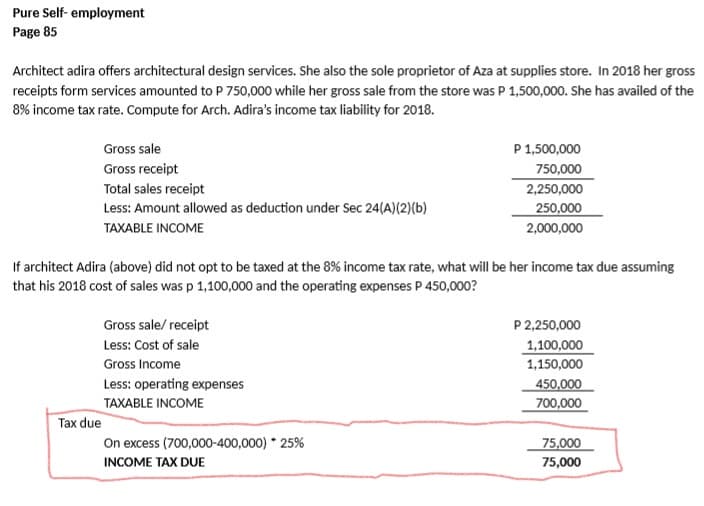

Pure Self- employment Page 85 Architect adira offers architectural design services. She also the sole proprietor of Aza at supplies store. In 2018 her gross receipts form services amounted to P 750,000 while her gross sale from the store was P 1,500,000. She has availed of the 8% income tax rate. Compute for Arch. Adira's income tax liability for 2018. P 1,500,000 750,000 2,250,000 250,000 Gross sale Gross receipt Total sales receipt Less: Amount allowed as deduction under Sec 24(A)(2)(b) TAXABLE INCOME 2,000,000 If architect Adira (above) did not opt to be taxed at the 8% income tax rate, what will be her income tax due assuming that his 2018 cost of sales was p 1,100,000 and the operating expenses P 450,000? Gross sale/ receipt P 2,250,000 Less: Cost of sale 1,100,000 1,150,000 Gross Income Less: operating expenses 450,000 700,000 TAXABLE INCOME Tax due On excess (700,000-400,000) 25% 75,000 INCOME TAX DUE 75,000

Pure Self- employment Page 85 Architect adira offers architectural design services. She also the sole proprietor of Aza at supplies store. In 2018 her gross receipts form services amounted to P 750,000 while her gross sale from the store was P 1,500,000. She has availed of the 8% income tax rate. Compute for Arch. Adira's income tax liability for 2018. P 1,500,000 750,000 2,250,000 250,000 Gross sale Gross receipt Total sales receipt Less: Amount allowed as deduction under Sec 24(A)(2)(b) TAXABLE INCOME 2,000,000 If architect Adira (above) did not opt to be taxed at the 8% income tax rate, what will be her income tax due assuming that his 2018 cost of sales was p 1,100,000 and the operating expenses P 450,000? Gross sale/ receipt P 2,250,000 Less: Cost of sale 1,100,000 1,150,000 Gross Income Less: operating expenses 450,000 700,000 TAXABLE INCOME Tax due On excess (700,000-400,000) 25% 75,000 INCOME TAX DUE 75,000

Chapter6: Business Expenses

Section: Chapter Questions

Problem 84TA

Related questions

Question

Where tax due get and how did they get excess (700,000-400,000)*25%. See photo for information.

Transcribed Image Text:Pure Self- employment

Page 85

Architect adira offers architectural design services. She also the sole proprietor of Aza at supplies store. In 2018 her gross

receipts form services amounted to P 750,000 while her gross sale from the store was P 1,500,000. She has availed of the

8% income tax rate. Compute for Arch. Adira's income tax liability for 2018.

Gross sale

P 1,500,000

Gross receipt

750,000

Total sales receipt

2,250,000

Less: Amount allowed as deduction under Sec 24(A)(2)(b)

250,000

TAXABLE INCOME

2,000,000

If architect Adira (above) did not opt to be taxed at the 8% income tax rate, what will be her income tax due assuming

that his 2018 cost of sales was p 1,100,000 and the operating expenses P 450,000?

P 2,250,000

1,100,000

Gross sale/ receipt

Less: Cost of sale

Gross Income

1,150,000

Less: operating expenses

450,000

700,000

TAXABLE INCOME

Tax due

On excess (700,000-400,000) * 25%

75,000

INCOME TAX DUE

75,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT