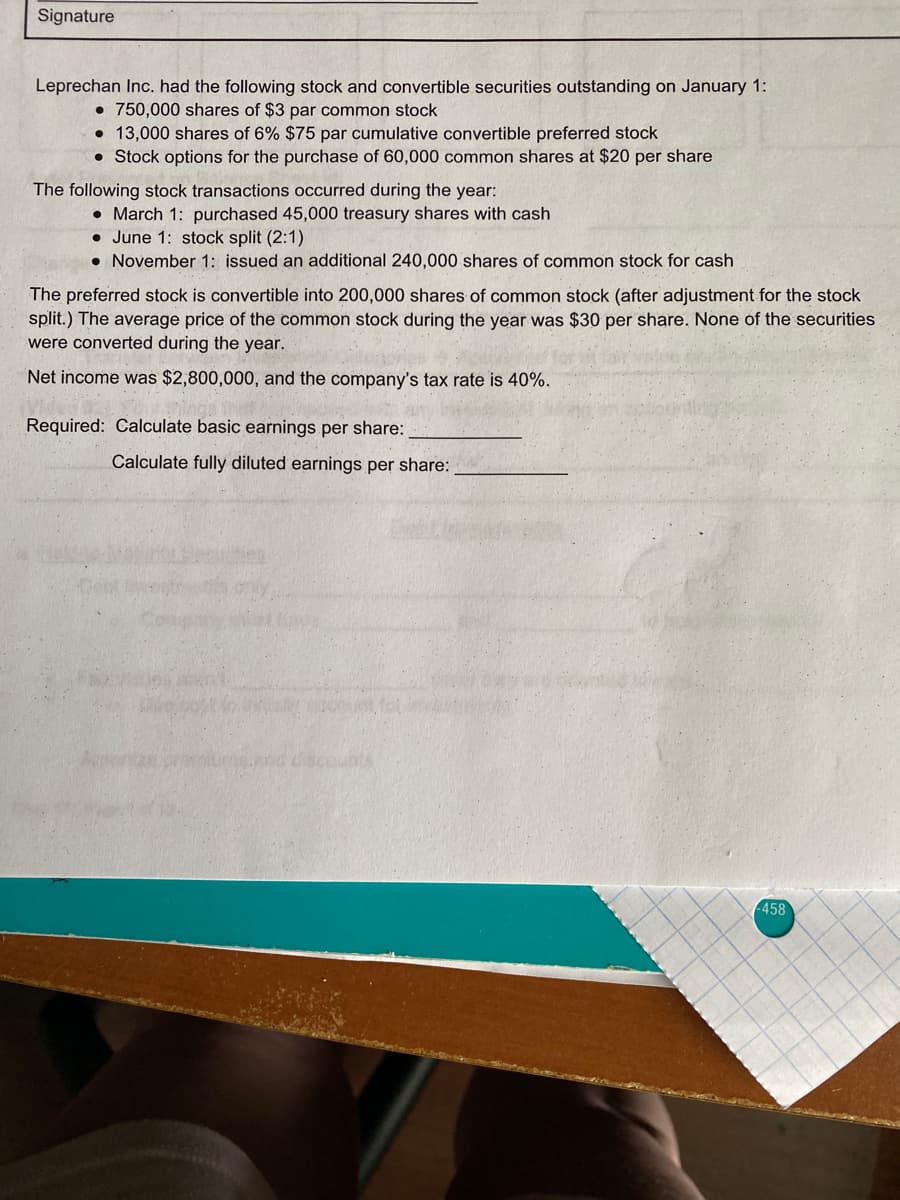

Leprechan Inc. had the following stock and convertible securities outstanding on January 1:

• 750,000 shares of $3 par common stock

• 13,000 shares of 6% $75 par cumulative convertible preferred stock

• Stock options for the purchase of 60,000 common shares at $20 per share

The following stock transactions occurred during the year:

• March 1: purchased 45,000 treasury shares with cash

• June 1: stock split (2:1)

• November 1: issued an additional 240,000 shares of common stock for cash

The preferred stock is convertible into 200,000 shares of common stock (after adjustment for the stock

split.) The average price of the common stock during the year was $30 per share. None of the securities

were converted during the year.

Net income was $2,800,000, and the company's tax rate is 40%.

Required: Calculate basic earnings per share:

Calculate fully diluted earnings per share:

458

Expert Solution

Step 1

Earnings per share (EPS) is calculated by dividing a company's profit by the number of shares of common stock outstanding. A company's earnings per share (EPS) are typically adjusted for unique items and potential share dilution. Earnings per share are calculated by dividing net income (also known as profits or earnings) by the number of shares available. A more precise calculation accounts for shares created through options, convertible debt, or warrants by adjusting the numerator and denominator. It becomes more relevant when the numerator of the equation is adjusted for continuing operations.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning